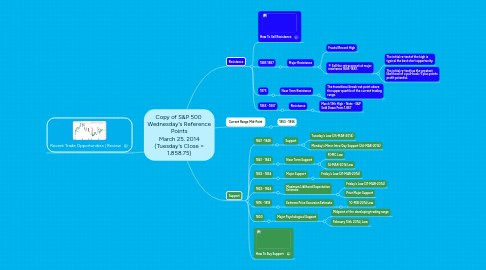

1. Recent Trade Opportunities | Review

2. Resistance

2.1. How To Sell Resistance

2.2. 1885 1887

2.2.1. Major Resistance

2.2.1.1. Fractal Record High

2.2.1.2. Sell the retracement at major resistance 1885-1887.

2.2.1.2.1. The initial re-test of the high is typical the best short opportunity.

2.2.1.2.2. The initial re-test has the greatest likelihood of a pull-back: 5 plus points profit potential.

2.3. 1875

2.3.1. Near Term Resistance

2.3.1.1. The transitional break-out point above the upper quartile of the current trading range.

2.4. 1865 - 1867

2.4.1. Resistance

2.4.1.1. March 13th High - Note - S&P Sold Down From 1,867

3. Current Range Mid-Point

3.1. 1853 - 1856

4. Support

4.1. 1847 -1848

4.1.1. Support

4.1.1.1. Tuesday's Low (25-MAR-2014)

4.1.1.2. Monday's Minor Intra-Day Support (24-MAR-2014)

4.2. 1841 - 1842

4.2.1. Near Term Support

4.2.1.1. FOMC Low

4.2.1.2. 14-MAR-2014 Low

4.3. 1832 - 1834

4.3.1. Major Support

4.3.1.1. Friday's Low (21-MAR-2014)

4.4. 1822 - 1824

4.4.1. Maximum Liklihood Expectation Estimate

4.4.1.1. Friday's Low (21-MAR-2014)

4.4.1.2. Prior Major Support

4.5. 1816 - 1818

4.5.1. Extreme Price Excursion Estimate

4.5.1.1. 10-FEB-2014 Low

4.6. 1800

4.6.1. Major Psychological Support

4.6.1.1. Midpoint of the developing trading range

4.6.1.2. February 13th, 2014 | Low