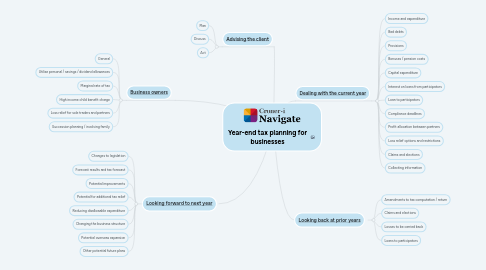

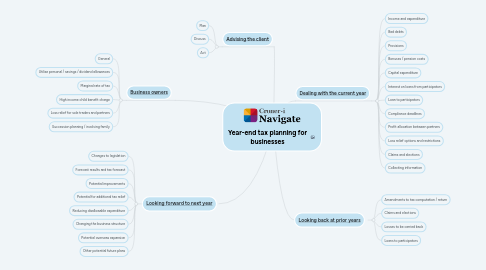

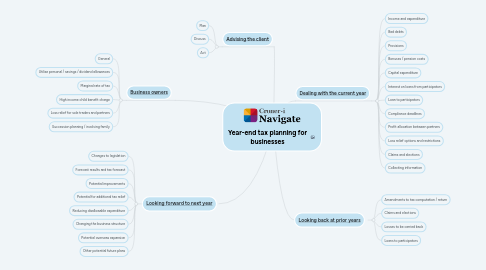

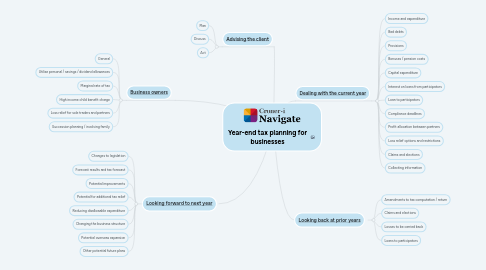

Year-end tax planning for businesses

作者:Laura Burrows

1. [Looking forward to next year](https://library.croneri.co.uk/WKID-202501130837440579-95142187)

1.1. Changes to legislation

1.2. Forecast results and tax forecast

1.3. Potential improvements

1.4. Potential for additional tax relief

1.5. Reducing disallowable expenditure

1.6. Changing the business structure

1.7. Potential overseas expansion

1.8. Other potential future plans

2. [Dealing with the current year](https://library.croneri.co.uk/WKID-202501090931580735-44280111)

2.1. Income and expenditure

2.2. Bad debts

2.3. Provisions

2.4. Bonuses / pension costs

2.5. Capital expenditure

2.6. Interest on loans from participators

2.7. Loan to participators

2.8. Compliance deadlines

2.9. Profit allocation between partners

2.10. Loss relief options and restrictions

2.11. Claims and elections

2.12. Collecting information

3. [Looking back at prior years](https://library.croneri.co.uk/WKID-202501130818490081-83089078)

3.1. Amendments to tax computation / return

3.2. Claims and elections

3.3. Losses to be carried back

3.4. Loans to participators

4. [Advising the client](https://library.croneri.co.uk/WKID-202501090916070719-82567005)

4.1. Plan

4.2. Discuss

4.3. Act

5. [Business owners](https://library.croneri.co.uk/WKID-202501130915540311-96562019)

5.1. General

5.2. Utilise personal / savings / dividend allowances

5.3. Marginal rate of tax

5.4. High income child benefit charge

5.5. Loss relief for sole traders and partners

5.6. Succession planning / involving family