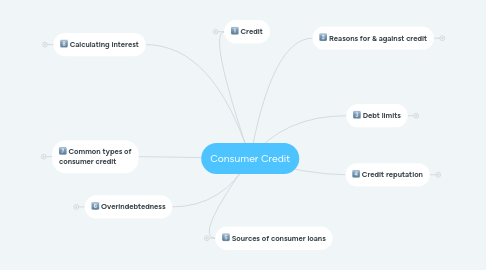

1. Credit

1.1. is any arrangement in which goods, services or money is received

1.2. in exchange for a promise to repay at later date

2. Sources of consumer loans

2.1. Banks

2.2. Sales finance companies

2.2.1. GMAC car financing

2.3. Consumer finance companies

2.3.1. The Money Store

2.4. Stockbrokers

2.4.1. lend money to clients

2.5. Insurance companies

2.6. Alternative lenders

2.6.1. Payday lenders

2.6.1.1. CheckNGo

2.6.2. Rent-to-own

2.6.2.1. Rent a Center

3. Overindebtedness

3.1. Indications:

3.1.1. running out of money

3.1.2. paying only minimum amount due

3.1.3. exceeding debt limits

3.1.4. making late or skipping payments

3.2. Debt collection

3.2.1. Regulated by Federal Fair Debt Collection Practices Act

3.3. Bankruptcy

3.3.1. all or a portion of debts are discharged

3.3.2. a last resort

3.3.3. Ch. 13

3.3.3.1. portion of debts are paid back over 3-5 years

3.3.4. Ch. 7

3.3.4.1. most assets are sold & applied to debts

4. Common types of consumer credit

4.1. Installment credit

4.1.1. a loan that is repaid by the borrower in regular installments.

4.1.2. Types of loans

4.1.2.1. Sales credit

4.1.2.2. unsecured loan

4.1.2.3. secured loan

4.1.2.3.1. require cosigner or collateral

4.2. noninstallment credit

4.2.1. repaid in lump-sum at future date

4.2.1.1. retail charge accounts

4.3. Revolving credit

4.3.1. can borrow up to your credit limit

4.3.2. Types

4.3.2.1. credit/charge card

4.3.2.1.1. types:

4.3.2.2. personal line of credit

4.3.2.3. home equity line of credit

4.3.2.4. service credit

5. Calculating interest

5.1. Declining balance method

5.1.1. interest calculated on each month's balance.

5.1.2. hence, after each month's payment - the balance declines

5.1.3. fair to lender & borrower

5.2. Add-on interest method

5.2.1. I = P x R x T

5.2.2. Payment = (Interest + Principal) / # pmts.

5.2.3. favors the lender because interest is calculated on beginning balance

5.2.3.1. because interest is calculated on beginning (largest) balance

6. Reasons for & against credit

6.1. Good uses of credit include:

6.1.1. *convenience, *emergencies, *reservations, *owning expensive items sooner, *taking advantage of free credit, *for protection against fraud, *to obtain an education.

6.2. Downside of credit

6.2.1. *Use of credit reduces financial flexibility. *It Is tempting to overspend. *There’s a possibility of becoming “overstretched”.

6.2.2. Interest is expensive

7. Debt limits

7.1. you should set your own debt limit

7.2. Methods:

7.2.1. Debt-to-income

7.2.1.1. debt payments/income

7.2.1.2. prefer 36% or less

7.2.2. Debt-to-payments

7.2.2.1. debt payments/disposable income

7.2.2.2. if > 15% - overindebted

7.2.3. Debt-to-equity

7.2.3.1. debt / assets

7.2.3.2. > 33% is excessive

8. Credit reputation

8.1. How to build credit history:

8.1.1. establish both checking & savings account

8.1.2. have telephone & other utilities in your name

8.1.3. get a gas company credit card

8.1.4. apply for a bank credit card

8.1.5. pay off student loans

8.2. get credit report at annualcreditreport.com

8.3. Fair Credit Reporting Act

8.3.1. allows you to challenge errors in credit bureau files