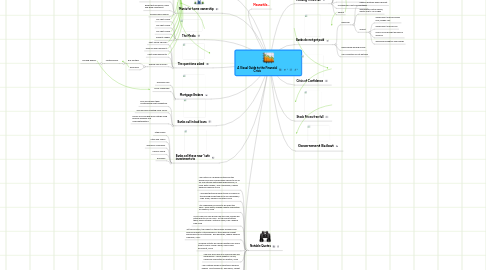

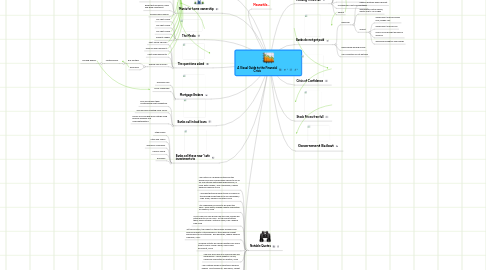

A Visual Guide to the Financial Crisis

by Dan Taylor

1. "Housing prices never fail"

2. Mania for home ownership

2.1. Historically low interest rates

2.2. Alternative investment after the dot-com crash

2.3. Belief that housing is a safe and good investment

2.4. Already own a home?

3. The Media

3.1. Flip That House

3.2. Flip That House

3.3. Flip That House

3.4. Property Ladder

4. The questions asked

4.1. Can't afford a house?

4.2. Have no down payment?

4.3. Can't make payments?

4.4. Already own a home?

4.4.1. Buy Another

4.4.1.1. Inflated prices

4.4.1.1.1. Housing Bubble

4.4.2. Refinance

5. Mortgage Brokers

5.1. sub prime loan

5.2. Home Ownership

6. Banks call in bad loans

6.1. Pool and rename them Collateralized Debt Obligations

6.2. Slice and dice creating more CDO's

6.3. Secure AAA and BBB bond ratings using financial wizardry and "overcapitalization"

7. Banks sell these new "safe investments to

7.1. Other banks

7.2. Cities and Towns

7.3. Insurance Companies

7.4. Pension Funds

7.5. Everyone

8. Notable Quotes

8.1. "The notion of a bubble bursting and the whole price level coming down seems to me as far as a national nationwide phenomenon, is really quite unlikely," Alan Greenspan, Federal Reserve Chairman 2003

8.2. "The idea that we're going to see a collapse in the housing market seems to me improbable," John Snow, Treasury Secretary 2005

8.3. "It's impossible for prices to go down this year." Gary Watts, Orange County Association of Realtors, 2006

8.4. "If you own your own home free and clear, people will often refer to you as a fool. All the money sitting there, doing nothing." Anthony Hsieh, CEO Lending Tree 2006

8.5. "At this juncture, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained." Ben Bernanke, Federal Reserve Chairman, 2007

8.6. "Housing Activity will remain healthy from some time to come." David Lereah, NAR's chief economist, 2005

8.7. "We may see a blip up in foreclosures and deliquencies." Leslie Appelton Young, California Association of Realtors, 2005

8.8. "The National media is reporting a housing bubble. Don't believe it." Dale Akins, Market Edge 2006

8.9. "Housing is still the bet investment, without question." Stan Sieron, President, Illinois Associ. of Realtors, 2006

8.10. "I think investors will have a good reason to come out here and buy again." Jeromith Sutton, NAR investment advisor, 2006

8.11. "We got a big problem." George W. Bush September 26, 2008

9. Meanwhile...

10. Housing Prices fail

10.1. Mania over home ownership

10.2. Overbuilding of homes

10.3. Too many homes

10.4. Housing prices fail

10.5. Mortgages worth more than homes themselves

10.6. Homeowners can't pay mortgage

10.7. Default

11. Banks do not get paid

11.1. Banks fail

11.1.1. Lehman Brothers goes bankrupt

11.1.2. Washington Mutual seized, assets sold to JP Morgan

11.1.3. Almost

11.1.3.1. Government rescues Fannie Mae, Freddy Mac

11.1.3.2. Government rescues AIG

11.1.3.3. Merrill Lynch bought by Bank of America

11.1.3.4. Wachovia bought by Wells Fargo