1. Gross Income

1.1. General Rule

1.2. Wages

1.2.1. Cost of $50,000 Insurance excluded, cost of extra coverage included.

1.3. Interest

1.3.1. Schedule B

1.3.1.1. Taxable Interest:

1.3.1.2. Tax- exempt Interest:

1.4. Dividends

1.4.1. Schedule B

1.5. State Tax Refunds

1.6. Alimony Received

1.7. Business Income

1.7.1. Schedule C

1.7.1.1. Nondeductible Expenses:

1.7.1.1.1. Salary to sole propritor

1.7.1.1.2. Federal Income Tax

1.7.1.1.3. Personal portion of auto, meal, health insurance....

1.7.1.1.4. Bad debt expense of cash basis taxpayer

1.7.1.2. 2 Tax on the net income

1.7.1.2.1. income tax

1.7.1.2.2. Federal self-employment tax

1.8. Capital Gain/Loss

1.9. IRA Income (Withdrawing fund from IRA)

1.9.1. Deductible IRA

1.9.1.1. Contribution Deductible, distribution taxable

1.9.2. Roth IRA

1.9.2.1. Contribution nondeductible, distribution nontaxable

1.9.3. Nondeductible IRA

1.9.3.1. Contribution nondeductible, original distribution nontaxable but earning taxable

1.9.4. Penalty Tax 10%

1.9.4.1. Exception

1.10. Pension and Annuity

1.11. Rental Income/Loss

1.11.1. Formula

1.11.2. Rental Loss: Only deduct rental income

1.12. Passive Activity Loss

1.12.1. Passive= Taxpayer don't materially participate

1.12.2. Can't offset other income

1.12.2.1. Exception: deduct up to $25,000 if "active"

1.13. Unemployment Compensation

1.14. Social Security Benefits

1.15. Other Income

1.15.1. Prize

1.15.2. Gambling Winning

1.15.3. Business Recoveries

1.15.4. Punitive Damage

1.15.5. Scholarship (Room&board, service rendered)

1.16. Nontaxable Income

1.16.1. Life insurance

1.16.2. Gifts and Inheritances

1.16.3. Medicare benefits

1.16.4. Workers' compensation

1.16.5. Personal physical injury awards

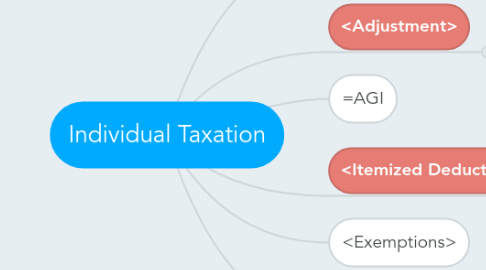

2. <Adjustment>

2.1. Alimony Paid

2.1.1. Nontaxable to Wife, Taxable to Husband(写反了吧?)

2.1.2. Payment first apply to child support, then to alimony

2.1.3. Property Settlement can't deduct for Husband

2.2. IRA (Individual Retirement Accounts)

2.2.1. Deductible IRA

2.2.1.1. No deductible if rich& participate pension plan

2.2.1.2. Maximum deduction: Lesser of

2.2.1.2.1. $5500

2.2.1.2.2. Individual compensation

2.2.2. Roth IRA

2.2.3. Nondeductible IRA

2.2.4. Keogh IRA (For self-employer)

2.2.4.1. Deduction= Lesser of

2.2.4.1.1. $52,000 (Keogh Deduction)

2.2.4.1.2. 25% of Keogh Net Earning

2.2.5. Coverdell education saving accounts

2.2.5.1. $2000 Annually

2.2.5.2. Tax-Free Earnings

2.2.5.3. Tax-Free Disreibutions

2.2.5.3.1. 受益人30岁

2.2.6. 总结

2.3. Educator Expense

2.3.1. Up to $250 of qualified expense paid

2.4. Education Loan Interest Expenses

2.4.1. Limited to $2500 (Any excess or disallowed is "personal interest' and not deductible)

2.5. Educational Expense

2.5.1. $4,000 Max; Can't take if expense was claimed for American Oppotunity

2.6. Tuition & Fee Deduction

2.6.1. $4000 AGI< 65000

2.6.2. $2000 65000< AGI< 80000

2.6.3. $0 80000< AGI

2.7. Interest Withdrawal Penalty

2.7.1. Interest Forfeited

2.8. Health Savings Account

2.8.1. Max Contribute: $3300 (Age 55加 $1000)

2.9. Self-Employed Health Insurance

2.9.1. All of the medical insurance premium paid

2.10. One-Half Self-Employment FICA

2.10.1. 50% of Social Security/Medical Tax

2.11. Self-Employed Retirement (Keogh Plan)

2.11.1. Max deduct: Lesser of $52000 or 25% Keogh net earnings

2.11.2. Max contribute: Lesser of $52000 or 100% net earnings

2.11.3. Business Income- Business Expense= Net Business Income- 50%Self Employment Tax- Keogh Deduction= Keogh New Earnings

2.12. Moving Expenses

2.12.1. New Workplace: At least 50 miles more commute

2.12.2. 75%(39 weeks) stay in new place

2.12.3. Direct moving cost: traveling, lodging, transporting household goods

2.12.4. No meals, house hunting, payment of lease breaking and temporary living expense

3. =AGI

4. <Itemized Deductions>

4.1. Medical

4.1.1. Qualified Medical Expense- Insurance Reimbursement= Qualified Medical Expense 'Paid' -10% AGI= Deductible Medical Expense

4.2. Theft/Casualty

4.2.1. Smaller Loss (Cost or decreased FMV)- Insurance Recovery- $100- 10% AGI

4.3. State/Local Tax

4.3.1. Deductible: Real Estate Tax, Income Tax, Personal Property Tax, Sale Tax

4.3.2. Nondeductible: Federal Tax, Inheritance Tax, Business and Rental Property Tax

4.4. Interest Expense

4.4.1. Home Mortgage: Interest on acquisition& home equity indebtedness (Up to $1,000,000)

4.4.2. Investment Interest: Deductible up to net investment income

4.4.3. Personal Interest: Nondeductible

4.4.4. Prepaid Interest: Allocate for proper period

4.4.5. Education Loan Interest: Adjustment, not Itemized Deduction

4.5. Charity

4.5.1. Nondeductible: Gift, Political Contribution

4.5.2. Cash (Max 50% AGI) or FMV of Property (Max 30%)

4.5.3. 总结

4.6. Miscellaneous (To the extent over 2% AGI)

4.7. Other Miscellaneous (Not subject to 2% AGI test)

4.7.1. Gambling Loss

4.7.2. Federal estate tax on income from estate