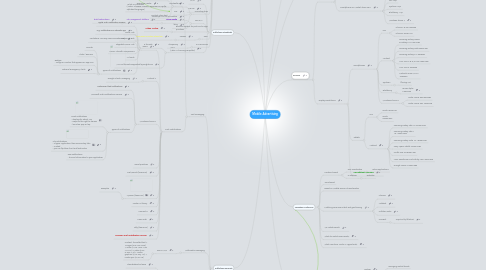

1. Publishing Formats

1.1. Text messaging

1.1.1. SMS

1.1.1.1. 7-bit 160 characters

1.1.1.2. 8-bit 140 characters/bytes

1.1.1.3. 16-bit 70 characters (Arabic, Chinese, Korean, Japanese or Cyrillic alphabet languages)

1.1.1.4. Content: plain text

1.1.2. Push Notifications

1.1.2.1. iOS 6

1.1.2.1.1. Apple Push Notification Service

1.1.2.1.2. e.g. Notifications on steroids app

1.1.2.1.3. Limitations: one way communication only

1.1.2.1.4. Types of notifications

1.1.2.2. Android 4

1.1.2.2.1. Google Cloud Messaging

1.1.2.3. Windows Phone 8

1.1.2.3.1. Lockscreen tiled notifications

1.1.2.3.2. Microsoft Push Notifications Service

1.1.2.3.3. Types of notifications

1.1.2.4. Good practices

1.1.2.5. PushWoosh (freemium)

1.1.2.6. Apoxee (freemium)

1.1.2.6.1. examples

1.1.2.7. Pusher JS library

1.1.2.8. ConnectAI

1.1.2.9. Parse Push

1.1.2.10. xtify (freemium)

1.1.2.11. Common Push Notification Service

1.2. Multimedia messaging

1.2.1. 3GPP MMS

1.2.1.1. Content: formatted text + images (JPG, GIF, PNG) + audio (AMR, MIDI, MP4 AAC LC) + video (MP4 H.264 AVC) + vector graphics (SVG Tiny 1.2) + media sync (SMIL 2.0)

1.3. Display ads

1.3.1. Static banners

1.3.1.1. Standardized ad sizes

1.3.1.2. e.g. Google banner ads

1.3.1.3. Format: JPG, GIF, PNG

1.3.2. Expandable ad

1.3.2.1. e.g. Google "Lightbox" display ad

1.3.3. Coupons

1.3.3.1. Apple Passbook compatible

1.3.3.1.1. Android PassWallet

1.3.3.1.2. Building your first pass

1.3.3.1.3. More apps joining the passbook club

1.3.3.1.4. Limitations: no rich media, just images

1.3.3.1.5. location-based notifications

1.3.3.1.6. updates

1.3.3.2. Google Wallet compatible

1.3.3.3. Windows Phone 8 Wallet Hub compatible

1.3.3.4. Multi-user broadcast

1.3.3.4.1. General offer for non VIP customers

1.3.3.4.2. One same coupon code for many

1.3.3.4.3. Short period of validity

1.3.3.4.4. Can be published on pinterest-style coupon portal

1.3.3.4.5. Sharable on social media

1.3.3.5. Single user or group target

1.3.3.5.1. VIP client

1.3.3.5.2. Different coupon code for each client

1.3.3.5.3. Longer period of validity

1.3.4. Rich media

1.3.4.1. Static rich media (looped content)

1.3.4.2. Interactive rich media

1.3.4.2.1. Click-to-web

1.3.4.2.2. App-within-an-app

1.3.4.2.3. Click-to-call

1.3.4.2.4. Click-to-text

1.3.4.2.5. Click-to-video

1.3.4.2.6. Click-to-gallery

1.3.4.2.7. Click-to-download

1.3.4.3. Interstitial ads

1.3.4.3.1. e.g. Flip interstitial

1.3.4.3.2. e.g. Image gallery template

1.3.4.4. e.g. Medialets

1.3.4.5. Format: HTML5, CSS3, JavaScript, SVG

1.3.5. Delivery

1.3.5.1. In mobile apps

1.3.5.2. On the mobile web

1.3.6. IAB Display advertising guidelines

1.4. Search ads

1.4.1. Google AdSense

1.4.2. cost-per-click

1.5. Video ads

1.5.1. Format: MP4 H.264 AVC

1.6. Fixed size

1.6.1. common denominator: smallest device supported

1.7. Responsive design

1.7.1. Resize images & videos

1.7.1.1. Aspect Ratio

1.7.2. Scale vector components

1.7.2.1. SVG animations

2. Publishing Standards

2.1. MMA

2.2. MRAID

2.3. ORMMA

2.3.1. JavaScript API for ad creators

2.3.2. blog

2.4. VAST (Video Ad Serving Template)

2.4.1. 5 formats

2.4.1.1. Linear Ads

2.4.1.2. Non Linear Ads

2.4.1.3. Skippable Linear Ads

2.4.1.4. Linear Ads with Companions

2.4.1.5. Ad Pods

2.4.2. VAST ad formats supported by Brightcove

3. Industry Players

3.1. Coupon Providers

3.1.1. The Coupons App

3.1.2. Coupon Sherpa

3.1.3. SnipSnap

3.1.4. Shopkick

3.1.5. Shooger

3.1.6. Groupon

3.1.7. Clip'd

3.2. Local Search Sites

3.2.1. Square

3.2.2. Local.com

3.3. Local ad networks

3.3.1. Chalkboard

3.3.2. xAd

3.3.3. Verve

3.3.4. InMobi

3.3.5. AdMob

3.3.6. Chitika

3.3.7. YP Local Ad Network

3.3.8. Sense Networks

3.3.9. Localstars

3.3.10. SLOAN

3.4. Ad Servers

3.4.1. mopub

3.4.2. video

3.4.2.1. videoplaza

3.4.2.1.1. formats

3.4.2.2. smartclip

3.4.2.2.1. ad gallery

3.4.3. MADS

3.4.3.1. video demo

3.5. Ad Creators

3.5.1. creation & delivery platform

3.5.1.1. Celtra

3.5.1.2. brainient

3.5.1.2.1. BrainStudio

3.5.2. HTML5 animations

3.5.2.1. Tumult Hype

3.5.2.2. Sencha Animator

3.6. Real-Time Digital Ad Marketplace

3.6.1. Supply Side Platforms for Publishers

3.6.1.1. PubMatic - real-time ad inventory selling

3.6.2. Demand Side Platforms for Advertisers

3.6.2.1. AppNexus Marketplace - trading desk - real time bidding platform

3.6.2.2. InviteMedia - cross-exchange ad inventory buying

3.6.2.3. StrikeAd

3.6.2.4. MediaMind

3.6.2.4.1. ad formats

3.6.2.4.2. creative zone

3.6.3. Nexage

3.6.4. DoubleClick

3.7. One-stop-shop

3.7.1. PointRoll

3.7.1.1. Resource Center

3.7.2. DG

3.7.3. Crisp Media

3.7.3.1. Ad Management Platform

3.7.3.1.1. build video demo

3.8. Backend system for push and in-app purchase

3.8.1. Urban Airship

3.9. SEO

3.9.1. veeseo

3.9.1.1. Commerce & video interaction

3.10. m-Commerce

3.10.1. ShopSavvy

4. Devices

4.1. Market Share

4.1.1. Vendor Market Share 2011

4.1.2. Top 5 Smartphone Manufacturers 2011

4.1.3. Smartphone OS Market Share 2011

4.1.3.1. Android 49%

4.1.3.2. iOS 19%

4.1.3.3. Symbian 16%

4.1.3.4. Blackberry 11%

4.1.3.5. Windows Phone ?

4.2. Display Resolutions

4.2.1. Smartphones

4.2.1.1. iOS

4.2.1.1.1. iPhone 4 & 4S 640x960

4.2.1.1.2. iPhone 5 640x1136

4.2.1.2. Android

4.2.1.2.1. Samsung Galaxy Nexus & Galaxy S III 720x1280

4.2.1.2.2. Samsung Galaxy Note 800x1280

4.2.1.2.3. Samsung Galaxy S II 480x800

4.2.1.2.4. HTC One X & EVO LTE 720x1280

4.2.1.2.5. HTC One S 540x960

4.2.1.2.6. Motorola RAZR MAXX 540x960

4.2.1.3. Symbian

4.2.1.3.1. Phasing out

4.2.1.4. Blackberry

4.2.1.4.1. 10 Dev alpha 1280x768

4.2.1.5. Windows Phone 8

4.2.1.5.1. Nokia Lumia 900 800x480

4.2.1.5.2. Nokia Lumia 920 1280x768

4.2.2. Tablets

4.2.2.1. iOS

4.2.2.1.1. iPad2 1024x768

4.2.2.1.2. iPad3 2048x1536

4.2.2.2. Android

4.2.2.2.1. Samsung Galaxy Tab 2 7.0 600x1024

4.2.2.2.2. Samsung Galaxy Tab 2 10.1 800x1280

4.2.2.2.3. Samsung Galaxy Note 10.1 800x1280

4.2.2.2.4. Sony Xperia Tablet S 800x1280

4.2.2.2.5. Kindle Fire HD 800x1280

4.2.2.2.6. Asus Transformer Pad Infinity 700 1920x1200

4.2.2.2.7. Google Nexus 7 800x1280

4.2.3. Spreadsheet summary

5. Mobile Ad Networks

5.1. Blind Networks

5.2. Premium Blind Networks

5.3. Premium Networks

5.4. Local Ad Networks

5.5. Affiliate and CPA Networks

6. Targeting Audiences

6.1. Location-based

6.1.1. GPS coordinates

6.1.1.1. native applications

6.1.2. IP address

6.1.2.1. websites

6.2. Time-based

6.3. Based on Mobile Device Characteristics

6.4. Matching consumer intent and geo-fencing

6.4.1. PlaceIQ

6.4.2. YieldBot

6.4.3. ColliderMedia

6.4.4. OneRiot

6.4.4.1. acquired by Walmart

6.5. Via mobile search

6.6. What do mobile users want?

6.7. What Counts as ‘Scale’ in Hyperlocal?

7. Data Suppliers (market intelligence)

7.1. Global Information and Measurement Companies

7.1.1. Nielsen

7.1.1.1. emerging market trends

7.1.1.2. consumer behaviour

7.1.2. comScore

7.1.3. bluecava

7.2. Network Operators

7.2.1. Top ten operator groups by subscribers and revenues – worldwide

7.3. Privacy

7.3.1. Doubleblind