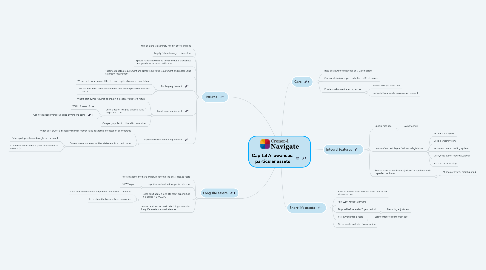

1. Fixtures

1.1. Item of plant & machinery fixed in or to a building

1.2. Legally fixture belongs to freeholder

1.3. Special rules allow tenants to claim capital allowances on expenditure incurred on fixtures

1.4. Must meet pooling requirement and either fixed-value requirement or disposal-value statement requirement

1.5. Pooling requirement

1.5.1. Where past owner was entitled to claim capital allowances on a fixture

1.5.2. Fixture must have been allocated to a pool before past owner ceases to own it

1.6. Fixed-value requirement

1.6.1. Where past owner required to bring in a disposal value for a fixture

1.6.2. Joint election to agree disposal value / acquisition cost

1.6.2.1. Within 2 years of sale

1.6.2.2. Can not exceed overall sale price or vendor's costs

1.6.3. One party applies to tribunal to determine

1.7. Disposal-value statement requirement

1.7.1. When past owner's disposal value was market value as a result of cessation of ownership

1.7.2. Current owner obtains a written statement from past owner

1.7.2.1. Detailing disposal value brought into account

1.7.2.2. Statement made within 2 years of cessation of ownership

2. Long-life assets

2.1. Assets expected to have a useful economic life of at least 25 years

2.2. Long-life assets added to special rate pool

2.2.1. 6% WDA p.a.

2.3. Rules don't apply if long-life asset expenditure in a period < £100,000

2.3.1. Limit increased/reduced for periods that are not 12 months

2.3.2. Limit shared between related companies

2.4. Assets provided for use in a building can not be long-life assets in some instances

3. Cars

3.1. Rate of allowances depends on CO2 emissions

3.2. Can not claim AIA, super-deduction or SR allowance

3.3. Private use by sole trader or partner

3.3.1. Include in single asset pool

3.3.2. Restrict allowances to business use element

4. Integral features

4.1. Special rate pool

4.1.1. 6% per annum

4.2. Items defined as integral features in legislation

4.2.1. An electrical system

4.2.2. A cold-water system

4.2.3. A space of water-heating system

4.2.4. A lift, escalator or moving walkway

4.2.5. external solar shading

4.3. Replacement of whole or majority of integral feature is capital expenditure

4.3.1. At once or over 12 month period

5. Short-life assets

5.1. Elect to include asset in single asset pool rather than main pool

5.2. 18% WDA for up to 8 years

5.3. Disposal before end of 8 year period

5.3.1. Balancing adjustment

5.4. Still owned after 8 years

5.4.1. Balance transferred to main pool