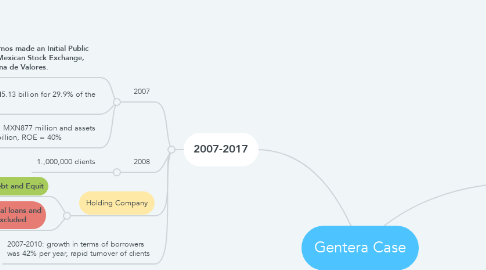

1. 2007-2017

1.1. 2007

1.1.1. Banco Compartamos made an Initial Public Offering on the Mexican Stock Exchange, the Bolsa Mexicana de Valores.

1.1.1.1. Triffered wide debate

1.1.1.2. Board of Directors argued about IPO

1.1.2. Raised MXN5.13 billion for 29.9% of the shares

1.1.3. Profits raised to MXN877 million and assets grew MXN5.1 billion, ROE = 40%

1.2. 2008

1.2.1. 1.,000,000 clients

1.3. Holding Company

1.3.1. Cash Inflow: Debt and Equit

1.3.2. Cash Outflow: Working capital loans and other services to financially excluded

1.4. 2007-2010: growth in terms of borrowers was 42% per year, rapid turnover of clients

2. 2010 Onwards

2.1. 2010: Banco COmpartamos had half the market share of borrowers

2.1.1. Holding company "COmpartamos SAB de CV was crearted.

2.1.2. Banco Compartamos became a subsidiary of the holding company

2.2. 2012: Offering 8 group and individual products

2.3. 2011

2.3.1. Expansion to Peru and Guatemala

2.3.2. Holding company acquired 83% in Peruvian microlender Finciera Arequipa SA

2.4. 2012

2.4.1. Aterna, Agente de Seguros y Fianzas SA de CV was founded as a joint venture with INTERproteccion

2.5. 2013

2.5.1. Compartamos announced new identity for its holding company: Gentera

2.6. 2011-2016

2.6.1. value of the company's shares traded in the MSE rose to 26%

3. Board Evolution

3.1. In 10 years, board size increased from 9 members to 13 members

3.2. Transition from fully male dominated to 2 female members

3.3. 22% independent members --> 62% independent members

4. 1999-2000

4.1. 1995: Breakdown in terms of clients 17.500

4.2. Non-governmental Agency

4.2.1. Cash Inflow: Donors, Grants. and Soft Loans

4.2.2. Cash Outflow: Working Capital loans to fincially excluded

4.3. 1991: Compartamos constituted as a non-profit

4.4. 1996-2000: Growth in terms of borrowers was 24% per year

5. 2000-2007

5.1. 2000: 64,000 clients, growth in rural areas but not urban areas

5.2. 2002: 145,000 clients and issues public debt

5.3. 2004: Independent chair of board

5.4. Renamed to: Financiera Compartamos SOFOL:

5.4.1. Cash Inflow: Debt and Grants

5.4.2. Cash Outflow: Working capital loans to financially excluded

5.4.3. Became a for-profit organization. THis provided access to funds from the Mexican financial market

5.4.4. 2000-2005: raised $150 million commercially

5.4.5. 2003: 68 brances in 15 mexican states

5.4.6. 453,131 clients in 2005

5.4.7. 2006: offer more financial products such as home improvement loans and savings accounts