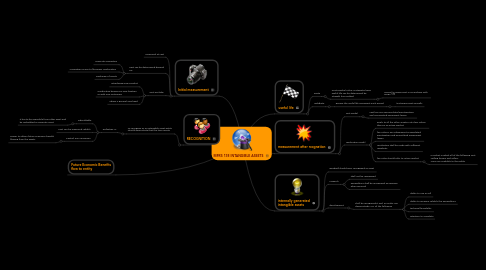

1. Future Economic Benefits flow to entity

2. Initial measurement

2.1. measured at cost

2.2. Cost can be determined depend on:

2.2.1. Separate acquisition

2.2.2. Acquisition as part of business combination

2.2.3. Exchange of assets

2.3. Cost exclude:

2.3.1. Introducing new product

2.3.2. Conducting business in new location or with new customers

2.3.3. Admin n general overhead

3. RECOGNITION

3.1. To recognise as an intangible asset,entity should demostrate that the item meets

3.1.1. Definition IA

3.1.1.1. Indentifiable

3.1.1.1.1. It has to be separable from other asset and be indentified as separate asset

3.1.1.2. Cost can be measured reliably

3.1.1.3. Control over resources

3.1.1.3.1. Power to obtain future economic benefit flowing from the assets

4. internally generated intangible assets

4.1. goodwill should NOT recognized as asset

4.2. research

4.2.1. shall not be recognised

4.2.2. expenditure shall be recognised as expense when incurred

4.3. development

4.3.1. shall be recognised it and an entity can demonstrade ALL of the following

4.3.1.1. ability to use or sell

4.3.1.2. ability to measure reliably the expenditure

4.3.1.3. technical fearsibility

4.3.1.4. intention to complete

5. useful life

5.1. Finite

5.1.1. Cost-residual value: Systematic basis useful life can be determined by: Straight line method

5.1.1.1. assess for imparment in accordance with MFRS 136

5.2. Indefinite

5.2.1. Review the useful life assesment each period

5.2.1.1. test imparment annually

6. measurement after rcognation

6.1. cost model

6.1.1. cost less any aaccumulated amortiasation and accumuated imparment losses

6.2. revaluation model

6.2.1. apply to all the other assets in its class unless there is no active market

6.2.2. fair value is any subsequent accumulated amortisation and acumulated impairment losses

6.2.3. revaluation shall be made with sufficient regularity

6.2.4. fair value should refer to active market

6.2.4.1. a market in which all of the following cost -willing buyers and sellers -price are available to the public