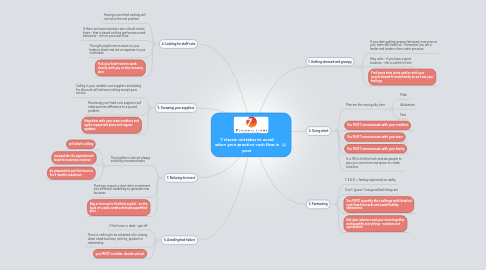

7 classic mistakes to avoid when your practice cash flow is poor

Christopher Barrowにより

1. 4. Looking for staff cuts

1.1. Having a sacrificial sacking will not solve the real problem

1.2. If there are team members who should not be there - that is based on their performance and behaviour - not on your cash flow

1.3. The right people are an asset on your balance sheet and not an expense in your overheads

1.4. Pick your best team to work closely with you on the recovery plan

2. 5. Screwing your suppliers

2.1. Calling in your variable cost suppliers and asking for discount will achieve nothing except poor service

2.2. Reviewing your fixed cost suppliers will make pennies difference to a pound problem

2.3. Negotiate with your main creditors and agree repayment plans and regular updates

3. 7. Refusing to invest

3.1. The problem is almost always solved by increased sales

3.1.1. sell what's selling

3.1.2. manipulate the appointment book to maximise revenue

3.1.3. be prepared to put the hours in for 3 months maximum

3.2. That may require a short-term investment into effective marketing to generate new business

3.3. Beg or borrow to find that capital - on the back of a well constructed and quantified plan

4. 6. Avoiding fast failure

4.1. If the horse is dead - get off

4.2. There is nothing to be ashamed of in closing down a bad business, activity, product or relationship

4.3. you MUST consider, decide and act

5. 1. Getting stressed and grumpy

5.1. If you start getting grumpy/stressed, everyone on your team will freak out - remember you are a leader and leaders shine under pressure

5.2. Stay calm - if you have a good business - this is a blink in time

5.3. Find some time alone and/or with your coach/closest friends/family to sort out your feelings

6. 2. Going silent

6.1. Men are the most guilty here

6.1.1. Pride

6.1.2. Abdication

6.1.3. Fear