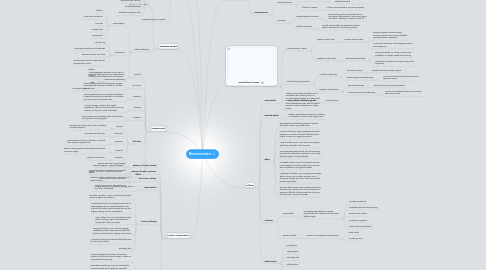

1. Supply side policies

1.1. Policies to increase potential output

1.1.1. Lower income tax

1.1.2. Reduced union power

1.1.3. Innovation, Research and Development

1.1.4. Competition

1.1.5. Investment in capital goods

1.1.6. Education and training

1.1.7. Reduced benefits

1.1.8. Relaxed immigration law

1.2. Improves long term growth

2. Aggregate Demand

2.1. AD= C + I + G + (E-M)

2.2. Factors affecting

2.2.1. Consumption

2.2.1.1. Inflation

2.2.1.2. Consumer confidence

2.2.1.3. Tax rates

2.2.1.4. Interest rates

2.2.1.5. Umployment

2.2.2. Investment

2.2.2.1. Interest rate

2.2.2.2. Government policies and subsidies

2.2.2.3. Business outlook for future

2.2.2.4. Credit crunch made it impossible for companies to invest

2.2.3. Government Spending

2.2.3.1. Inflation

2.2.3.2. Income

2.2.3.3. Debt

2.2.3.4. Confidence in investment

3. Unemployment

3.1. Cyclical

3.1.1. When aggregate demand is too low in a negative output gap, firms make workers redundant and they become umployed.

3.2. Structural

3.2.1. When the structure of the economy changes, and people do not have the skills for the new jobs

3.3. Seasonal

3.3.1. These happen because of regular fluctuations in weather conditions or demand in industries such as tourism and construction

3.4. Classical

3.4.1. When real wage is above the market equillibrium, and firms cannot afford as many workers, so they are made redundant

3.5. Frictional

3.5.1. When people are in between jobs, and they are in the process of finding jobs.

3.6. Solutions

3.6.1. Cyclical

3.6.1.1. Demand side policy (e.g. fiscal, monetary) to boost demand

3.6.2. Structural

3.6.2.1. Education and training

3.6.3. Seasonal

3.6.3.1. Create demand for the industries, e.g. build more houses, Olympics etc

3.6.4. Classical

3.6.4.1. Reduce union powers and employment laws for minimum wages

3.6.5. Frictional

3.6.5.1. Improve information

3.7. Effect

3.7.1. Government has to pay benefits

3.7.2. People lose skills, decreasing the potential output

3.7.3. Government loses tax revenue

3.7.4. People lose income, decreasing AD

4. Current Account Balance

4.1. Balance of trade in goods

4.1.1. Export of goods - import of goods

4.2. Balance of trade in services

4.2.1. Export of services - import of services

4.3. Net income inflows

4.3.1. Interest, profits, dividents from ownership of assets abroad

4.4. Net transfers

4.4.1. Foreign workers' remittances, foreign aid, EU, UN, IMF, World Band

4.5. Factors affecting

4.5.1. Short term growth. A high AD will lead to higher import of goods and services

4.5.2. Funddamental lack of competitiveness due to weak supply side and low productivity. Low productivity makes cost of production per unit higher, making it not as competitive

4.5.3. High inflation of a country leads to higher prices, making it again uncompetitive compared to other countries

4.5.4. Non-price factors, such as quality, design, reliability and after-sales services affect the balance of both trade in goods and services

4.5.5. A country's financial investment affects the part of net income inflows.

4.5.6. Exchange rate

4.6. How to control it

4.6.1. Demand-side policy to control short term growth, and this can reduce import. Known as expenditure dampening

4.6.2. Expenditure switching. Firms and individuals can switch away from expensive imported goods and buy domestically producced goods

4.6.3. Increase a economy's competitiveness by supply side policies. It improves productivity, lowering the cost per unit production and thus price as well as non-price factors, such as quality and design

4.6.4. Control currency. Keep currency low improves an economy's current account balance

4.6.5. Protectionist policies

5. New node

6. Business cycle

6.1. Stages

6.1.1. New node

6.2. Characterisrics

6.2.1. Recovery/ Boom

6.2.1.1. Umemployment decreases

6.2.1.1.1. There is more demand, so factories need to employ more people to produce additional output

6.2.1.2. Inflation increases

6.2.1.2.1. There is more demand, so prices increases

6.2.2. Recession

6.2.2.1. Umemployment increases

6.2.2.1.1. Demand for goods and services fall, so firms need fewer people. They make people redundant, resulting in overall income fall

6.2.2.2. Inflation decreases

6.2.2.2.1. Overall income falls, so people have less to spend. Demand falls, so prices go down

7. Circular flow of money

7.1. Monetary Policy ( Bank)

7.1.1. Positive Output Gap

7.1.1.1. Increase interest rates

7.1.1.1.1. Saving increases, because saving money in banks is now more profitable, so people reduce spending

7.1.1.1.2. Investment decreases, as borrowing money is more expensive

7.1.2. Negative Output Gap

7.1.2.1. Decrease interest rates

7.1.2.1.1. Saving decreases, as saving money is less profitable, so people spend more money

7.1.2.1.2. Investment increases, as saving money is less expensive

7.2. Fiscal Policy (Government)

7.2.1. Positive Output Gap

7.2.1.1. Tax rate increases

7.2.1.1.1. People have less money to spend

7.2.1.2. Reduce government spending

7.2.1.2.1. Firms and individuals have less money to spend or invest

7.2.2. Negative Output Gap

7.2.2.1. Tax rate decreases

7.2.2.1.1. People have more money to spend

7.2.2.2. Increase government spending

7.2.2.2.1. Firms and individuals have more money to spend and invest

7.3. Mainly controls short term growth

7.3.1. Increases GDP

8. Inflation

8.1. Cost pushed

8.1.1. Inflation caused by increased cost of production due to things such as increased global wages, increased cost in raw materials, low exchange rate, and increased tax rates, and the cost is passed on to the consumers in higher prices

8.2. Demand pulled

8.2.1. Inflation caused by increased AD, shifting AD outwards, so firms set a higher price

8.3. Effect

8.3.1. Decreased real purchasing power for people with fixed income, e.g. pensioners

8.3.2. Workers will bid for higher wages becasued of high prices, and this will push inflation further higher. Known as a wage-price spiral

8.3.3. Make the debt small in real terms, as money is worth less now within the economy

8.3.4. Price signal become blurred, and the economy becomes less efficient as people can no longer tell what good is to be produced

8.3.5. Increased inflation mean that exports are now more expensive, and this makes the economy less competitive in the global market

8.3.6. Adjusting to inflation, e.g. changing prices tags, takes money. This is known as menu cost. If the prices change too much, then this cost will become significant

8.3.7. Business feels insecure and uncertain about the economy as prediction for costs and revenues becomes difficult, so they invest less, harming the economy's long term growth

8.4. Solutions

8.4.1. Cost-pushed

8.4.1.1. Use supply side policy to increase productivity, thus reduce cost and lowers inflation again

8.4.1.1.1. Increase investment

8.4.1.1.2. Increased education and training

8.4.1.1.3. Reduce union power

8.4.1.1.4. Increase immigration

8.4.1.1.5. Public sector pay restraint

8.4.2. Demand-pulled

8.4.2.1. Control AD using demand side policy

8.4.2.1.1. Fiscal Policy

8.4.2.1.2. Monetary policy

8.5. Other factors

8.5.1. Immigration

8.5.2. Wage growth

8.5.3. Exchange rate

8.5.4. Globalisation

8.5.5. Increased competition

8.5.6. Bank of England