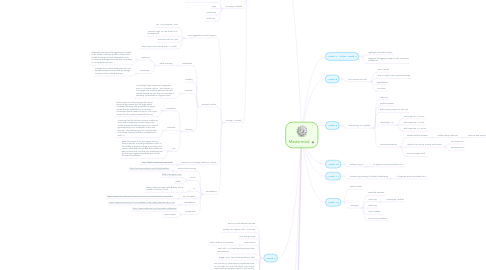

1. Week 1: Module 0

1.1. Setting Up Business

1.1.1. Secretary Of State Sites: http://www.coordinatedlegal.com/SecretaryOfState.html

1.1.2. Why Setup A Corporation Or LLC

1.1.2.1. Shield Your Business

1.1.2.2. Tax Benefits

1.1.2.2.1. Deduct Online Training & Software

1.1.2.2.2. Deduct Home Office

1.1.2.2.3. Deduct Home Utilities

1.1.2.2.4. Deduct Office Supplies

1.1.2.2.5. Deduct Travel Expenses

1.1.2.2.6. Deduct Automobile

1.1.2.2.7. Take A Client To Lunch

1.1.2.2.8. Upgrade Your Office

1.1.2.2.9. Health Insurance

1.1.2.2.10. The Best Self-Employed Tax Deduction of All One deduction in particular can make going into business for yourself particularly profitable: the deduction for self-employed retirement plans. Contributions to SEP-IRAs, SIMPLE IRAs and solo 401(k)s reduce your tax bill now and help you rack up tax-deferred investment gains for later. For the 2014 tax year, you could feasibly contribute as much as $17,500 in deferred salary ($23,000 if you’re 50 or older) plus another 25% of your net self-employment earnings after deducting one-half of self-employment tax and contributions for yourself, up to a maximum of $52,000 total for both contribution categories, with a self-employed 401(k), for example. Contributions limits vary by plan type and the IRS adjusts the maximums annually. In 2015, for example, the solo 401(k) contribution limit increases to $53,000. Read more: 10 Tax Benefits For The Self-Employed | Investopedia http://www.investopedia.com/articles/tax/09/self-employed-tax-deductions.asp#ixzz43fSPFChN Follow us: Investopedia on Facebook

1.1.2.2.11. More Tax Resources

1.1.2.3. LLC Vs Scorp

1.1.2.3.1. Forming a corporation or an LLC (and then making what’s called an “S Corp Election”) might help you reduce your self-employment taxes. That’s because with an S Corporation, you can pay yourself a “reasonable salary”; any remaining profits can be taken as a profit distribution (and these aren’t subject to self-employment taxes). For example, Jackson is a mobile app designer. As a sole proprietor, he made $95,000 last year and had to pay self-employment taxes on the whole amount. This year, he formed an LLC and filed for S Corp election. His business brought in $130,000 in revenue. He paid himself the going rate for an app designer (this was subject to self-employment tax); then, he gave himself a distribution from the remaining profit (and this was not subject to self-employment tax).

1.1.2.4. Book Keepimg

1.1.2.4.1. Bench.co

1.1.2.5. Business tax filing date

1.1.2.5.1. March

1.1.2.6. EIN

1.1.2.6.1. What Is It? -

1.1.2.6.2. How To File

1.1.2.6.3. Personal Tax Filing Date

1.1.2.7. Stripe

1.1.2.8. Paypal Setup

1.1.2.8.1. Tax Advisor/filing

1.1.2.8.2. LLC

1.1.2.8.3. EIN

1.1.2.8.4. Business Address

1.1.2.9. Is A DBA Appropriate?

1.1.2.10. Estimated Taxes

1.1.2.10.1. If Your Self Employed You Need To File Quarterly Estimated Taxes 1040ES

1.1.2.10.2. Estimated Taxes Due Dates

1.2. Company Website

1.2.1. Choose A Theme

1.2.2. Pay Someone To Setup Like Demo

1.2.3. Logo

1.2.4. Customize

1.2.5. Install SSL

1.3. Picking A Niche(s)

1.3.1. Our Suggestion For The Program

1.3.1.1. 3k+ Avg Customer Value

1.3.1.2. Converts High On The Phone (Is It Emergency?)

1.3.1.3. Converts Well On Apts

1.3.1.4. Sales Cycle Is Short (Less Than A Month)

1.3.2. Example Niches

1.3.2.1. Restoration

1.3.2.1.1. Water Damage

1.3.2.2. Roofing

1.3.2.3. Windows

1.3.2.3.1. According to REMODELING Magazine's 2012-13 Window Cost vs. Value Report, a mid-range vinyl window replacement cost should average $9,720.This is an average of replacing 10 windows in a typical home.

1.3.2.4. Flooring

1.3.2.4.1. Hardwood

1.3.2.4.2. Laminate

1.3.2.4.3. Tile

1.3.3. How To Find Average Customer Values?

1.3.3.1. http://www.homeadvisor.com/cost/

1.3.4. Competitors

1.3.4.1. HomeAdvisor Pricing

1.3.4.1.1. https://pro.homeadvisor.com/billing/leadfees/

1.3.4.2. Porch

1.3.4.2.1. https://pro.porch.com/

1.3.4.2.2. Lowes

1.3.4.3. YP

1.3.4.3.1. Selling Water Damage Calls @ $400 With 5 Minimum Calls Per Month

1.3.4.4. 33 Mile Radius

1.3.4.4.1. https://www.evernote.com/l/APBHW1KW1FhAMKXhXhsIFDKf4VJ0BKAxzh4

1.3.4.5. LeadsByFone

1.3.4.5.1. https://www.evernote.com/l/APC7uE2k86FAHopVAjBbCjawXPBMrBAM15Q

1.3.4.6. Red Beacon

1.3.4.6.1. https://www.redbeacon.com/pro/#why-redbeacon/

1.3.4.6.2. Home Depot

2. Week 2

2.1. Bart No Holds Barred Interview

2.2. Scaling To 6 Figures With 1-3 Clients

2.3. Your Going To Die

2.4. Commitment

2.4.1. Define actions as necessary

2.5. 100k With 1-2 Clients (Backing Down Sales Expectations)

2.6. Bigger Term Vision (Like Boardroom Talk)

2.7. Your PROOF*** Leverage Our Results Because We Will Help You With Fulfillment. Call Volume Screenshots & Example Closed CAlls (Monthly Updated Screenshots)

2.8. 90 Day Sprint

2.9. Setting Up Your Outline & Order Form

2.10. "Future Proofing Your Reputation" & Owning Your Search Results!

3. Week 3 - Sales Stack Setup

3.1. Go Through All Problems

3.1.1. Gmail Vs Hosted Email

3.1.2. Stripe Embedding Order Form

3.1.2.1. Free & Paid Plugin

3.1.3. Hellosign Real EXAMPLE

3.1.4. Quickmail

3.1.4.1. Add Retargeting

3.1.4.2. Add Tagging For Called

3.1.4.3. Show How To Run Report Based Upon Tag To Determine Who You Need To Call Today

3.1.4.4. Create Additonal Groups

3.1.4.4.1. Not Interested

3.1.4.4.2. Apt. Booked

3.1.4.4.3. Client

3.1.4.4.4. Bad Emails?

3.1.4.4.5. Not Restoration

3.1.4.4.6. Send Proposal

3.1.4.5. Add Real Signature

3.2. 300 Minimum Contacts With LK

3.2.1. Save Results Without Email For Later***

3.3. Lead Kahuna

3.3.1. Link To Buy

3.3.2. Installing

3.3.3. 101 Basics To Finding Leads

3.3.4. LK With Proxies

3.3.5. Where To Get Proxies

3.4. Quickmail.io

3.4.1. Signup With Your Gmail/Hosted Googel Apps Email You Want To Use

3.4.2. Forget Current Steps...

3.4.3. Setup Additional Groups

3.5. Hello Sign

3.5.1. Setup

3.6. Stripe

3.6.1. Already Have Setup Video

3.7. Stripe WP Plugin (Optional)

3.7.1. Charlie Video

3.7.2. Have Ryan Make Step By Step

4. Week 4 - Prospecting Week 1

4.1. Goal: Setting Apt

4.2. Rebuttals

4.3. Peer Group (Accountability & Practice (Look @ Cooch Product)

4.4. Library Of Example Consults Booked

4.5. Weekly Contest

4.5.1. First To Book Apt $100

4.5.2. 2-10 $50 Each

5. Week 5 - Prospecting Week 2

5.1. Consult Deep Dive

5.1.1. Consult Outline

5.1.2. Library Of Example Consults

5.1.3. Rebuttals

5.1.4. Peer Group Check In

5.2. Highlight Success & Failures

5.3. Weekly Contest

5.3.1. First To Book Apt $100

5.3.2. Apt Bookings #2-10 - $50 Each

6. Week 6 - Sales Week 3

6.1. Highlight Successful People

6.2. Diagnose Struggling People & Help Overcome Road Blocks

7. Contest

7.1. 1st Consult Booked $500

7.2. 1st Customer - $1,000

7.3. 1st To 3 Customers - All Expenses PAID Full Day One - On - One With Me

7.4. 1st To 6 Customers

7.4.1. All Expenses Trip To Mastermind & 1 Full Day One-On-One With Me

8. Week 7 - Sales Week 4

8.1. Highlight Successful People

8.2. Diagnose Struggling People & Help Overcome Roadblocks

9. Week 8

9.1. D4Y Services Go Live

9.1.1. How It Works

9.1.2. How To Submit Your Customers Order

9.1.3. Expectations

9.1.4. Timelines

10. Week 9

10.1. Outsourcing: Our System

10.1.1. Job Post

10.1.2. Gotcha/Tripwire

10.1.3. Bulk Inviting People To Job Post

10.1.4. Test Project 1-3

10.1.4.1. Test Project #1: 2 Hours

10.1.4.2. Test Project #2: 4 Hours

10.1.4.3. Test Project #3: 6-7 Hours

10.1.5. Canned Responses

10.1.5.1. Passed Gotcha/Tripwire

10.1.5.1.1. Profile Check Looks Ok

10.1.5.2. Approval & Moving To Next Test Project

10.1.5.2.1. Test Project #2

10.1.5.2.2. Test Project #3

10.1.5.3. Decline (Sugar Coat)

11. Week 10

11.1. Outsourcing LK

11.1.1. All Systems & Documentation D4Y

12. Week 11

12.1. Outsourcing Probing/Multiplier/SiteBuilding

12.1.1. All Systems & Documentation D4Y

13. Week 12

13.1. Special Guest

13.2. Managing

13.2.1. Quarterly Reviews

13.2.2. Write Ups

13.2.2.1. Hamburger Method

13.2.3. Stand Ups

13.2.4. Slack Updates

13.2.5. KPIs for each position