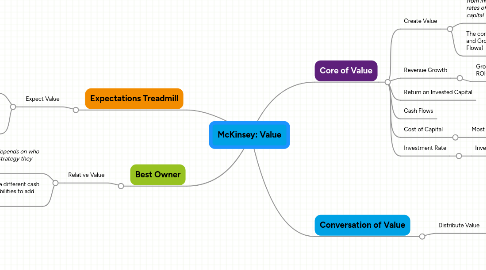

1. Expectations Treadmill

1.1. Expect Value

1.1.1. Performance in the stock market beside value creation is driven by changes in the stock markets expectations

1.1.2. Given Executive compensation is mainly driven by relatively short term share price gains turning around a weak performer is most likely paying more than even more improving a high-performer

2. Best Owner

2.1. Relative Value

2.1.1. The value of a business depends on who is managing it and what strategy they pursue

2.1.2. Different owners will generate different cash flows based on their unique abilities to add value

3. Core of Value

3.1. Create Value

3.1.1. Companies create value by investing capital from investors to generate future cash flows at rates of return exceeding the cost of that capital

3.1.2. The combination of Return on invested Capital (ROIC) and Growth drives value creation (resulting in Cash Flows)

3.2. Revenue Growth

3.2.1. Growth increases value only when ROIC > Cost of Capital

3.3. Return on Invested Capital

3.4. Cash Flows

3.5. Cost of Capital

3.5.1. Most Big Companies from 8 to 10 %

3.6. Investment Rate

3.6.1. Investement Rate = Growth / ROIC

4. Conversation of Value

4.1. Distribute Value

4.1.1. Value is created for shareholders when companies generate higher cash flows, not by rearranging investors' claims on those cash flows

4.1.2. NOT

4.1.2.1. Substitute Dept for Equity

4.1.2.2. change in accounting principles

4.1.3. issue dept to repurchase shares

4.1.4. Just a change in ownership of the claims in cash flows