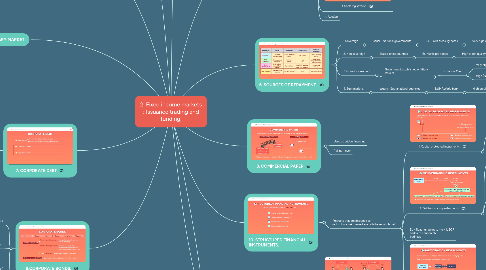

1. 1.CLASSIFICATIONS OF SECURITIES.

1.1. Maturity

1.2. Credit Rating

1.3. Types of issuers

1.4. Coupon structure

1.5. Currency

1.6. Geography

1.7. Indexing

1.8. Tax status

2. 3.TYPES OF INVESTORS IN FIXED INCOME.

2.1. Institutional

2.1.1. Invest directly

2.2. Central Bank

2.2.1. Invest directly

2.3. Retail Investors

2.3.1. Through mutual funds ,ETF’s

3. 5. SECONDARY MARKET.

3.1. Over the counter market

4. 7. CORPORATE DEBT

4.1. 1. Bank loans

4.1.1. From single bank : Bilateral loan

4.1.2. From group of lender : Syndicated loan

4.2. 2. Commercial paper

5. 9.CORPORATE BONDS.

5.1. Short term - < 5 years

5.2. Principal repayment -

5.2.1. 1.Term maturity sturucture - lum sum at maturity (19 -20)

5.2.2. 2.Serial maturity structure - portions through maturity

5.2.3. 3.Sinking Fund - Redemption dates are unknown

5.3. Medium term note(MTN) : Type of note that must be sold through an agent.

6. 11. Short term funding alternatives

7. 2.IBOR.

7.1. Interbank offered rate

7.2. LIBOR

7.2.1. London interbank offered rate.

7.3. Reference rate in floating rate note -

7.3.1. LIBOR + margin = Coupon

7.3.1.1. BPS (Basis points) Its like mm of cm

7.3.1.1.1. 100 Bps = 1%

8. 4.PRIMARY MARKET ISSUING OF BOND.

8.1. 1. Underwriter offering

8.2. 2. Best effort offering

8.3. 3. Shelf registration

8.4. 4. Auction

9. 6. SOURCES OF REPAYMENT.

9.1. 1.Sovereign

9.1.1. Issuer - National governments

9.1.1.1. Ex. T-bills ,treasury notes

9.1.1.1.1. Very high credit quality

9.2. 2. Non sovereign

9.2.1. States ,cities,counties

9.2.1.1. Ex. Municipal bonds

9.2.1.1.1. High credit quality

9.3. 3. Quasi Government

9.3.1. Government established entities- Issuers

9.3.1.1. Ex. Fannie Mae

9.3.1.1.1. Very high(backed)

9.3.1.1.2. High (Not backed)

9.4. 4. Supranational

9.4.1. Issuers - Supranational agencies

9.4.1.1. Ex.IMF,World bank

9.4.1.1.1. High credit quality

10. 8. COMMERCIAL PAPER

10.1. Used as bridge financing

10.2. Rolling - over

11. 10. STRUCTURED FINANCIAL INSTRUMENTS.

11.1. Products that are designed to redistribute risk. Issase kese hota he redistribute?

11.1.1. 1. Capital protected instruments

11.1.1.1. Promise investors a minimum payout at maturity as well as some potential upside gains

11.1.1.1.1. $100 in call options after one year they will gain some more money.

11.1.1.1.2. Through these two measures they guarantee the customer returns are fixed.

11.1.1.1.3. They invest 900$ in zero coupon bond hence 1000$ fixed after one year.

11.1.2. 2. Yield enhancing instruments

11.1.2.1. Credit linked note -

11.1.2.2. Credit event - a downgrade in issuers credit rating.

11.1.2.2.1. Kam hua credit to par value se kam principal milega.

11.1.2.2.2. Jyada hua to ?

11.1.2.2.3. Credit event matlab credit rating niche nahi Gaya to Jitna paisa dala utna Milna pakka he.= mane par value milega.

11.1.2.2.4. Kisliye jyada hota he Iska coupon pata nahi? Kyoki risk jyada he !

11.1.3. Eg - floating rate note me - LIBOR badha to coupon bhi badhega

11.1.4. 3. Participation instruments

11.1.4.1. kisi asset ke returns me paisa Dalke partner banana mane kisi reference rate ke Sath jud Jana - stock index ke sath jud Jana -

11.1.4.1.1. Kyo judna - Uska rate badha to tumhara coupon bhi badhega

11.1.4.1.2. LIBOR kam hua to coupon bhi kam hoga participate kiya he to returns ke sath loss bhi zhelne ki kshamta rakho

11.1.5. 4. Leveraged instruments

11.1.5.1. Leverage mane paisa Ghene broker kadhun jasta paisa lavnyasathi mhanze returns jasta miltil .

11.1.5.2. Eg. Inverse floater Madge reference rate chya downfall var paisa lavlay.

11.1.5.3. Pan kadhi kadhi khup Vadhla na reference rate tar Kai? Zero floor asto tya Madhe reference rate khup vadhla tari negative nahi honar coupon investor la kahi tari milelach.