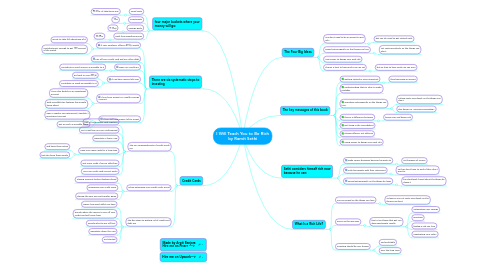

1. Credit Cards

1.1. The Six Commandments of Credit Cards are

1.1.1. Pay off your credit card regularly

1.1.2. Try to get fees on your cards waived

1.1.3. Negotiate a lower APR

1.1.4. Keep your main cards for a long time

1.1.4.1. and keep them active

1.1.4.2. but also keep them simple

1.1.5. Get more credit if you’re debt-free

1.1.6. Use your credit card’s secret perks

1.2. When optimizing your credit cards, avoid

1.2.1. Closing accounts before thinking ahead

1.2.2. Damaging your credit score

1.2.3. Playing the zero percent transfer game

1.3. The five steps to getting rid of credit card debt are

1.3.1. Figure how much debt you have

1.3.2. Decide where the money to pay off your credit card will come from

1.3.3. Decide what to pay off first

1.3.4. Negotiate down the APR

1.3.5. Get started

2. There are six systematic steps to investing

2.1. If your employer offers a 401(k) match

2.1.1. invest to take full advantage of it

2.1.2. contribute just enough to get 100 percent of the match

2.2. Pay off your credit card and any other debt

2.3. Open up a Roth IRA

2.3.1. contribute as much money as possible to it

2.4. If you have money left over

2.4.1. go back to your 401(k)

2.4.2. contribute as much as possible to it

2.5. If you have access to a Health Savings Account

2.5.1. it can also double as an investment account

2.5.2. with incredible tax features few people know about

2.6. If you still have money left to invest

2.6.1. open a regular non-retirement (“taxable”) investment account

2.6.2. put as much as possible there

3. four major buckets where your money will go:

3.1. Fixed costs

3.1.1. 50-60% of take-home pay

3.2. Investments

3.2.1. 10%

3.3. Savings goals

3.3.1. 5-10%)

3.4. Guilt-free spending money

3.4.1. 20-35%

4. Made by Arpit Banjara Hire me on Fiverr ---->

5. Hire me on Upwork--->

6. The Four Big Ideas

6.1. You don’t need to be an expert to get rich…

6.1.1. but you do need to get started early

6.2. Spend extravagantly on the things you love

6.2.1. cut costs mercilessly on the things you don’t

6.3. Use money to design your Rich Life

6.4. There’s a limit to how much you can cut

6.4.1. but no limit to how much you can earn

7. What Is a Rich Life?

7.1. you can spend on the things you love

7.1.1. as long as you cut costs mercilessly on the things you don’t

7.2. Focus on the Big Wins

7.2.1. five to ten things that get you disproportionate results

7.2.1.1. automating your savings

7.2.1.2. investing

7.2.1.3. finding a job you love

7.2.1.4. negotiating your salary

7.3. Investing should be very boring

7.3.1. and profitable

7.3.2. over the long term

8. The key messages of this book

8.1. Getting started is more important

8.1.1. than becoming an expert

8.2. Understanding that it’s okay to make mistakes

8.3. Spending extravagantly on the things you love

8.3.1. cutting costs mercilessly on the things you don’t

8.3.2. also known as “conscious spending”

8.4. there’s a difference between

8.4.1. being sexy and being rich

8.5. Not living in the spreadsheet

8.6. Playing offense, not defense

8.7. Using money to design your Rich Life

9. Sethi considers himself rich now because he can:

9.1. Make career decisions because he wants to

9.1.1. not because of money

9.2. Help his parents with their retirement

9.2.1. so they don’t have to work if they don’t want to

9.3. Spend extravagantly on the things he loves

9.3.1. be relentlessly frugal about the things he doesn’t