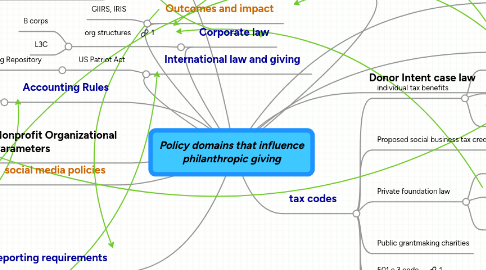

Policy domains that influence philanthropic giving

by Lucy Bernholz

1. Corporate law

1.1. org structures

1.1.1. B corps

1.1.2. L3C

2. Reporting requirements

2.1. Payout rates

2.2. grantees

2.3. investment earnings

2.4. Board constitution

2.4.1. Proposed new rules on governance

2.5. Proposal to share fndn knowledge? Freedom of Foundation Information Act

2.6. New 990 forms

2.7. online giving/marketplace reporting reqs

3. Accounting Rules

3.1. philanthropic equity

4. Outcomes and impact

4.1. GIIRS, IRIS

5. social media policies

6. International law and giving

6.1. US Patriot Act

6.1.1. Exempt Org Repository

7. Nonprofit Organizational Parameters

7.1. IRS double test (purpose / operations)

8. Policy domains that influence Impact Investing

8.1. Exchange and listing regulations

8.2. Microfinance policies and regulators

8.3. Banking regulations - domestic, transnational

9. Policy domains that influence social enterprise

10. tax codes

10.1. individual tax benefits

10.1.1. Estate tax

10.1.2. Deductibility of gifts

10.1.3. tiered tax benefits by income level? by issue area?

10.2. Proposed social business tax credit

10.3. Private foundation law

10.3.1. gifts to individuals

10.3.2. gifts to non 501c3

10.3.3. grants to organizations that lobby

10.4. Public grantmaking charities

10.5. 501 c 3 code

10.6. corporate tax benefits

10.6.1. deductibility of gifts

10.6.2. relative cost/benefit of allocating funds to other tax-reduction incentives