1. Using probability in decision making

1.1. The key role of probability is to improve decision-making in the face of uncertainties

1.2. It helps decision-making be more objective and data-driven rather than being based on instinct

1.3. Many retail companies use probability to predict the chances that they'll sell a certain amount of goods in a given day, week, or month

1.4. The tourism industry uses the probability of predicted weather patterns to estimate occupancy rates

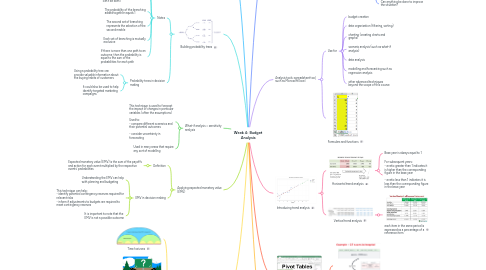

2. Building probability trees

2.1. Notes

2.1.1. When branching occurs, this represents an event that produces a mutually exclusive event

2.1.2. The first branching in the diagram is the first selection of a marble, which is either black or white (it can’t be both)

2.1.3. The probability of the branching added together equals 1

2.1.4. The second set of branching represents the selection of the second marble

2.1.5. Each set of branching is mutually exclusive

2.1.6. If there is more than one path to an outcome, then the probability is equal to the sum of the probabilities for each path

2.2. Probability trees in decision making

2.2.1. Using a probability tree can provide valuable information about the buying habits of customers

2.2.2. It could also be used to help identify targeted marketing campaigns

3. What-if analysis = sensitivity analysis

3.1. This technique is used to forecast the impact of changes in particular variables (often the assumptions) Used to: - compare different scenarios and their potential outcomes - consider uncertainty in forecasting

3.2. Used in many areas that require any sort of modelling

4. Applying expected monetary value (EMV)

4.1. Definition

4.1.1. Expected monetary value (EMV) is the sum of the payoffs and action for each event multiplied by the respective events’ probabilities

4.2. EMV in decision making

4.2.1. Understanding the EMV can help with planning and budgeting

4.2.2. This technique can help: - identify potential contingency reserves required for relevant risks - inform if adjustments to budgets are required to meet contingency reserves

4.2.3. It is important to note that the EMV is not a possible outcome

5. Understanding the impact of time on decision making

5.1. Time horizons

5.2. Uncertainty

5.3. Risk Exposure

5.4. Time horizons and decision making

6. A budget analysis involves the examination and explanation of budgeted cost and revenue

6.1. Aims to

6.1.1. identify areas of over/underspending in the budget

6.1.2. identify areas of improvement in money management

6.1.3. identify risk mitigation in future projects by avoiding underspending

6.1.4. provide regular and objective evaluations of actual performance

6.2. requires analysts to estimate the budget over a period of time

6.2.1. use budgeting strategy, forecasting

6.2.2. use of current and expected data

6.2.3. Track actual figures to align with the budgeted figures

6.3. If budgeted figures do not always match actual figures

6.3.1. Why is it not meeting expectations?

6.3.2. Where is the mismatch in expectations versus reality?

6.3.3. Where does the discrepancy come from?

6.3.4. Why did this occur?

6.3.5. Can this be avoided in the future?

6.3.6. Can anything be done to improve the situation?

7. Analysis tools: spreadsheet tool, such as Microsoft Excel

7.1. Use for

7.1.1. budget creation

7.1.2. data organisation (filtering, sorting)

7.1.3. charting (creating charts and graphs)

7.1.4. scenario analysis (such as what-if analysis)

7.1.5. data analysis

7.1.6. modelling and forecasting such as regression analysis

7.1.7. other advanced techniques beyond the scope of this course

7.2. Formulars and functions

8. Introducing trend analysis

8.1. Horizontal trend analysis

8.1.1. Base year is always equal to 1

8.1.2. For subsequent years: - a ratio greater than 1 indicates it is higher than the corresponding figure in the base year - a ratio less than 1 indicates it is less than the corresponding figure in the base year

8.2. Vertical trend analysis

8.2.1. each item in the same period is expressed as a percentage of a reference item

9. Creating pivot tables A pivot table is an interactive way to quickly summarise large amounts of data.

9.1. Pivot tables are used to explore relationships based on aggregate values.

9.2. Benefits of pivot tables

10. Working with probability

10.1. Probability in decision making

10.1.1. involve forecasting expected earnings or estimated costs, it is rare not to have some level of uncertainty with the outcome

10.1.2. Probability is the study of chance

10.1.3. It helps us understand the likelihood of particular events occurring

10.1.4. This helps account for uncertainty, as well as quantify it as much as possible in business decision making