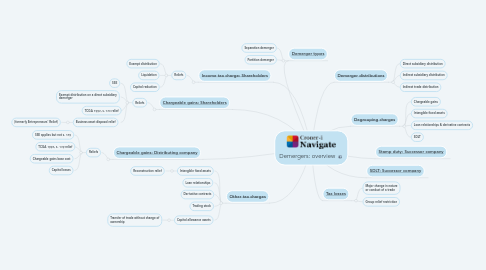

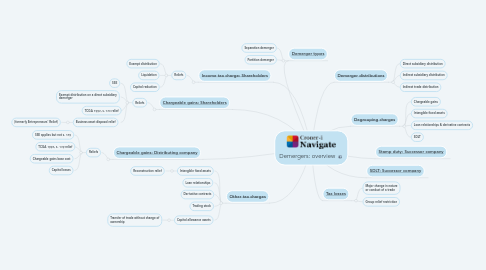

Demergers: overview

by Paul Davies

1. [Other tax charges](https://library.croneri.co.uk/po-heading-id_9rSNIJcCwE2FZq0G9lwHZA)

1.1. Intangible fixed assets

1.1.1. Reconstruction relief

1.2. Loan relationships

1.3. Derivative contracts

1.4. Trading stock

1.5. Capital allowance assets

1.5.1. Transfer of trade without change of ownership

2. [Chargeable gains: Shareholders](https://library.croneri.co.uk/po-heading-id_EA0Ghy3oIEus0YbdJ_LhXg)

2.1. Reliefs

2.1.1. SSE

2.1.2. Exempt distribution on a direct subsidiary demerger

2.1.3. TCGA 1992, s. 136 relief

2.1.4. Business asset disposal relief

3. [Income tax charge: Shareholders](https://library.croneri.co.uk/po-heading-id_0l5CMFEQXU-gc1lkYj939Q)

3.1. Reliefs

3.1.1. Exempt distribution

3.1.2. Liquidation

3.1.3. Capital reduction

4. [Demerger types](https://library.croneri.co.uk/po-heading-id_Iy3zDjHtHkSCsT48Pij1yQ)

4.1. Separation demerger

4.2. Partition demerger

5. [Degrouping charges](https://library.croneri.co.uk/po-heading-id_1Rmpjy4BaUC3ORrYvODu-g)

5.1. Chargeable gains

5.2. Intangible fixed assets

5.3. Loan relationships & derivative contracts

5.4. SDLT

6. [SDLT: Successor company](https://library.croneri.co.uk/po-heading-id_3nUkCs-e9UeGf2qVGqAaNA)

7. [Tax losses](https://library.croneri.co.uk/po-heading-id_e-irH20Mpkm5awgNd4m8xQ)

7.1. Major change in nature or conduct of a trade

7.2. Group relief restriction

8. [Demerger distributions](https://library.croneri.co.uk/po-heading-id_Dr_seYoZkEmtdwFa1dqPlw)

8.1. Direct subsidiary distribution

8.2. Indirect subsidiary distribution

8.3. Indirect trade distribution

9. [Stamp duty: Successor company](https://library.croneri.co.uk/po-heading-id_3nUkCs-e9UeGf2qVGqAaNA)

10. [Chargeable gains: Distributing company](https://library.croneri.co.uk/po-heading-id_GgG1trvfSUiPShSw4k_UwQ)

10.1. Reliefs

10.1.1. SSE applies but not s. 139

10.1.2. TCGA 1992, s. 139 relief

10.1.3. Chargeable gains base cost

10.1.4. Capital losses