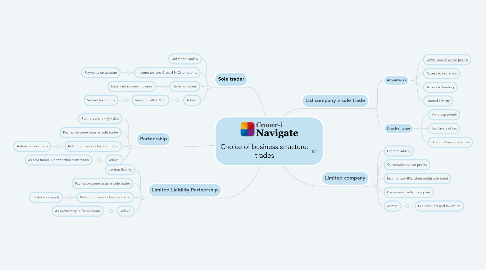

Choice of business structure: trades

Julia Bowyerにより

1. [Sole trader](https://library.croneri.co.uk/po-heading-id_0CdcPkdd4EqleeeQOxtzBg)

1.1. Unlimited liability

1.2. Income tax and Class 4 NICs on profits

1.2.1. Payments on account

1.3. Relief for losses

1.3.1. Enhanced in opening years

1.4. Admin.

1.4.1. Register with HMRC

1.4.1.1. Submit tax returns

2. [Limited Liability Partnership](https://library.croneri.co.uk/po-heading-id_MiauKLoSJUeMKj04wyr9eQ)

2.1. Limited liability

2.2. Pay tax on same basis as sole trader

2.3. Relief for losses as for sole trader

2.3.1. Restrictions apply

2.4. Admin.

2.4.1. As partnership + file accounts

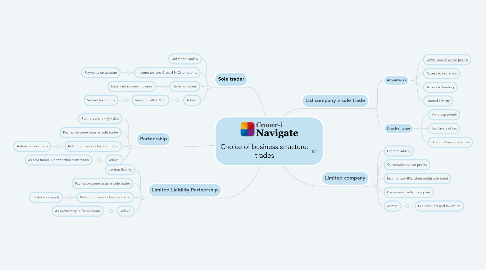

3. Ltd company v sole trade

3.1. [Advantages](https://library.croneri.co.uk/po-heading-id_-JdHmthIokOaUKmyN9fHgw)

3.1.1. [Lower rate of tax on profits](https://library.croneri.co.uk/po-heading-id_O_F0zltFX0miV1a7VIauXw)

3.1.2. [Access to tax reliefs](https://library.croneri.co.uk/po-heading-id_1VRbQgvJ-UiSOzcjugdPfQ)

3.1.3. Access to funding

3.1.4. Limited liability

3.2. [Disadvantages](https://library.croneri.co.uk/po-heading-id_-JdHmthIokOaUKmyN9fHgw)

3.2.1. More paperwork

3.2.2. Two layers of tax

3.2.3. Directors' responsibilities

4. [Limited company](https://library.croneri.co.uk/po-heading-id_Qar1VLEex0yekCC1C6tE2w)

4.1. Limited liability

4.2. Corporation tax on profits

4.3. Income tax/NICs when profits extracted

4.4. Losses used within company

4.5. Admin.

4.5.1. File accounts and tax return

5. [Partnership](https://library.croneri.co.uk/po-heading-id_qrRVgVUCIU6ieE2UA4iMoQ)

5.1. Partners are jointly liable

5.2. Pay tax on same basis as sole trader

5.3. Relief for losses as for sole trader

5.3.1. Anti-avoidance rules

5.4. Admin.

5.4.1. As sole trader + partnership's tax return