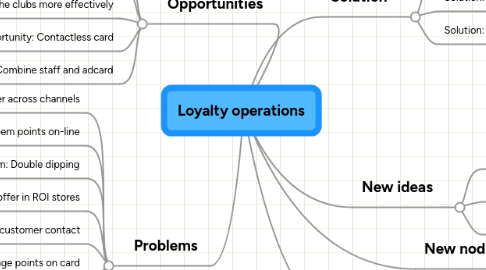

1. Problems

1.1. Problem: Inconsistent customer offer across channels

1.1.1. E.g. Vouchers on-line v on card, different process (and tech)

1.1.2. Can be done but not straight forward

1.1.3. Has been done as one-off, but not captured as a repeatable process

1.2. Problem: Can't redeem points on-line

1.2.1. Top request from customers

1.2.2. Have to pick up points at a kiosk, when spending on-line

1.2.2.1. As points are physically on the card only

1.2.2.2. 5-day delay for points update, but used as a control so points issued only when product delivered (also could spend points twice)

1.2.3. However, is this driving increased foot-fall as have to visit store to gather points

1.3. Problem: Double dipping

1.3.1. Slows tills down

1.3.2. Replacement of card readers twice as high as elsewhere

1.3.3. 365k hours wasted per year at till

1.3.4. 400m till transactions per annum

1.3.5. Worse still if credit card fails (as process has to be repeated)

1.4. Problem: Different offer in ROI stores

1.4.1. No kiosks in ROI stores

1.5. Problem: No systemic control over customer contact

1.5.1. Three mailing on joining

1.5.2. Ad card, Parent and Health club communications potentially all at the same time (only if joined these all at the same time)

1.6. Problem: Can't age points on card

1.6.1. If points have an age and they are warned, this encourages spending of these points

1.6.2. Only of value cost-wise, in being able to write off value of unspent points

1.6.3. Points liability is a risk

1.7. Problem: There is a central copy of customer data but 24 hrs out of date

1.7.1. But not linked to till

1.7.2. Need a near real time communication to the store of this data

1.8. Problem: Cost of current cards too expensive

1.8.1. £0.25 per smart card

1.8.2. £0.08 per magnetic strip card

1.8.3. Replace 750k cards per year

1.8.3.1. Of 2m new cards

1.9. Problem: Can’t award points over the phone (e.g. for customer service)

1.10. Problem: Can’t be as versatile or tailored as a centralised card can be

2. Opportunities

2.1. Opportunity: Kiosk drives £21m increase in sales

2.1.1. Some customers like the experience of seeing the offers at the kiosk

2.1.2. This the downside of centralisation as kiosks would not be required

2.1.3. Only 5% of Adcard customers use Kiosks

2.1.4. Not profit but sales increase only

2.2. Opportunity: What do competitors, who centralise card points, do better?

2.2.1. Tailor the scheme to customers use

2.2.2. Opportunity: Identifying customer at the till

2.2.3. Targeted offers at POS

2.2.4. Expands redemption opportunities (airmiles or other partners)

2.2.5. Better policing of customers who "use" the system

2.2.5.1. Web sites that tell you how to do this

2.3. Opportunity: Managing the clubs more effectively

2.3.1. Decrease till time (saves staff having to spend time selling clubs)

2.3.2. Potential store staff savings

2.3.2.1. But store staff cheaper

2.3.3. But DM communications are happening anyway

2.3.4. Selection of customers for clubs is not done via analysis of what they spend

2.4. Opportunity: Contactless card

2.4.1. Speed up transaction

2.4.2. Customer expectation

2.4.3. Improves longevity of card readers

2.4.4. Reliability supposed to be better

2.4.5. Business case not good short term

2.4.5.1. Effectively similar to magnetic card but costs currently 5 times per card

2.5. Opportunity: Combine staff and adcard

2.5.1. Cost saving on managing staff card

2.5.2. May be issues with staff not wanting company to know some data on their spending e.g. pregnancy tests

3. Solution

3.1. Solution: Centralisation

3.1.1. Card system

3.1.2. Customer data

3.1.3. Exec don't understand why

3.1.3.1. Originally smart card was special, gut feeling is that it is a backward step to go to magnetic or barcode card

3.1.4. Quick fixes

3.1.4.1. Don't need to change card to centralise

3.1.4.2. Currently don't use Adcard to identify customer at till

3.2. Solution: Contact-less card

3.2.1. Transition could be an issue

3.2.1.1. From chip to contactless

3.2.2. £0.5 per card

3.2.3. Also looking at using mobiles for this function

3.2.4. Look to launch with a credit card company so costs can be shared

3.3. Solution: Magnetic card

3.3.1. Cheaper to buy

3.3.2. Don't need smart card for centralisation

4. New ideas

4.1. Idea: Improve redemption opportunities

4.1.1. Would make step change in value of card scheme

4.2. Idea: Want to move from 15m to 18m active members

4.2.1. Widen scheme to family membership

4.2.2. Would improve benefit to the wife

4.2.3. Customers don't understand 4 points per £1, but do believe it is more generous than competitors

4.2.4. Should use other customer databases to drive new membership

4.3. Idea: Desire to offer 121 deals at the till

4.3.1. Need to visit kiosk first to active this now

5. Parking lot

5.1. Is there a code of conduct issue for pharmacy data

5.1.1. This team will be "by the book"

5.1.2. Can't be seen to link offers to conditions explicitly

5.1.3. Can be done with clever wording!