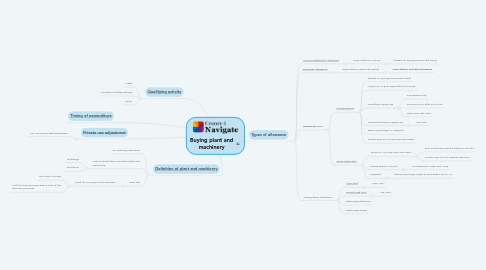

1. [Definition of plant and machinery](https://library.croneri.co.uk/navigate-taxb/po-heading-id_j6MfqNpmF0u1Ci9Z0uIIpw)

1.1. No statutory definition

1.2. Lists of assets that cannot be plant and machinery

1.2.1. Buildings

1.2.2. Structures

1.3. Case law

1.3.1. Used for carrying on the business

1.3.1.1. Not stock in trade

1.3.1.2. Not the business premises or part of the business premises

2. [Qualifying activity](https://library.croneri.co.uk/navigate-taxb/po-heading-id_tyhlleOSEkWJZnr4U9XL6g)

2.1. Trade

2.2. Furnished holiday lettings

2.3. Other

3. [Private use adjustment](https://library.croneri.co.uk/navigate-taxb/po-heading-id_F5KKLkFlIkGzRSw0o-WATA)

3.1. For unincorporated businesses

4. [Timing of expenditure](https://library.croneri.co.uk/navigate-taxb/po-heading-id_NlGApbDey0yJrc7egRwZ3w)

5. Types of allowance

5.1. [Annual Investment Allowance](https://library.croneri.co.uk/navigate-taxb/po-heading-id_KaR2ZjVK4U631kLeF0QXmQ)

5.1.1. 100% relief on £1m pa

5.1.1.1. [Based on Spring Finance Bill 2023}

5.2. [First-year Allowance](https://library.croneri.co.uk/navigate-taxb/po-heading-id_to--W3qdJkytMlFotD25mw)

5.2.1. 100% relief on particular assets

5.2.1.1. Cars: electric and zero emissions

5.3. Temporary FYAs

5.3.1. [Full-expensing](https://library.croneri.co.uk/navigate-taxb/po-heading-id_to--W3qdJkytMlFotD25mw#po-heading-id_EduYQ2Vgd0y1OuQ-ER-UTA )

5.3.1.1. [Based on Spring Finance Bill 2023]

5.3.1.2. 100% FYA in year expenditure incurred

5.3.1.3. Conditions apply, eg

5.3.1.3.1. Companies only

5.3.1.3.2. Incurred on or after 01/04/23

5.3.1.3.3. New main rate P&M

5.3.1.4. General exclusions apply, eg

5.3.1.4.1. Not cars

5.3.1.5. Balancing charge on disposal

5.3.1.6. Similar 50% FYA for special rate assets

5.3.2. [Super-deduction](https://library.croneri.co.uk/navigate-taxb/po-heading-id_to--W3qdJkytMlFotD25mw#po-heading-id_y7bnWY4ua06SBECeUPQKTw)

5.3.2.1. 130% FYA for new main rate P&M

5.3.2.1.1. But, had to be incurred before 01/04/23

5.3.2.1.2. Similar 50% FYA for special rate P&M

5.3.2.2. Period spans 01/04/23

5.3.2.2.1. CAs between 100% and 130%

5.3.2.3. Disposal

5.3.2.3.1. Balancing charge equal to proceeds x up to 1.3

5.4. Writing down allowance

5.4.1. [Main pool](https://library.croneri.co.uk/navigate-taxb/po-heading-id_4LWzKPqCp0CkXNtEDzOP9g)

5.4.1.1. 18% WDA

5.4.2. [Special-rate pool](https://library.croneri.co.uk/navigate-taxb/po-heading-id_EZY4ZQoeAUGlHjPQwBV_GQ)

5.4.2.1. 6% WDA

5.4.3. Balancing allowance

5.4.4. Balancing charge