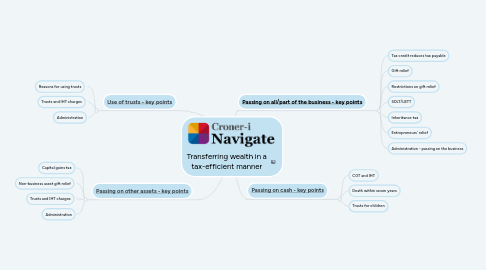

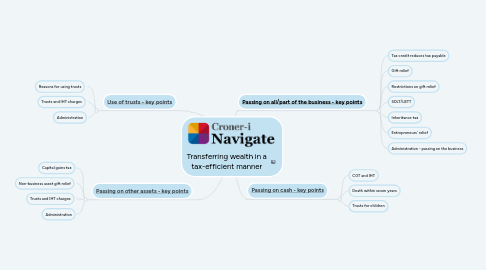

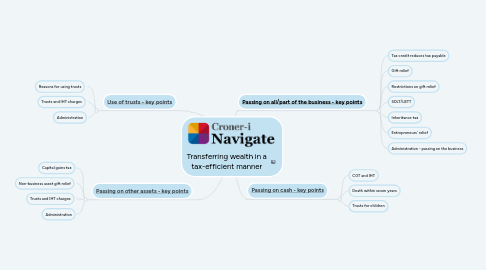

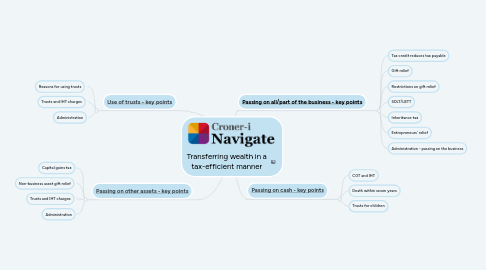

Transferring wealth in a tax-efficient manner

stephanie webberにより

1. [Use of trusts - key points](https://library.croneri.co.uk/po-heading-id_fGsrKkT8bEmdK01bA7c6vQ)

1.1. Reasons for using trusts

1.2. Trusts and IHT charges

1.3. Administration

2. [Passing on other assets - key points](https://library.croneri.co.uk/po-heading-id_2PB1RpX3MEe2UDceQRv95Q)

2.1. Capital gains tax

2.2. Non-business asset gift relief

2.3. Trusts and IHT charges

2.4. Administration

3. [Passing on all/part of the business - key points](https://library.croneri.co.uk/po-heading-id_QwCsd1fTp0yciZs5_3QPUg)

3.1. Tax credit reduces tax payable

3.2. Gift relief

3.3. Restrictions on gift relief

3.4. SDLT/LBTT

3.5. Inheritance tax

3.6. Entrepreneurs' relief

3.7. Administration - passing on the business

4. [Passing on cash - key points](https://library.croneri.co.uk/po-heading-id_NMXMjKuGmkGhl9OuHzjwLw)

4.1. CGT and IHT

4.2. Death within seven years

4.3. Trusts for children