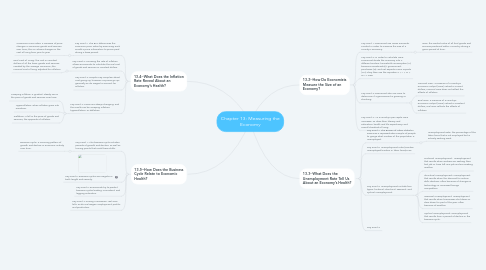

1. 13.4--What Does the Inflation Rate Reveal About an Economy’s Health?

1.1. Key Point 1: The BLS determines the consumer price index by examining each month's price information to prices paid during a base period.

1.1.1. Consumer Price Index: a measure of price changes in consumer goods and services over time; the CPI shows changes in the cost of living from year to year.

1.2. Key Point 2: Knowing the rate of inflation allows economists to calculate the real cost of goods and services in constant dollars.

1.2.1. Real Cost of Living: the cost in constant dollars of all the basic goods and services needed by the average consumer; the nominal cost of living adjusted for inflation.

1.3. Key Point 3: People may complain about cost going up; however, as prices go up, generally so do wages to account for inflation.

1.4. Key Point 4: Prices are always changing, and the results can be creeping inflation, hyperinflation, or deflation.

1.4.1. Creeping Inflation: a gradual, steady rise in the price of goods and services over time.

1.4.2. Hyperinflation: when inflation goes into overdrive.

1.4.3. Deflation: a fall in the price of goods and services; the opposite of inflation.

2. 13.5--How Does the Business Cycle Relate to Economic Health?

2.1. Key Point 1: The business cycle includes periods of growth and decline, as well as turning points that mark these shifts.

2.1.1. Business Cycle: a recurring pattern of growth and decline in economic activity over time.

2.2. Key Point 2: Business cycles are irregular in both length and severity.

2.3. Key Point 3: Economists try to predict business cycles leading, coincident, and lagging indicators.

2.4. Key Point 4: During a recession, real GDP falls, as do real wages, employment, profits, and production.

3. 13.2--How Do Economists Measure the Size of an Economy?

3.1. Key Point 1: Economist use Gross Domestic Product in order to measure the size of a country's economy.

3.1.1. GDP: the market value of all final goods and services produced within a country during a given period of time.

3.2. Key Point 2: In order to calculate GDP, economist divide the economy into 4 different sectors: household consumption (C), business investments(I), government purchases (G), and net exports minus imports (NX).They then use the equation C + I + G + NX = GDP.

3.3. Key Point 3: Economist also use GDP to determine if a government is growing or shrinking.

3.3.1. Nominal GDP: a measure of a country’s economic output (GDP) valued in current dollars; nominal GDP does not reflect the effects of inflation

3.3.2. Real GDP: a measure of a country’s economic output (GDP) valued in constant dollars; real GDP reflects the effects of inflation

3.4. Key Point 4: As a country's per capita GDP increases, so does their literacy and education, health and life expectancy, and overall standard of living.

4. 13.3--What Does the Unemployment Rate Tell Us About an Economy’s Health?

4.1. Key Point 1: The Bureau of Labor Statistics examines a representative sample of people to gauge what number of the population is unemployed.

4.1.1. Unemployment Rate: the percentage of the labor force that is not employed but is actively seeking work.

4.2. Key Point 2: Unemployment rate=(number unemployed/number in labor force)x100

4.3. Key Point 3: Unemployment include four types: frictional, structural, seasonal, and cyclical unemployment.

4.3.1. Frictional Unemployment: unemployment that results when workers are seeking their first job or have left one job and are seeking another.

4.3.2. Structural Unemployment: unemployment that results when the demand for certain skills declines, often because of changes in technology or increased foreign competition.

4.3.3. Seasonal Unemployment: unemployment that results when businesses shut down or slow down for part of the year, often because of weather.

4.3.4. Cyclical Unemployment: unemployment that results from a period of decline in the business cycle.