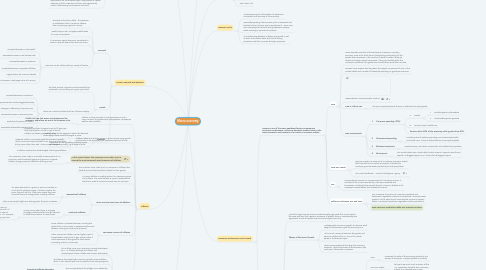

1. Inflation

1.1. Inflation is a key concept in macroeconomics, and a major concern for government policymakers, companies, workers and investors.

1.1.1. It tells you how fast prices are changing in the economy, and where we are in the business cycle.

1.2. Inflation refers to a broad increase in prices across many goods and services in an economy over a sustained period of time.

1.2.1. It means you have to spend more to fill your gas tank, buy a gallon of milk or get a haircut. Inflation increases your cost of living.

1.2.2. Moderate inflation is actually good for economic growth. When consumers expect prices to rise, they are more likely to buy now, rather than wait. This increases demand.

1.2.3. If inflation reaches the double-digits, that's hyperinflation.

1.3. In the United States, the Consumer Price Index (CPI) is among the most commonly-used measures of inflation.

1.3.1. The Consumer Price Index is a monthly measurement of U.S. prices for most household goods and services. It reports inflation (rising prices) and deflation (falling prices.)

1.4. The Producer Price Index (PPI) is a measure of inflation that tracks the prices that producers obtain for their goods.

1.5. The GDP deflator is another option for measuring prices and inflation. The GDP deflator is a price measurement tool that is used to convert nominal GDP to real GDP.

1.6. There are two main types of inflation.

1.6.1. Demand-pull Inflation

1.6.1.1. It's when demand for a good or service increases so much that it outstrips supply. If sellers maintain the price, they will sell out. They soon realize they now have the luxury of raising prices, creating inflation.

1.6.1.2. When more people fight over fewer goods, the price increases.

1.6.2. Cost-push inlfation

1.6.2.1. It only occurs when there is a supply shortage combined with enough demand to allow the producer to raise prices.

1.6.2.1.1. Natural disasters create temporary cost-push inflation by damaging production facilities. That's what happened to oil refineries after Hurricane Katrina. The depletion of natural resources is a growing cause of cost-push inflation. For example, overfishing reduces the supply of seafood, driving up prices.

1.7. Two Major Causes of Inflation

1.7.1. Some inflation is caused because a country has printed too much money or experienced financial disaster, causing its currency to plummet.

1.7.2. Other sources of inflation can be higher input or transportation costs such as gas, which makes it more expensive to ship good to retail stores, increasing costs for consumers.

1.8. Phillips Curve

1.8.1. The Phillips curve is an economic concept developed by A. W. Phillips stating that inflation and unemployment have a stable and inverse relationship.

1.8.2. The theory claims that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment.

1.8.3. The concept behind the Phillips curve states the change in unemployment within an economy has a predictable effect on price inflation.

1.8.3.1. Increasing inflation decreases unemployment, and vice versa.

1.8.4. Stagflation

1.8.4.1. Stagflation occurs when an economy experiences stagnant economic growth, high unemployment and high price inflation.

1.8.4.2. Demand usually declines in a stagnant economy, since unemployed workers naturally consume less and businesses reduce prices to re-attract consumers.

2. Unemployment

2.1. Labor is a driving force in every economy – wages paid for labor fuel consumer spending, and the output of labor is essential for companies.

2.1.1. Likewise, unemployed workers represent wasted potential production within an economy. Consequently, unemployment is a significant concern within macroeconomics.

3. Supply, Demand and Elasticity

3.1. Demand

3.1.1. Demand is driven by utility – the pleasure or satisfaction that a consumer obtains from consuming a good or service.

3.1.2. Wealth plays a role, as higher wealth leads to more consumption.

3.1.3. if consumers expect economic conditions to worsen, they will spend less and save more.

3.1.4. Demand can be influenced by a variety of factors.

3.1.4.1. Increase/decrease in real wealth

3.1.4.2. Decrease/increase in real interest rate

3.1.4.3. Increase/decrease in optimism

3.1.4.4. Increase/decrease in expected inflation

3.1.4.5. Higher/lower real incomes abroad

3.1.4.6. Reduction/increase in exchange value of currency

3.2. Supply

3.2.1. the total amount of goods and services that are produced in an economy at a given price level.

3.2.2. There are numerous factors that can influence supply:

3.2.2.1. Increase/decrease in resources

3.2.2.2. Improvements in technology/productivity

3.2.2.3. Changes in efficiency of resource use

3.2.2.4. Decrease/increase in resource prices

3.2.2.5. Reduction/increase in inflation

3.2.2.6. Favorable/unfavorable supply shocks

3.3. Elasticity

3.3.1. Elasticity refers to the degree to which the demand and supply curves react to changes in price.

3.3.2. Expressed as the equation, elasticity equals % change in quantity / % change in price.

4. Schools Of Thought

4.1. Classical

4.1.1. Classical economists hold that prices, wages and rates are flexible and markets always clear

4.1.2. As there is no unemployment, growth depends upon the supply of production factors.

4.2. Keynesian

4.2.1. Keynesian economics was largely founded on the basis of the works of John Maynard Keynes.

4.2.2. Keynesians focus on aggregate demand as the principal factor in issues like unemployment and the business cycle.

4.2.3. Keynesian economists believe that the business cycle can be managed by active government intervention through fiscal policy and monetary policy.

4.3. Monetarist

4.3.1. Monetarist economists believe that the role of government is to control inflation by controlling the money supply.

4.4. New Keynesian

4.4.1. While New Keynesians do accept that households and firms operate on the basis of rational expectations, they still maintain that there are a variety of market failures, including sticky prices and wages.

4.4.2. Because of this "stickiness", the government can improve macroeconomic conditions through fiscal and monetary policy.

4.5. Neoclassical

4.5.1. Neoclassical economics assumes that people have rational expectations and strive to maximize their utility.

4.5.2. The idea of marginalism and maximizing marginal utility is attributed to the neoclassical school, as well as the notion that economic agents act on the basis of rational expectations.

4.5.3. Since neoclassical economists believe the market is always in equilibrium, macroeconomics focuses on the growth of supply factors and the influence of money supply on price levels.

4.6. New Classical

4.6.1. The New Classical school is built largely on the Neoclassical school.

4.6.2. The New Classical school emphasizes the importance of microeconomics and models based on that behavior.

4.6.3. New Classical economists believe that unemployment is largely voluntary and that discretionary fiscal policy is destabilizing, while inflation can be controlled with monetary policy.

4.7. Austrian

4.7.1. Austrian school economists believe that human behavior is too idiosyncratic to model accurately with mathematics and that minimal government intervention is best.

4.7.2. The Austrian school has contributed useful theories and explanations on the business cycle, implications of capital intensity, and the importance of time and opportunity costs in determining consumption and value.

5. Definition

5.1. Economics is the study of how agents (people, firms, nations) use scarce resources to satisfy unlimited wants.

5.1.1. Macroeconomics

5.1.1.1. Macroeconomics is the branch of economics that concerns itself with market systems that operate on a large scale.

5.1.1.2. Key Questions

5.1.1.2.1. What causes unemployment?

5.1.1.2.2. What causes inflation?

5.1.1.2.3. What creates or stimulates economic growth?

5.1.1.3. Macroeconomics attempts to measure how well an economy is performing, understand how it works, and how performance can improve.

5.1.1.4. Economics holds that maximizing welfare is a key goal in all economic pursuits.

5.1.1.4.1. Welfare can be broadly defined as the maximum enjoyment of resources for the minimum output of effort (work, labor or capital).

5.1.1.4.2. Welfare is measured in part by consumer and producer surpluses

5.1.2. Microeconomics

5.1.2.1. Where microeconomics is more focused on the choices made by individual actors in the economy (individual consumers or firms, for instance), macroeconomics deals with the performance, structure and behavior of the entire economy.

5.1.2.2. When investors talk about macroeconomics, discussions of policy decisions like raising or lowering interest rates or changing tax rates are discussed.

5.1.3. Goals

5.1.3.1. economic growth

5.1.3.2. full employment

5.1.3.2.1. Gini ratio measures the inequality of income distribution across an economy

5.1.3.3. economic efficiency

5.1.3.4. price stability

5.1.3.5. balanced trade

6. Economic Performance and Growth

6.1. Income is one of the most significant factors in measuring economic performance, and gross domestic product (GDP) is the most commonly used measure of a country's economic activity.

6.1.1. GDP

6.1.1.1. Gross domestic product is the best way to measure a country's economy. GDP is the total value of everything produced by all the people and companies in the country. It doesn't matter if they are citizens or foreign-owned companies. If they are located within the country's boundaries, the government counts their production as GDP.

6.1.1.2. Personal consumption has long been the largest component of GDP in the United States and is made of household spending on goods and services.

6.1.1.3. News Release: Gross Domestic Product

6.1.1.4. How It Affects You

6.1.1.4.1. The GDP impacts personal finance, investments and job growth.

6.1.1.5. GDP Components

6.1.1.5.1. 1. Consumer spending (70%)

6.1.1.5.2. 2. Government spending

6.1.1.5.3. 3. Business investment

6.1.1.5.4. 4. Net exports

6.1.2. GDP per Capita

6.1.2.1. GDP per capita is a measure of a country's economic output that accounts for its number of people. It divides the country's gross domestic product by its total population

6.1.2.2. The World Factbook — Central Intelligence Agency

6.1.3. GNI

6.1.3.1. Gross national income is a measurement of a country's income. It includes all the income earned by a country's residents and businesses, including those earned abroad. Income is defined as all employee compensation and investment income.

6.1.4. Difference between GNI and GDP

6.1.4.1. GNI measures all income of a country's residents and businesses, regardless of where it's produced. Gross domestic product, on the other hand, measures the income of anyone within a country's boundaries, regardless of who produces it.

6.1.4.2. GDP measures production while GNI measures income.

6.2. Models of Growth

6.2.1. While the large majority of economists basically agree with the use of metrics like GDP and GDP per capita as measures of growth, there is considerably less agreement in how to explain how economies grow over time.

6.2.2. Phases of Economic Growth

6.2.2.1. Analysts watch economic growth to discover what stage of the business cycle the economy is in.

6.2.2.2. As too much money chases too few goods and services, inflation kicks in. This is the "peak" phase in the business cycle.

6.2.2.3. When more people sell than buy, the economy contracts. When that phase of the business cycle continues, it becomes a recession

6.2.3. Economy indicators

6.2.3.1. These first five indicators tell you how the economy is doing. They are the most closely watched by analysts, Wall Street and the government.

6.2.3.1.1. GDP

6.2.3.1.2. GDP per capita

6.2.3.1.3. The current jobs

6.2.3.1.4. The unemployment rate

6.2.3.1.5. Inflation with the consumer price index

6.2.3.2. The best way to predict what the economy will do is with the five following leading economic indicators.

6.2.3.2.1. The current durable goods orders report tells you how many orders were received by manufacturers.

6.2.3.2.2. Manufacturing jobs tell you manufacturers' confidence level.

6.2.3.2.3. The stock market often predicts what the economy will do in the next six months.

6.2.3.2.4. Building permits give you a nine-month lead in new home construction.

6.2.3.2.5. Interest rates are the most important indicator because that’s how the Fed influences growth.

6.2.4. Track the economy

6.2.4.1. U.S. Bureau of Economic Analysis (BEA)

6.2.4.2. Economic News Releases : U.S. Bureau of Labor Statistics

6.2.4.3. Economagic: Economic Time Series Page

6.2.4.4. Economic Indicators and Analysis | Moody's Analytics Economy.com