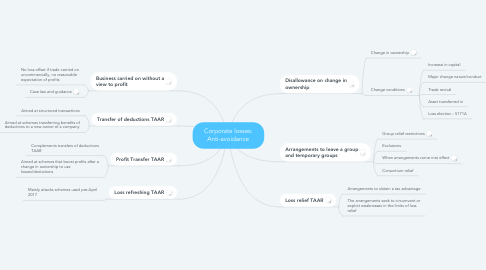

Corporate losses: Anti-avoidance

저자: Glyn Fullelove

1. Disallowance on change in ownership

1.1. Change in ownership

1.2. Change conditions

1.2.1. Increase in capital

1.2.2. Major change nature/conduct

1.2.3. Trade revival

1.2.4. Asset transferred in

1.2.5. Loss election - S171A

2. Arrangements to leave a group and temporary groups

2.1. Group relief restrictions

2.2. Exclusions

2.3. When arrangements come into effect

2.4. Consortium relief

3. Business carried on without a view to profit

3.1. No loss offset if trade carried on uncommercially, no reasonable expectation of profits

3.2. Case law and guidance

4. Transfer of deductions TAAR

4.1. Aimed at structured transactions

4.2. Aimed at schemes transferring benefits of deductions to a new owner of a company

5. Profit Transfer TAAR

5.1. Complements transfers of deductions TAAR

5.2. Aimed at schemes that boost profits after a change in ownership to use losses/deductions

6. Loss relief TAAR

6.1. Arrangements to obtain a tax advantage

6.2. The arrangements seek to circumvent or exploit weaknesses in the limits of loss relief

7. Loss refreshing TAAR

7.1. Mainly attacks schemes used pre-April 2017