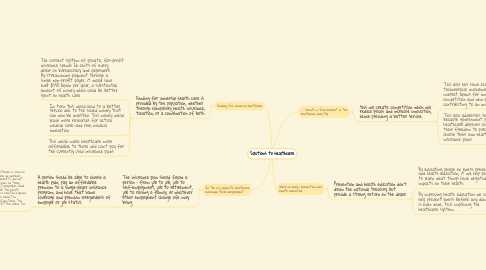

1. Funding for universal healthcare

1.1. Funding for universal health care is provided by the population, whether through compulsory health insurance, taxation, or a combination of both

1.1.1. The current system of private, for-profit insurance spends 26 cents of every dollar on bureaucracy and paperwork. By streamlining payment through a single non-profit payer, it would save over $350 billion per year, a substantial amount of money which could be better spent on health care.

1.1.2. In turn this would lead to a better service due to the saved money that can now be invested. This money would leave more resources for actual medical care—and real medical innovation.

1.1.3. This would make healthcare more affordable to those who can’t pay for the currently used insurance plans.

2. In the US, separate healthcare insurance from employment

2.1. The insurance plan should follow a person – from job to job, job to self-employment, job to retirement, job to raising a family, or whatever other employment change life may bring

2.1.1. A person should be able to choose a health plan, pay an affordable premium to a single-payer insurance program, and have that same coverage and premium irregardless of employer or job status.

2.1.1.1. Employment tied healthcare is used as a tax avoidance scheme as workers who received health benefits did not have to pay income taxes on them, and by the fact that employers could write off the cost of the health benefits as a business related expense so that they can also avoid tax. Therefore, by separating them, the government will benefit for more tax being received.

3. Create a free-market in the healthcare industry

3.1. this will create competition which will reduce prices and increase innovation, hence providing a better service.

3.1.1. This also has some economic and technological involvement as a free market allows for innovation, competition and new products, thus contributing to an improved economy

3.1.2. This also addresses social issues because government provided healthcare deprives consumers of their freedom to purchase and choose their own healthcare and insurance plans

4. Work on illness prevention and health education

4.1. Prevention and health education don’t drain the national treasury but provide a strong return on the dollar

4.1.1. By educating people on illness prevention and health education, it will help people to learn what things have negative impacts on their health.

4.1.2. By improving health education we can help prevent illness before any damage is even done, thus improving the healthcare system.