1. The fall out from the credit crunch and a recession in global trade, production and jobs has made it abundantly clear for people and businesses in Britain just how inter-connected the world is in an economic sense.

2. Why does output grow over time ?

2.1. Reserach and development

2.2. Education and training

2.3. Technology advances

2.4. Specialisation and Division of labour

2.5. Trend output over time

2.6. Potential GDP

2.7. Actual output in UK

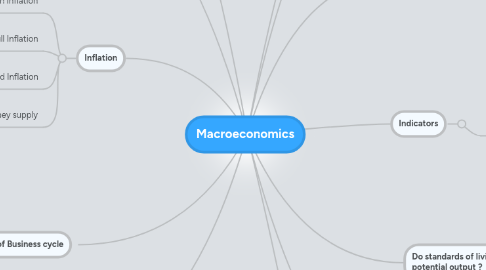

3. Stages of Business cycle

3.1. Economic growth

3.1.1. Upswing in the level of economic activity in a year

3.2. Boom

3.2.1. Economy's at its peak of level of economic activity in a year

3.3. Recession

3.3.1. Downswing in the level of economic activity in a year

3.4. Slump

3.4.1. Level of economic activity is at it's lowest in a year

3.5. Recovery

3.5.1. Economy recovers from a recent recession

4. Factors affecting Saving

4.1. Inflation rate

4.2. Interest rate

4.3. Mortgage rate

4.4. Expectations

4.5. Tax rates

4.6. Pension schemes

4.7. Unemployment rate

4.8. Consumer confidence

4.9. Economic cycle

4.10. Opportunity cost

5. Inflation

5.1. Cost-Push Inflation

5.1.1. Increase in costs of production for firms causes prices to rise

5.2. Demand-Pull Inflation

5.2.1. Excess aggregate demand causes an increase in prices

5.3. Imported Inflation

5.3.1. Importing inflated goods from countries experiencing increasing inflation

5.4. Money supply

5.4.1. Increasing money supply in the economy would cause people to have more money and thus increase aggregate demand which causes prices to rise

6. Current Account

6.1. Trade in goods

6.2. Trade in services

6.3. Net income inflows

6.4. Net transfers

6.5. Weaker Exchange rate=Increase in exports(Cheaper=Decrease in Imports(more expensive)

6.6. Stronger exchange rate=Decrease in exports(more expensive)=Increase in imports(cheaper)

7. Government's main economic objectives

7.1. Low inflation

7.2. Steady and sustained growth

7.3. High levels of employment

7.4. Improvements in living standards

8. Indicators

8.1. Real GDP growth

8.1.1. Jobs - unemployment and emplopyment rates

8.1.2. Prices - annual change in the consumer price index

8.1.3. Trade balances and measures of competitiveness

8.1.4. Productivity of labour and capital inputs

8.1.5. Average standard of living e.g. measured by per capita GDP (PPP adjusted)

8.1.6. Quality and accessibility of public services

9. The macroeconomic performance of any one nation is affected by events, policies and shocks in other countries. No economy is immune to what is happening in the global financial and economic system.

10. Do standards of living always rise in line with potential output ?

11. Factors affecting Aggregate demand (Consumption, Investment, Government Spending.

11.1. Real consumer disposable income

11.2. Interest rates

11.3. Economic cycle

11.4. Inflation

11.5. Exchange rate

11.6. Unemployment

11.7. Weather/Climate

11.8. Expectation/Speculation

11.9. Consumer confidence

11.10. National debt

11.11. Tax rates

11.12. War

11.13. Politics/Elections

12. Unemployment

12.1. Structural

12.1.1. Whole industries close down

12.2. Classical

12.2.1. Too high wage expectations

12.3. Cyclical

12.3.1. Caused by an economic recession

12.4. Frictional

12.4.1. Time period when someone moves from one job to another

12.5. Seasonal

12.5.1. Caused by changes in season and weather

12.6. Hidden

12.6.1. People who don't take part in claimant count