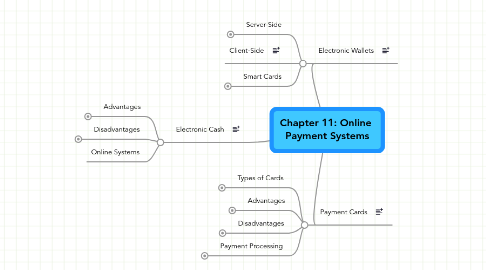

1. Payment Cards

1.1. Types of Cards

1.1.1. Debit

1.1.1.1. Banking

1.1.2. Credit

1.1.2.1. Visa/Mastercard etc.

1.1.3. Change

1.1.3.1. Amex and Discover Card

1.1.3.2. Closed Loop

1.2. Advantages

1.2.1. 1. Consumer protection from fraud

1.2.2. 2. Worldwide acceptance

1.2.3. 3. Currency Convergence handled

1.2.4. 4. Merchant protection (authorization/verification)

1.2.5. 5. Merchant assurance from issuing companies

1.3. Disadvantages

1.3.1. 1. Cost to merchants: per transaction or a monthly fee

1.3.2. 2. Cost to consumers: annual fees

1.4. Payment Processing

1.4.1. EMV standard

1.4.2. 30-day shipping requirement

1.4.3. Merchant accounts required to accept credit cards

1.4.4. General Payment Service Providers

1.4.4.1. icVerify

1.4.5. Online Payment Service Providers

1.4.5.1. InternetSecure

1.4.5.2. PaymentOnline

1.4.5.3. PayPal merchants

1.4.5.4. Reg.Net for DRM

1.4.6. Figure 11.3

1.4.6.1. Customer Logs into the Internet on an HTTPS

1.4.6.2. Payment Authorization is done by merchant - check balance to see that payment is a go

1.4.6.3. Issuing bank

1.4.6.4. ACH network

1.4.6.5. Merchant bank

2. Electronic Cash

2.1. Advantages

2.1.1. 1. good for micro payments (<$1) and small transactions (<$10)

2.1.2. 2. readily exchanged for real cash (unlike scrip)

2.1.3. 3. useful for those who cannot get credit cards

2.1.4. 4. no need for authorizations, as required by payment cards

2.1.5. 5. Independence: unrelated to any proprietary network or storage device

2.1.6. 6. portability: freely transferable between two parties (across borders)

2.1.7. 7. convenience: does not require any special hard/software

2.2. Disadvantages

2.2.1. 1. not standardized or universall accepted

2.2.2. 2. no audit trail, due to independence and privacy

2.2.3. 3. security issues: potential for "double-spending" and "money laundering"

2.2.4. 4. security issues: susceptible to forgery

2.3. Online Systems

3. Electronic Wallets

3.1. Server-Side

3.1.1. Bileo services

3.1.2. Microsoft Passport

3.1.3. Yahoo Wallet

3.2. Client-Side

3.3. Smart Cards

3.3.1. One card for everything

3.3.2. Benefits over magnetic cards