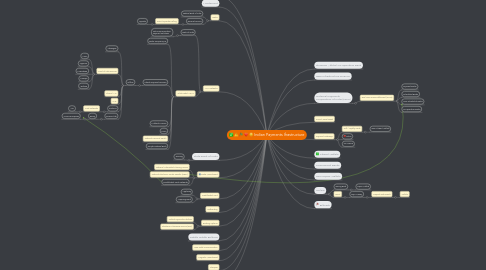

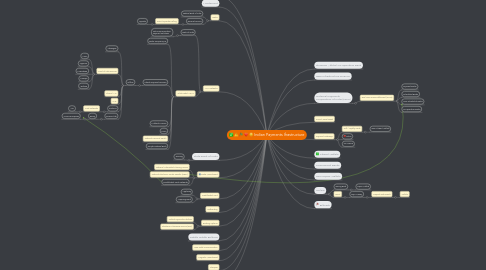

Indian Payments Ifrastructure

Osborne Saldanhaにより

1. Regional Rural Banks

2. Shamrao Vithhal Co-operative Bank

3. Mastercard

4. Banks

4.1. Federal Bank of India

4.2. Euronet Service

4.2.1. Direct Operator Billing

4.2.1.1. Yippster

5. SREI Infrastructure Finance

6. ATM Networks

6.1. Bank of India

6.1.1. Tata Communication Payment Solutions

6.2. White Label ATM's

6.2.1. Radio Frequency ID

6.2.2. Hitachi Payment Services

6.2.2.1. Offline

6.2.2.1.1. Vakrangee

6.2.2.1.2. Point of Sale Devices

6.2.2.1.3. Phone / IVR

6.2.2.1.4. SMS

6.2.2.1.5. Fortumo

6.2.2.1.6. Diners Club

6.2.3. Muthoot Finance

6.2.4. Prizm

6.2.5. National Financial Switch

6.2.6. Punjab National Bank

7. State Bank of India

7.1. ToneTag

8. Radio Wave-based

8.1. National Automated Clearing House

8.2. National Electronic Funds Transfer (NEFT)

8.3. Credit/Debit Card Networks

9. Credit/Debit Card

9.1. ApplePay

9.2. Acquiring Bank

10. Netbanking

11. Banking Systems

11.1. Unified Payments Interface

11.2. Electronic Clearance Service (ECS)

12. Riddhi Siddhi Bullions

13. Near Field Communication

14. National Payments Corporation of India (NPCI)

14.1. Real Time Gross Settlement (RTGS)

14.1.1. Payment Banks

14.1.2. Scheduled Banks

14.1.3. Non-Scheduled Banks

14.1.4. Co-operative Banks

15. Magnetic Wave-based

16. Cheques

17. BTI Payments

18. Sound Wave-based

19. Payment Gateways

19.1. Gift / Loyalty Cards

19.1.1. Semi Closed Wallets

19.2. Citrus

19.3. CCAvenue

20. Closed Wallets

21. Commercial Banks

22. Semi Open Wallets

23. Online

23.1. Issuing Bank

23.1.1. Open Wallets

23.2. Email

23.2.1. PayU Money

23.2.1.1. Prepaid Instruments

23.2.1.1.1. Wallets