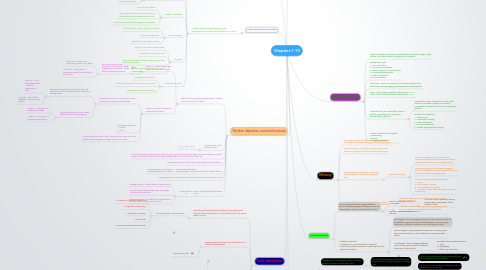

1. Profit maximisation

1.1. Normal profit: that level of profit which is just sufficient to keep all factors of production in their present use. this occurs where AC=AR.

1.1.1. The role of profit in the economy

1.1.1.1. 1. Allocation of factors of production

1.1.1.2. 2. Signal for market entry

1.1.1.3. 3. Promotes innovation

1.1.1.4. 4. Investment

1.1.1.5. 5. Economic performance indicator

1.2. Supernormal profit: This is any profit which is in excess of normal profit.

1.2.1. supernormal profit

1.3. profits are maximised at the point where MC=MR

1.4. Alternative goals

1.4.1. 1. Market share or sales growth

1.4.2. 2. revenue maximisation

1.4.3. 3. Managerial status (This is where managers seek to increase their overall job satisfaction i.e. company car etc)

1.5. Principle agent problem

1.5.1. The principal, employs an agent to perform tasks on his behalf but they can't ensure that the agent will perform them in precisely the way the principal would like due to asymmetric information.

2. The firm: objectives, costs and revenues

2.1. fixed cost: Do not change with output. Variable costs: Change with output.

2.1.1. Short run: Where at least one factor of production is fixed.

2.1.1.1. Firms can only increase production in the short run by employing more labour - could lead to diminishing returns.

2.1.1.1.1. short run - Rising SRAC = diminishing returns to a factor

2.1.1.1.2. Short run - Falling SRAC = increasing returns to a factor plus falling AFC

2.1.2. Long run: where no factors of production are fixed.

2.1.2.1. economies of scale: as a firm gains in size its long run average costs decrease.

2.1.2.1.1. External economies of scale: Exists when the growth of a whole industry leads to falling long average costs.

2.1.2.1.2. Internal economies of scale: exists when the firm itself is growing.

2.1.2.2. Long term expansion: 1. Capital 2. Land

2.1.2.3. Minimum Efficient Scale (MES): The point when you reach the bottom of the Long Run Average Cost / LRAC curve

2.2. Average cost = total costs/ quantity

2.2.1. AC = AFC + AVC

2.3. Law of Diminishing returns: as we add more of a variable input such as labour or raw materials to a fixed amount of land and capital the change in total output will at first rise and then fall.

2.4. Increasing returns to labour is found through division of labour.

2.5. Increasing returns to a factor: 1. Increased specialisation. decreasing returns to a factor: 1. Overcrowding 2. Employment of less efficient labour.

2.6. Marginal product: The output produced by one more unit of a given input.

2.7. Total revenue = Price x quantity of products sold TC P x Q

2.7.1. Average revenue = total revenue / quantity sold

2.7.2. Price to the consumer is the same as average revenue to the producer

2.7.3. Marginal revenue: The addition to total revenue from the sale of 1 extra unit of output.

3. Monopoly

3.1. A monopoly exists when a firm has greater than 25% of the market share in an industry

3.1.1. Monopoly can also be called a price maker as it can have the power to et price in a market.

3.2. Factors assessing monopoly power: 1. number and closeness of substitutes 2. Level of barriers to entry 3. degree of product differentiation

3.2.1. demand will be relatively inelastic due to a lack of close substitutes.

3.3. Protecting monopoly in the Long Run through barriers to entry

3.3.1. 1. high fixed costs 2. economies of scale 3. brand loyalty 4. predatory pricing 5. Legal barriers

3.3.2. other forms of barriers to entry: 1. Hostile takeovers 2. Product differentiation 3. capacity expansion 4. predatory pricing

3.4. Costs of monopoly: 1. abnormal supernormal profits 2. loss of allocative efficiency 3. reduced consumer surplus 4. could be productive and X inefficiency

3.5. Benefits of monopoly: 1. Natural monopoly - economies of scale leading to lower prices. 2. R & D 3. dynamic efficiency from profits 4. scope to be internationally competitive

4. market structure and Technology

4.1. A market structure is best defined as the organisational and other characteristics of a market.

4.1.1. Features of market structure

4.1.1.1. Number of firms

4.1.1.2. market share of the largest firms

4.1.1.3. nature of costs

4.1.1.4. the extent of product differentiation

4.1.2. main factors influencing pricing decisions

4.1.2.1. The market structure

4.1.2.2. business objectives

4.1.3. Perfect competition

4.1.3.1. firms are price takers

4.1.3.2. Free entry and exit of firms in the long run drives down profits toward normal profit

4.1.3.3. each supplier produces homogeneous products

4.1.4. pure monopoly

4.1.4.1. has the ability to earn supernormal profit

4.1.4.2. barriers to entry exist

4.1.4.3. potential for price discrimination

4.1.5. oligopoly

4.1.5.1. each firm has some market power

4.1.5.2. competition among few firms

4.1.5.3. firms must consider strategic behaviour of other firms in the market

4.1.5.4. may have alternate objectives to profit maximisation

4.1.6. contestable markets

4.1.6.1. low entry and exit costs

4.1.6.2. potential for hit and run entry to erode profits

4.1.6.3. less scope for monopoly pricing

5. Perfect competition

5.1. Perfect competition is where no participants in markets are big enough to have the market power to set prices for a product.

5.2. assumptions made: 1. Many small firms 2. Many individual buyers 3. Perfect freedom of entry and exit. 4. Homogeneous products 5. Perfect information 6. No externalities

5.3. Sunk costs: These are costs which cannot be recovered e.g. advertising, training, highly specialised pieces of equipment.

5.4. Short run shut-down condition is where price < AVC Long run shut-down condition is where pice < AC

5.5. Industries that come reasonably close to perfect Competition are Agriculture, commodities, metals etc.

5.5.1. Competition drives inefficient firms out of the market. Competition pushes prices down. Competition ensures that consumer sovereignty prevails.

5.5.2. Benefits of competition: 1. Lower prices 2. Low barriers to entry 3. Lower total profits 4. Economic efficiency 5. Greater entrepreneurial activity

5.6. Factors on which firms compete: 1. advertising 2. brand 3. range of goods etc

6. Efficiency

6.1. Consumer surplus: The difference between the price the consumer is prepared to pay and the market price.

6.2. Producer surplus: The difference between the price the firm is prepared to sell for and the market price.

6.3. Static efficiency is at a given point in time whereas dynamic efficiency occurs over time.

6.3.1. Dynamic efficiency

6.3.1.1. Product innovation: this examines those improvements that lead to goods and services which perform better or are a higher quality.

6.3.1.2. Process innovation: This examines progress which leads to better methods of production and hence reduces firm's average costs.

6.3.1.3. Factors improving dynamic efficiency: 1. R & D 2. technological change 3. increased physical capital 4. Increased human capital through education and training.

6.4. Allocative efficiency occurs where Price = marginal cost (P = MC). It exists where goods are produced in line with consumer preference.

6.4.1. Productive efficiency occurs at the lowest point on the average cost curve.

6.4.2. X efficiency occurs when firms are not producing on the AC curve owing to organisational slack (normally associated with monopoly)

7. Price discrimination

7.1. Occurs when a business charges different prices to different groups of consumers for the same good or service, not because of costs.

7.1.1. Impact on producer surplus: it is increased.

7.1.1.1. It can be use as a predatory pricing tactic to harm competition at the supplier's level.

7.1.2. Impact on consumer suplus: it is reduced

7.2. conditions required: 1. Differences in Price Elasticity of Demand 2. Barriers to prevent consumers switching from one supplier to another

7.2.1. First degree: This is charging the consumer the maximum they are prepared to pay (For this to be achieved they must know every consumer's individual preferences and willingness to pay)

7.2.2. Second degree: Selling batches of products at a lower prices than previous batches. (can be effective in securing market share)

7.2.3. Third degree: This is charging different prices for the same product to different consumers in the market.

7.2.3.1. Examples of price discrimination: 1. Time 2. Geography 3. Status e.g. pensioner

7.2.4. third degree discrimination

8. Concentrated markets

8.1. The degree of concentration within a market is measured by the concentration ratio.

8.1.1. This is the percentage of total market sales accounted for by a given number of leading firms.

8.1.1.1. C.R.5: this is the value of output produced from the 5 largest firms in an industry.

8.1.1.2. C.R.3: The value of output produced from the 3 largest firms in an industry.

8.2. Factors associated with desire of firms to grow: 1. market power motive 2. increased pricing power 3. Manager's objectives 4. profit motive 5. Economies of scale

8.3. Internal growth: Uses the retained profits or leans to finance expansion by increasing fixed and variable factors.

8.4. External growth: This provides a rapid route for expansion and occurs through acquisitions and mergers.

8.4.1. Types of merger

8.4.1.1. Horizontal integration - two businesses in same industry at same stage of production

8.4.1.2. Vertical integration - acquiring a business in the same industry but at different stages of the supply chain e.g. oil drilling + refining.

8.4.1.3. Lateral merger - Merger between companies that are related but not identical e.g. newspapers and magazines.

8.4.1.4. Conglomerate merger - merger between unrelated firms e.g. automobile manufacturer + food processing.

8.4.2. This is also a way of gaining monopoly power in the market.

8.5. Outsourcing - Where businesses move some of their production operations overseas e.g. Dyson to Malaysia.

8.5.1. Factors promoting outsourcing: 1. Technological change 2. Increased competition 3. Pressure from the financial markets

9. Contestable markets

9.1. The Theory of contestable markets challenges the view that it is the number of firms that determines conduct and performance.

9.1.1. If there are lower barriers to entry then a single firm will drop its prices due to the threat of new entrants in the market.

9.1.2. a market is perfectly contestable when entry and exit costs by potential rivals are zero

9.1.2.1. as a result of this it is the threat of hit-and-run entry which means that existing firms are forced to set their prices at the competitive level on a permanent basis to stop this from happening.

9.1.3. A market is not perfectly contestable if there are substantial costs of exit. If there are large sunk costs which can't be recovered then that could also put off potential firms entering the industry.

9.1.3.1. examples include 1. capital inputs which are specific to an industry and which have little resale value. 2. training.

9.1.4. Evaluation

9.1.4.1. clearly no market is perfectly contestable i.e. has no sunk costs

9.1.4.2. Existing firms may protect themselves through patents or strategic barriers to entry.

9.1.4.3. The level of knowledge needed to enter an industry may be high and not freely available.

9.1.5. The increasing contestability of markets

9.1.5.1. Entrepreneurial zeal

9.1.5.2. Deregulation of markets

9.1.5.3. The Eurozone

9.1.5.4. Technological change