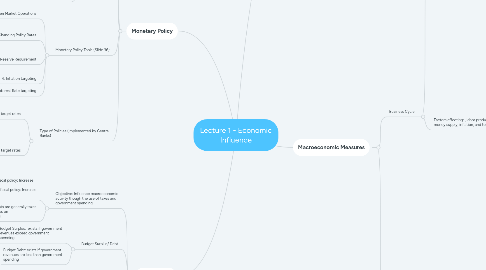

1. Monetary Policy

1.1. Monetary Policy (slide30)

1.1.1. Set of activities of a nation’s central bank that are intended to affect the money supply and the credit in the economy

1.2. Fiscal Policy

1.2.1. Set of activities of a nation’s government, including taxation and spending, that can affect the economy

1.3. Central Bank

1.3.1. The central bank is the banker to the government, to other banks, and the supplier of the nation’s currency

1.3.2. Central banks are often charged with • Setting monetary policy • Controlling money supply • Regulating banking system • Issuing currency • Assessing how economy behaves • Responding to economic and financial market conditions

1.4. Monetary Policy Tools (Slide 36)

1.4.1. 1. Open Market Operations

1.4.1.1. Purchases and sales of government bonds from and to commercial banks or market makers

1.4.2. 2. Changing Policy Rates

1.4.2.1. Establishing a policy rate (official policy rate or interest rate) that influences other rates in the economy

1.4.3. 3. Changing Reserve Requirement

1.4.3.1. Requirement whereby banks keep a specified percentage of their deposits on hand, which thus affects the supply of money

1.4.4. 4. Inflation targeting

1.4.5. 5. Interest Rate targeting

1.5. Type of Policies (implemented by Central Banks)

1.5.1. 1. Increase target rates

1.5.1.1. Reducing liquidity in the system

1.5.1.2. Leads to Contractionary

1.5.1.2.1. Slows the rate of growth in the money supply and the real economy

1.5.2. 2. Cut target rates

1.5.2.1. Increase liquidity in the system

1.5.2.2. Leads to Expansionary

1.5.2.2.1. Increases the rate of growth in the money supply and the real economy

2. Fiscal Policy

2.1. Objective: Influence macroeconomic activity though the use of taxes and government spending

2.1.1. • Expansionary fiscal policy: Increase spending • Contractionary fiscal policy: Increase taxes

2.1.2. Government receipts are generally taxes on income and taxes on goods and services

2.2. Budget Surplus/ Debt

2.2.1. Budget Surplus: exists if government revenues exceed government spending

2.2.2. Budget Debt: exists if government revenues are less than government spending

2.3. Fiscal Policy Tools

2.3.1. Advantages

2.3.1.1. • Social policies, such as discouraging tobacco use, can be implemented very quickly via indirect taxes. • Quick implementation of indirect taxes means that government revenues can be increased without significant additional costs.

2.3.2. • transfer payments, such as welfare and social security • current government spending on goods and services • capital expenditures (e.g., spending on infrastructure)

2.3.3. Disadvantages

2.3.3.1. • Direct taxes and transfer payments take time to implement, delaying the impact of fiscal policy. • Capital spending takes a long time to implement. The economy may have recovered by the time its impact is felt.

3. Three Step Investment Approach

4. Macroeconomic Measures

4.1. Business Cycle

4.1.1. The study of business cycles is the study of short-term economic fluctuations

4.1.2. Factors affecting: , labor productivity, money supply, inflation, and technology

4.1.2.1. Unemployment

4.1.2.1.1. • Unemployed: People who are actively seeking a job but do not have a job. • Frictionally unemployed are in the process of changing jobs. • Long-term unemployed have been out of work for a long time, but are still looking. • Underemployed: Employed people who have the qualifications to work a higher-paying job. • Discouraged worker: Unemployed person who stopped looking for a job. • Voluntarily unemployed: Person who is outside of the labor force voluntarily.

4.1.2.1.2. Measures describing the labor market: • Employed: Number of people with a job. • Labor force: Number of people with a job or actively seeking a job. • Unemployment rate: Ratio of the number of unemployed persons to the labor force. • Activity ratio (participation ratio): Ratio of labor force to total population of working age persons

4.1.2.2. Inflation

4.1.2.2.1. • Inflation is an increase in the level of prices in the economy. • The inflation rate is the percentage change in a price index. • The purchasing power of money decreases. • The liability of the borrower decreases if the loan has fixed monetary terms. • Deflation is a sustained decrease in the aggregate price level (negative inflation rate). • The purchasing power of money increases. • The liability of the borrower increases if the loan has fixed monetary terms. • Hyperinflation is an extremely fast increase in the aggregate price level. • It generally occurs when government spending is not backed with tax revenues and the money supply is increased (or unlimited). • Disinflation is a decline in the inflation rate. 20

4.1.2.2.2. • Inflation is an increase in the level of prices in the economy. • The inflation rate is the percentage change in a price index. • The purchasing power of money decreases. • The liability of the borrower decreases if the loan has fixed monetary terms. • Deflation is a sustained decrease in the aggregate price level (negative inflation rate). • The purchasing power of money increases. • The liability of the borrower increases if the loan has fixed monetary terms. • Hyperinflation is an extremely fast increase in the aggregate price level. • It generally occurs when government spending is not backed with tax revenues and the money supply is increased (or unlimited). • Disinflation is a decline in the inflation rate. 20

4.2. Economic indicators

4.2.1. An indicator is a measure that provides information about the state of the overall economy.

4.2.2. • A leading economic indicator is a measure that has turning points that precede changes in the economy. • A coincident economic indicator has turning points that coincide with the changes in the economy. • A lagging economic indicator has turning points that are later than changes in the economy.