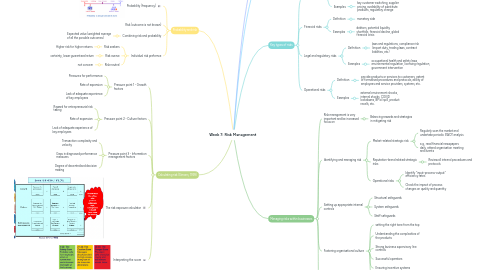

1. Probability and risk

1.1. Probability (frequency)

1.2. Risk (outcome is not known)

1.3. Combining risk and probability

1.3.1. Expected value (weighted average of all the possible outcomes)

1.4. Individual risk prefernce

1.4.1. Risk seekers

1.4.1.1. Higher risk for higher returns

1.4.2. Risk averse

1.4.2.1. certainty, lower guaranteed return

1.4.3. Risk neutral

1.4.3.1. not concern

2. Calculating risk (Simons, 1999)

2.1. Pressure point 1 - Growth factors

2.1.1. Pressures for performance

2.1.2. Rate of expansion

2.1.3. Lack of adequate experience of key employees

2.2. Pressure point 2 - Culture factors

2.2.1. Reward for entrepreneurial risk taking

2.2.2. Rate of expansion

2.2.3. Lack of adequate experience of key employees

2.3. Pressure point 3 - Information management factors

2.3.1. Transaction complexity and velocity

2.3.2. Gaps in diagnosed performance measures

2.3.3. Degree of decentralised decision making

2.4. The risk exposure calculator

2.5. Interpreting the score

3. Risk is the uncertainty of an event occurring

4. Magnitude of risk depends on

4.1. Harm if the scenario happens

4.2. Likelihood that the scenario will happen

5. Key types of risks

5.1. Strategic risks

5.1.1. Definition

5.1.1.1. market-related activity, competivie dynamics, threats from competitors, changes in technology

5.1.2. Examples

5.1.2.1. key customer switching, supplier pricing, availability of substitute products, regulatory change

5.2. Financial risks

5.2.1. Definition

5.2.1.1. monetary side

5.2.2. Examples

5.2.2.1. debtors, potential liquidity shortfalls, financial decline, global financial crisis

5.3. Legal and regulatory risks

5.3.1. Definition

5.3.1.1. laws and regulations, compliance risk (import duty, trading laws, contract liabilities, etc)

5.3.2. Examples

5.3.2.1. occupational health and safety laws, environmental regulation, licensing regulation, government intervention

5.4. Operational risks

5.4.1. Definition

5.4.1.1. provide products or services to customers, extent of formalised procedures and protocols, ability of employees and service providers, systems, etc.

5.4.2. Examples

5.4.2.1. external environment shocks, internal shocks, COVID lockdowns, BP oil spill, product recalls, etc.

6. Managing risks within businesses

6.1. Risk management is very important and be increased focus on

6.1.1. Balancing rewards and strategies in mitigating risk

6.2. Identifying and managing risk

6.2.1. Market-related strategic risk

6.2.1.1. Regularly scan the market and undertake periodic SWOT analysis

6.2.1.2. e.g., read financial newspapers daily, attend organisation meeting and events

6.2.2. Reputation-brand related strategic risks

6.2.2.1. Review all internal procedures and protocols

6.2.3. Operational risks

6.2.3.1. Identify "input-process-output" efficiency rates

6.2.3.2. Check the impact of process changes on quality and quantity

6.3. Setting up appropriate internal controls

6.3.1. Structural safeguards

6.3.2. System safeguards

6.3.3. Staff safeguards

6.4. Fostering organisational culture

6.4.1. setting the right tone from the top

6.4.2. Understanding the complexities of the products

6.4.3. Strong business supervisory line controls

6.4.4. Successful operators

6.4.5. Ensuring incentive systems

6.4.6. etc

6.5. Reducing risk through organisational level factors

6.5.1. Organisational values

6.5.2. Organisation mission and strategy

6.5.3. Organisational culture

6.5.4. Recruitment

6.5.5. Setting behavioural expectations