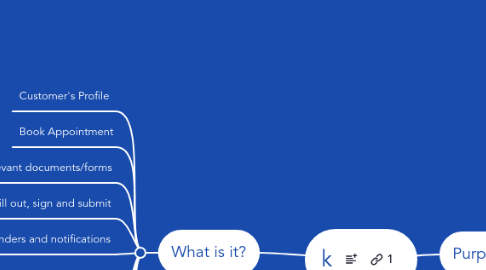

1. What is it?

1.1. Customer's Profile

1.2. Book Appointment

1.3. Download relevant documents/forms

1.4. Fill out, sign and submit

1.5. Friendly reminders and notifications

1.6. Track the process

1.6.1. Training

1.6.2. Channels

1.6.3. International

1.6.4. Public Sector

1.6.5. Sales

1.6.6. Marketing Communications

1.6.7. Product Management

1.7. Cancel an appointment/ swap with another user.

1.8. Interaction between the users of the platform.

1.9. Keep history

2. Purposes

2.1. Open Account

2.1.1. Situational Analysis / Drivers

2.1.1.1. What is driving us to do this?

2.1.1.2. SWOT Analysis

2.1.1.2.1. Strengths

2.1.1.2.2. Weaknesses

2.1.1.2.3. Opportunities

2.1.1.2.4. Threats

2.1.1.3. Customer Findings - What have we learned from customers?

2.1.2. Competitive Analysis

2.1.2.1. Do we have competitors and threats in these target markets with the proposed offerings?

2.1.2.2. What are our competitors doing and how are they positioning?

2.1.2.3. How do we position against each competitor?

2.1.3. Target Customer(s)

2.1.3.1. Buyer Profile

2.1.3.1.1. Title

2.1.3.1.2. Industry

2.1.3.1.3. Geography

2.1.3.1.4. Business Size

2.1.3.2. Influencer Profile

2.1.3.3. User Profile

2.1.3.4. What do customers want and need?

2.1.3.5. What business problems do each of these customers have?

2.1.4. Customer Segmentation

2.1.4.1. Which customers or sets of customers do we sell to?

2.1.4.2. What are the target market segments that we want to go after?

2.1.4.3. What are the distinct problems for each segment of the market?

2.1.5. Total Available Market

2.1.5.1. New Prospects

2.1.5.1.1. How much of each target segment have we penetrated?

2.1.5.1.2. How much opportunity is available in each target segment?

2.1.5.2. Existing Customers

2.1.5.2.1. Can we up-sell existing customers?

2.2. Mortgages and loans

2.2.1. Service Offer

2.2.1.1. What are we selling?

2.2.1.2. Product Definition

2.2.1.3. Pricing

2.2.1.4. Packaging

2.2.1.5. Positioning

2.2.2. Value Proposition

2.2.2.1. What is the Value Proposition to the Customer?

2.2.2.2. What pain are we solving?

2.3. Investment Options

2.3.1. Revenue Forecasts

2.3.1.1. Revenue and P&L Forecast (5 Years)

2.3.1.2. Revenue should be split out quarterly

2.3.2. Cost Analysis

2.3.2.1. Should include a description of the costs in entering this business and profitability analysis

2.3.3. Profitability Analysis

2.3.3.1. P&L for the offer to include gross margin, net income and break even analysis.

2.4. Monitoring accounts

2.4.1. Sales Strategy

2.4.1.1. Direct Sales Strategy

2.4.1.2. Inside Sales Strategy

2.4.1.3. Channel Sales Strategy

2.4.2. Partner Strategy

2.4.2.1. Channel Strategy

2.4.2.1.1. What 3rd party channels should we consider for reselling this service?

2.4.2.2. Technology Partnerships

2.4.2.2.1. What technology vendors (if any) do we need to work with to execute on this plan?

2.4.2.3. Solutions Partners

2.5. Monitoring accounts by third parties (Other banks, Insurance Companies)

2.5.1. Positioning & Messaging

2.5.1.1. What is the key messaging and positioning for the service offer? (Pain, alternatives, solution)

2.5.1.2. How do we communicate internally?

2.5.1.3. How do we communicate externally?

2.5.2. Promotion Strategy

2.5.2.1. Marketing Programs (Installed base versus new prospects)

2.5.2.2. Advertising (Publications, etc.)

2.5.2.3. Analyst Relations (Target Analysts)

2.5.2.4. Public Relations

2.5.2.5. Events (Trade shows, SEO/SEA, Seminars)

2.5.2.6. Webinars

2.5.3. Demand Generation & Lead Qualification

2.5.3.1. How do we generate and qualify new leads for the target offer?

2.5.3.2. Prospect Lists

2.5.3.3. Key Questions to Ask

2.5.3.4. Sales Collateral

2.5.3.5. Presentations

2.5.3.6. Data Sheets

2.5.3.7. White Papers

2.5.3.8. ROI Tools

2.5.3.9. Other Sales Tools (web site, etc.)

2.6. Check balance of all types of the accounts (Saving, Checking,CDs etc)

2.6.1. Numbers, budget, waterfall, break-even (cost>leads>trials>deals)

2.6.2. Sales Programs

2.6.3. Accelerated Learning Strategy, Controls, Metrics

2.6.4. Include feedback loops

2.6.5. Include financial metrics (definition of success)

2.6.6. Pipeline reports, etc…

2.7. Share experiences with other customers

2.7.1. M&A?

2.7.2. Risk Analysis & Mitigation