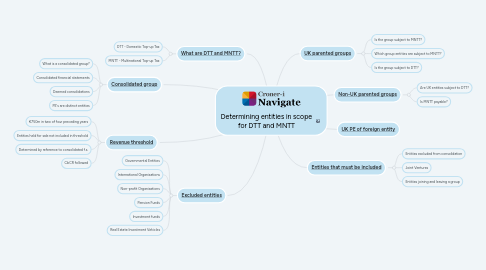

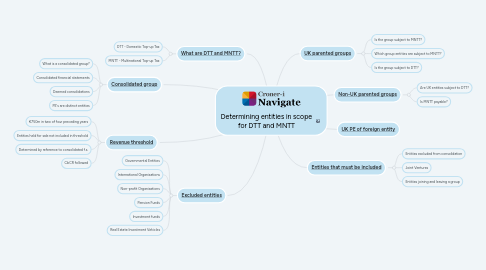

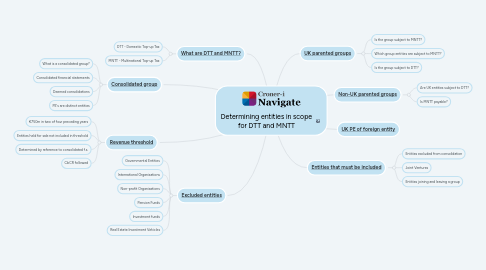

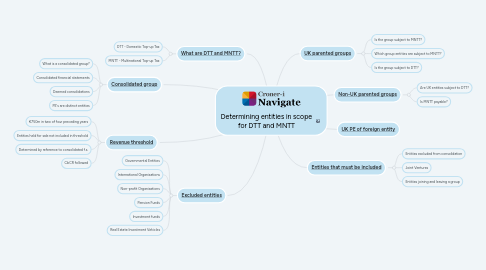

Determining entities in scope for DTT and MNTT

作者:Martin Jackson

1. [Excluded entities](https://library.croneri.co.uk/po-heading-id_GtUiJH7lsESTSG9BIZK8dQ)

1.1. Governmental Entities

1.2. International Organisations

1.3. Non-profit Organisations

1.4. Pension Funds

1.5. Investment funds

1.6. Real Estate Investment Vehicles

2. [Revenue threshold](https://library.croneri.co.uk/po-heading-id_7ixfSjN6H0mIB96UeuNm0w)

2.1. €750m in two of four preceding years

2.2. Entities held for sale not included in threshold

2.3. Determined by reference to consolidated f.s.

2.4. CbCR followed

3. [Consolidated group](https://library.croneri.co.uk/po-heading-id_PldbxAqfSUOhoeMFrM1Yiw)

3.1. What is a consolidated group?

3.2. Consolidated financial statements

3.3. Deemed consolidations

3.4. PE's are distinct entities

4. [What are DTT and MNTT?](https://library.croneri.co.uk/po-heading-id_3s984gEyu0aiqyJAKee93Q)

4.1. DTT - Domestic Top-up Tax

4.2. MNTT - Multinational Top-up Tax

5. [UK parented groups](https://library.croneri.co.uk/po-heading-id_pGqt-jVM5kOt2WZJwEkUnQ)

5.1. Is the group subject to MNTT?

5.2. Which group entities are subject to MNTT?

5.3. Is the group subject to DTT?

6. [UK PE of foreign entity](https://library.croneri.co.uk/po-heading-id_YcVjigxqqkWDODFoQOcaKQ)

7. [Non-UK parented groups](https://library.croneri.co.uk/po-heading-id_MX2nZ0QTAkeReM5MHoTZ2A)

7.1. Are UK entities subject to DTT?

7.2. Is MNTT payable?

8. [Entities that must be included](https://library.croneri.co.uk/po-heading-id_UcnwI3SgikaejSASBCQ2iw)

8.1. Entities excluded from consolidation

8.2. Joint Ventures

8.3. Entities joining and leaving a group