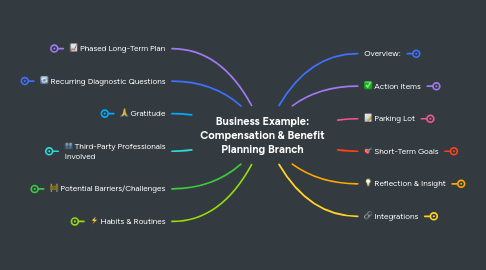

Business Example: Compensation & Benefit Planning Branch

von Joseph Baldwin

1. 📈 Phased Long-Term Plan

1.1. Phase 1 (0-3 months): Finalize plan structure, conduct employee education, and initiate PIPs.

1.2. Phase 2 (3-6 months): Begin profit-sharing payouts and deferred compensation enrollments.

1.3. Phase 3 (6-12 months): Review employee participation and retention metrics.

1.4. Phase 4 (1+ year): Evaluate the impact of new compensation strategies on employee retention and performance.

2. 🔄 Recurring Diagnostic Questions

2.1. Are employees engaged and satisfied with the new compensation structure?

2.2. Are PIPs improving employee performance, or creating resistance?

2.3. Are profit-sharing and stock options driving long-term retention?

2.4. How does compensation compare to competitors in attracting top talent?

2.5. Is the new plan financially sustainable as the company scales?

3. 🙏 Gratitude

3.1. Employees express appreciation for new financial growth opportunities.

3.2. Leadership recognizes team loyalty and long-term commitment.

3.3. The company celebrates first-year profit-sharing bonuses as a success.

4. 👥 Third-Party Professionals Involved

4.1. Compensation & Benefits Consultant – Guides strategy and implementation.

4.2. HR & Payroll Provider – Ensures correct processing and compliance.

4.3. Tax & Legal Advisors – Ensures compliance with IRS and SEC regulations.

4.4. Wealth Management Partner – Provides financial education for employees on stock options & deferred comp plans.

5. 🚧 Potential Barriers/Challenges

5.1. Employee confusion around non-qualified deferred compensation plans and stock options.

5.2. Negative perceptions around Performance Improvement Plans (PIPs).

5.3. Balancing short-term cash flow with new profit-sharing obligations.

5.4. Regulatory hurdles in setting up deferred compensation and equity incentives.

5.5. Managing expectations for long-term benefits that don’t provide immediate payouts.

6. ⚡ Habits & Routines

6.1. Quarterly compensation reviews to ensure alignment with company goals.

6.2. Annual performance evaluations tied to compensation adjustments.

6.3. Regular financial education sessions to help employees understand their benefits.

6.4. Routine benchmarking of salaries and benefits to maintain competitiveness.

7. Overview:

7.1. ensures that salary structures, bonuses, incentives, and employee benefits align with long-term career and financial goals. By optimizing compensation strategies, reviewing benefits, and planning for future growth, this Sub-MAP helps individuals and business owners maximize earnings, attract and retain top talent, and enhance overall financial security.

8. ✅ Action Items

8.1. Conduct market benchmarking to align compensation with industry standards.

8.2. Design and implement Performance Improvement Plans (PIPs) for underperforming employees.

8.3. Launch the Non-Qualified Deferred Compensation (NQDC) Plan with clear guidelines.

8.4. Establish a profit-sharing model, ensuring fairness and alignment with business growth.

8.5. Develop employee stock options (ESOs) as a long-term incentive for key employees.

8.6. Communicate compensation updates clearly to employees through town halls and Q&A sessions.

8.7. Integrate all compensation components into HR & payroll systems for seamless execution.

9. 📝 Parking Lot

9.1. Evaluating the impact of compensation changes on company culture and morale.

9.2. Considering a tuition reimbursement program to support employee development.

9.3. Assessing the feasibility of a 4-day workweek or flexible PTO policies.

9.4. Exploring additional wellness benefits such as gym memberships and mental health resources.

10. 🎯 Short-Term Goals

10.1. Finalize the new compensation plan structure and announce it to employees.

10.2. Ensure compliance with tax regulations for the deferred compensation and profit-sharing plans.

10.3. Roll out Performance Improvement Plans (PIPs) and training for managers on how to implement them effectively.

10.4. Begin employee education on stock options and profit-sharing benefits.

11. 💡 Reflection & Insight

11.1. ✔️ The new compensation structure is attracting better talent, reducing hiring struggles.

11.2. ✔️ Employees are more engaged with long-term incentives like stock options and profit sharing.

11.3. ⚠️ Some employees struggle to understand the full benefits of the NQDC plan.

11.4. ⚠️ Performance Improvement Plans (PIPs) are viewed negatively, causing morale concerns.

11.5. 🔹 Key Adjustments: Enhance communication and education efforts around compensation benefits and adjust PIP language to focus on growth rather than punishment.

12. 🔗 Integrations

12.1. Connect compensation planning with financial strategy to ensure long-term affordability.

12.2. Align with recruiting and retention goals to measure the impact of new benefits.

12.3. Integrate into performance management systems for a seamless feedback loop.

12.4. Link stock options and profit-sharing to company growth milestones for added transparency.