1. Macroeconomic factors (bigger picture view of the economy and how it behaves) as external factors

1.1. Examples

1.1.1. Rising interest rates --> pay more for loans

1.1.2. Higher wages --> more spending --> more payments for employees

1.1.3. Global shortage of chips --> more difficult and costly for automotive manufacturer

1.2. Indicators

1.2.1. Gross domestic product (GDP)

1.2.2. Inflation: percentage change in the CPI (consumer price index)

1.2.3. Unemployment

1.2.4. Balance of payments

1.2.5. Consumer sentiment

1.2.6. Misery index: sume of inflation rate and unemployment rate

1.3. Exchange rates: price of one currency in terms of another

1.3.1. Direct impact on import and export transactions

1.3.2. Influence prices and supply of goods and services

1.3.3. Regimes: fixed, flexible or in between

1.3.3.1. Flexible regimes: market supply and demand

1.3.3.2. Fixed regimes: government authority

1.3.4. Trends: devaluation of currency --> exporter's products more competitive, imported products more expensive

1.4. Digital currencies: any currency or money-like asset that is stored and/or exchanged on digital systems

1.4.1. Cryptocurrency, virtual currency, central bank digital currency

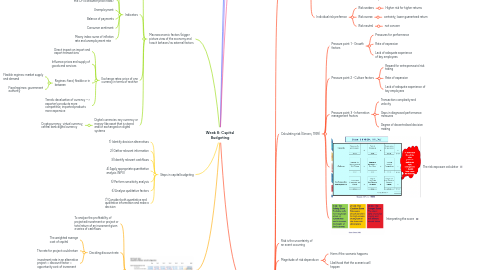

2. Introducing capital budgeting

2.1. Evaluating large long-term projects

2.2. Small investments: time spent is small (buying office stationery) --> not high-risk

2.3. Larger investments: time spent incease, much high risk --> affect business profitability and long-term success

2.4. Capital budgeting: the process of evaluation major potential projects and investments (construction of new plant) --> long-term investment decisions

2.4.1. Examing cash flows

2.4.1.1. Pay-back period

2.4.1.2. Net preset value

2.4.1.3. Internal rate of return

2.4.2. Budgeting is numerically planning: expect earning a return

3. Steps in capital budgeting

3.1. 1) Identify decision alternatives

3.2. 2) Gather relevant information

3.3. 3) Identify relevant cashflows

3.4. 4) Apply appropriate quantitative analysis (NPV)

3.5. 5) Perform sensitivity analysis

3.6. 6) Analyse qualitative factors

3.7. 7) Consider both quantiative and qualitative information and make a decision

4. Net present value (NPV)

4.1. To analyse the profitability of projected investment or project or total return of an invesment given a series of cashflows

4.2. Deciding discount rate

4.2.1. The weighted average cost of capital

4.2.2. The rate for project could return

4.2.3. investment rate in an alternative project = discount factor = opportunity cost of invesment

4.3. Sensitivity of NPV calculation

5. Cost of capital

5.1. Evaluting potential projects or invesments

5.1.1. A university, a consultancy, a retiler, ect.

5.2. Including capital interest on debt, the return expected by equity holders

5.3. Types: equity (shares), debt (bonds), combination of equity and debt (weighted average cost of capital (WACC))

5.4. Financially feasible project: Higher return > cost of capital

6. Information for capital budgeting

6.1. Cash flows

6.1.1. How much cash is expected to flow into or out, how often --> overall cash flow

6.1.2. unknown, mush be forecasted

6.2. Missing data

6.2.1. Caused by: failure of consideration potential factors, failure in providing data, poor data collection, making mistakes in data entry

6.2.2. Solutions: to be conscious of missing data, of potential "blind spots", always interrogate the data

6.3. Unknown/ knowns framework

6.3.1. Known knowns

6.3.2. Known unknowns

6.3.3. Unknown knowns

6.3.4. Unknown unknowns

7. Risk Management

7.1. Probability and risk

7.1.1. Probability (frequency)

7.1.2. Risk (outcome is not known)

7.1.3. Combining risk and probability

7.1.3.1. Expected value (weighted average of all the possible outcomes)

7.1.4. Individual risk prefernce

7.1.4.1. Risk seekers

7.1.4.1.1. Higher risk for higher returns

7.1.4.2. Risk averse

7.1.4.2.1. certainty, lower guaranteed return

7.1.4.3. Risk neutral

7.1.4.3.1. not concern

7.2. Calculating risk (Simons, 1999)

7.2.1. Pressure point 1 - Growth factors

7.2.1.1. Pressures for performance

7.2.1.2. Rate of expansion

7.2.1.3. Lack of adequate experience of key employees

7.2.2. Pressure point 2 - Culture factors

7.2.2.1. Reward for entrepreneurial risk taking

7.2.2.2. Rate of expansion

7.2.2.3. Lack of adequate experience of key employees

7.2.3. Pressure point 3 - Information management factors

7.2.3.1. Transaction complexity and velocity

7.2.3.2. Gaps in diagnosed performance measures

7.2.3.3. Degree of decentralised decision making

7.2.4. The risk exposure calculator

7.2.5. Interpreting the score

7.3. Risk is the uncertainty of an event occurring

7.4. Magnitude of risk depends on

7.4.1. Harm if the scenario happens

7.4.2. Likelihood that the scenario will happen

7.5. Key types of risks

7.5.1. Strategic risks

7.5.1.1. Definition

7.5.1.1.1. market-related activity, competivie dynamics, threats from competitors, changes in technology

7.5.1.2. Examples

7.5.1.2.1. key customer switching, supplier pricing, availability of substitute products, regulatory change

7.5.2. Financial risks

7.5.2.1. Definition

7.5.2.1.1. monetary side

7.5.2.2. Examples

7.5.2.2.1. debtors, potential liquidity shortfalls, financial decline, global financial crisis

7.5.3. Legal and regulatory risks

7.5.3.1. Definition

7.5.3.1.1. laws and regulations, compliance risk (import duty, trading laws, contract liabilities, etc)

7.5.3.2. Examples

7.5.3.2.1. occupational health and safety laws, environmental regulation, licensing regulation, government intervention

7.5.4. Operational risks

7.5.4.1. Definition

7.5.4.1.1. provide products or services to customers, extent of formalised procedures and protocols, ability of employees and service providers, systems, etc.

7.5.4.2. Examples

7.5.4.2.1. external environment shocks, internal shocks, COVID lockdowns, BP oil spill, product recalls, etc.

7.6. Managing risks within businesses

7.6.1. Risk management is very important and be increased focus on

7.6.1.1. Balancing rewards and strategies in mitigating risk

7.6.2. Identifying and managing risk

7.6.2.1. Market-related strategic risk

7.6.2.1.1. Regularly scan the market and undertake periodic SWOT analysis

7.6.2.1.2. e.g., read financial newspapers daily, attend organisation meeting and events

7.6.2.2. Reputation-brand related strategic risks

7.6.2.2.1. Review all internal procedures and protocols

7.6.2.3. Operational risks

7.6.2.3.1. Identify "input-process-output" efficiency rates

7.6.2.3.2. Check the impact of process changes on quality and quantity

7.6.3. Setting up appropriate internal controls

7.6.3.1. Structural safeguards

7.6.3.2. System safeguards

7.6.3.3. Staff safeguards

7.6.4. Fostering organisational culture

7.6.4.1. setting the right tone from the top

7.6.4.2. Understanding the complexities of the products

7.6.4.3. Strong business supervisory line controls

7.6.4.4. Successful operators

7.6.4.5. Ensuring incentive systems

7.6.4.6. etc

7.6.5. Reducing risk through organisational level factors

7.6.5.1. Organisational values

7.6.5.2. Organisation mission and strategy

7.6.5.3. Organisational culture

7.6.5.4. Recruitment

7.6.5.5. Setting behavioural expectations