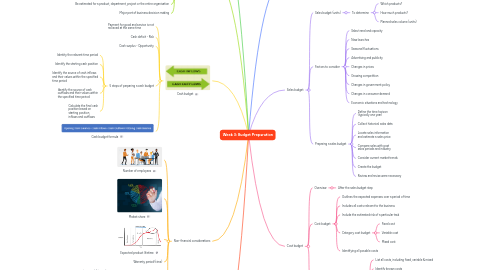

1. Profit planning

2. Revenue budget

2.1. Determine which price

2.2. Specify

2.2.1. Planned sales volume

2.2.2. Selling price

2.2.3. Revenue

3. Calculating profitability

3.1. Profit = revenue budget - cost budget

3.1.1. Gross profit margin

3.1.2. Net profit margin (incoporated tax, interest, other expenses)

3.2. Be estimated for a product, department, project or the entire organisation

3.3. Major part of business decision making

4. Cash budget

4.1. Payment for good and service is not recieved at the same time

4.2. Cash deficit - Risk

4.3. Cash surplus - Opportunity

4.4. 5 steps of perparing a cash budget

4.4.1. Identity the relevant time period

4.4.2. Identify the starting cash position

4.4.3. Identify the source of cash inflows and their values within the specified time period

4.4.4. Identify the source of cash outflows and their values within the specified time period

4.4.5. Calculate the final cash position based on starting position, inflows and outflows

4.5. Cash budget formula

5. Non-financial considerations

5.1. Number of employees

5.2. Market share

5.3. Expected product lifetime

5.4. Warranty period (time)

5.5. Other non-financial considerations

5.5.1. environmental impact

5.5.2. relationship with stakeholders

5.5.3. social corporate responsibility

5.5.4. ethical sourcing of products

5.5.5. staff morale

5.5.6. brand strength

5.5.7. competitive advantage

5.5.8. organisational culture

6. Sales budget

6.1. Sales budget (units)

6.1.1. To determine

6.1.1.1. Which products?

6.1.1.2. How much products?

6.1.1.3. Planned sales volume (units)

6.2. Factors to consider

6.2.1. Sales trend and capacity

6.2.2. New launches

6.2.3. Seasonal fluctuations

6.2.4. Advertising and publicity

6.2.5. Changes in prices

6.2.6. Growing competition

6.2.7. Changes in government policy

6.2.8. Changes in consumer demand

6.2.9. Economic situations and technology

6.3. Preparing a sales budget

6.3.1. Define the time horizon (typically one year)

6.3.2. Collect historical sales data

6.3.3. Locate sales information and estimate a sales price

6.3.4. Compare sales with past sales periods and industry

6.3.5. Consider current market trends

6.3.6. Create the budget

6.3.7. Review and revise were necessary

7. Behavioural implications of budgets

7.1. Incentive to use all the budget

7.2. Avoiding under budget

7.3. Avoiding over budget

7.4. Short-term thinking vs. longer-term outcomes

7.5. Effective budgeting

8. Cost budget

8.1. Overview

8.1.1. After the sales budget step

8.2. Cost budget

8.2.1. Outlines the expected expenses over a period of time

8.2.2. Includes all costs relevant to the business

8.2.3. Include the estimated risk of a particular task

8.2.4. Category cost budget

8.2.4.1. Fixed cost

8.2.4.2. Variable cost

8.2.4.3. Mixed cost

8.2.5. Identifying all possible costs

8.3. Preparing a cost budget (typical steps)

8.3.1. List all costs, including fixed, variable & mixed

8.3.2. Identify known costs

8.3.3. Estimate expected costs

8.3.4. Define the cost budget’s time horizon

8.3.5. Create a cost budget by calculating total cost

8.3.6. Review and revise where necessary