1. risk classification

1.1. geography

1.1.1. region

1.1.2. country

1.2. asset class

1.2.1. FX

1.2.1.1. carry risk

1.2.2. commodities

1.2.3. equities

1.2.3.1. sector

1.2.3.2. company size

1.2.3.3. event specific

1.2.4. fixed income

1.2.4.1. government

1.2.4.2. corporate

1.2.4.2.1. sector

1.2.4.2.2. company size

1.2.4.2.3. event specfic

1.2.4.3. municipal

1.2.4.4. credit risk

1.2.4.5. term structure

1.2.5. real estate

1.2.6. private equity

1.2.7. hedge funds

1.2.8. cross-asset

1.3. volatility

1.3.1. long vol

1.3.2. short vol

1.3.3. vol neutral

1.4. liquidity risk

1.5. other

1.5.1. hedging demand

1.5.2. convergence

1.6. margin call risk

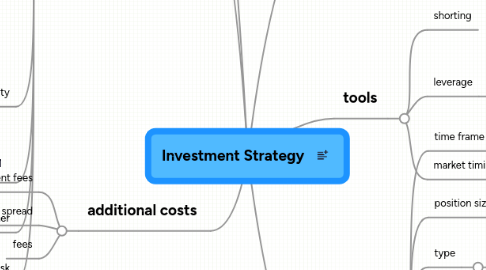

2. additional costs

2.1. taxes & government fees

2.2. spread

2.3. fees

3. for more visit softwaretrading.co.uk

4. approach

4.1. price based

4.1.1. use of prices

4.1.1.1. reactive only

4.1.1.2. forward looking/forecasting

4.1.2. type

4.1.2.1. technical

4.1.2.2. mechanical

4.1.2.3. statistical

4.1.2.3.1. factor models

4.1.2.3.2. PCA

4.2. fundamental

4.2.1. macro

4.2.2. industry (equities only)

4.2.3. company/instrument specific

4.2.4. type

4.2.4.1. factor models

4.2.4.2. PCA

5. tools

5.1. shorting

5.2. leverage

5.2.1. instrument based

5.2.1.1. futures

5.2.1.2. options

5.2.2. debt-based

5.3. market timing

5.3.1. non-linearity of return

5.3.2. event based

6. style

6.1. time frame

6.1.1. holding period of positions

6.1.2. time frames of candles used

6.2. position size

6.2.1. many small trades

6.2.2. big bets on a particular change

6.3. type

6.3.1. momentum

6.4. frequency

6.4.1. mean reversion

6.4.2. high frequency

6.4.3. low frequency

6.5. direction

6.5.1. with the trend

6.5.2. countertrend

6.5.3. non-directional

6.6. application

6.6.1. increase return

6.6.2. reduce risk

6.7. source

6.7.1. macro

6.7.2. value

6.7.3. growth/momentum

6.7.4. opportunistic