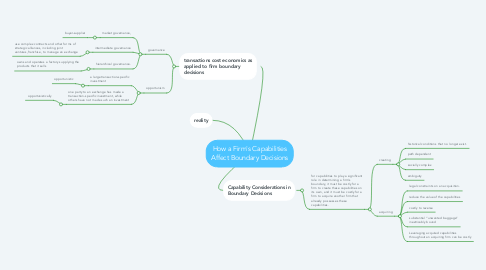

1. transactions cost economics as applied to firm boundary decisions

1.1. governance

1.1.1. market governance,

1.1.1.1. buyer-supplier

1.1.2. intermediate governance

1.1.2.1. use complex contracts and other forms of strategic alliances, including joint ventures,franchise, to manage an exchange

1.1.3. hierarchical governance.

1.1.3.1. owns and operates a factory supplying the products that it sells

1.2. opportunism

1.2.1. a large transaction-specific investment

1.2.1.1. opportunistic

1.2.2. one party to an exchange has made a transaction-specific investment, while others have not made such an investment

1.2.2.1. opportunistically

2. Capability Considerations in Boundary Decisions

2.1. for capabilities to play a significant role in determining a firm’s boundary, it must be costly for a firm to create these capabilities on its own, and it must be costly for a firm to acquire another firm that already possesses these capabilities.

2.1.1. creating

2.1.1.1. historical conditions that no longer exist.

2.1.1.2. path dependent

2.1.1.3. socially complex

2.1.1.4. ambiguity

2.1.2. acquiring

2.1.2.1. legal constraints on an acquisition.

2.1.2.2. reduce the value of the capabilities

2.1.2.3. costly to reverse

2.1.2.4. substantial “unwanted baggage” inextricably bound

2.1.2.5. Leveraging acquired capabilities throughout an acquiring firm can be costly