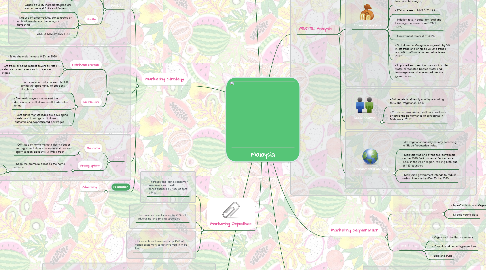

1. Marketing Strategy

1.1. Product

1.1.1. Packaging

1.1.1.1. - Keep the supplier packaging format: 250ml glass screw top bottles

1.1.2. Brand name

1.1.2.1. Minuman yang indah

1.1.3. Quality

1.1.3.1. - Organic quality ingredients/products including natural fruits and flowers

1.1.3.2. - Not use of preservatives, concentrates or artificial sweeteners, colouring or flavouring

1.1.3.3. ADD A MALAYSIAN FRUIT

1.2. Place

1.2.1. Distribution channels

1.2.1.1. - Sales channels increase 0.2% in 2020

1.2.1.2. - Off-trade or home market covers all retail sales via hypermarkets and conviences stores

1.2.2. Distributors

1.2.2.1. - Premium wholesalers across the UK giving the opportunity of effecient distribution

1.2.2.2. - Domestic players maintained their dominance in soft drinks in off-trade value terms

1.2.2.3. - Soft drinks manufactures are developing low-fat and low-sugar soft drinks: authentic and sophisticated beverages

1.3. Price

1.3.1. Discounts

1.3.1.1. - Off-trade or home market sales via super and hypermarkets and convience stores can apply season discounts (3 with 1 free)

1.3.2. Pricing options

1.3.2.1. - Keep the premium prices as the home country

1.3.2.1.1. - £1.458 per unit (B2C)

1.3.2.1.2. - £35.00 per 24 units (B2B)

1.4. Promotion

1.4.1. Advertising

2. Marketing Objectives

2.1. - Increase and rising consumer awareness and health consciousness by 45% of soft drinks

2.2. - Increase soft drinks sales by 20% with advertising and pricing strategies

2.3. - Increase brand awareness by 45% of vegan customers to get involved in MIFB Fair

3. Market Entry Strategy

3.1. Market analysis

3.1.1. - Revenue in Non-Alcoholic Drinks Malaysian market amounts to $2,642m in 2020

3.1.1.1. - Revenue in Soft Drinks in Malaysia it is $1,871m in 2020

3.1.2. - The Non-Alcoholic Drinks Malaysian market is expected to growth annually by 3.9% (2020-2023)

3.1.3. - The market's largest segment is Soft Drinks with a market volume of $1,871m in 2020

3.1.4. - Malaysian are adopting health and wilness food and drink trends, demanding for premium soft drinks

3.2. Entry Strategy

3.2.1. FDI - Foreign Direct Investment

3.2.1.1. Join Venture

3.2.1.1.1. - The entry strategy suitable for this market is a Join Venture with Malaysian International Food and Beverage Trade Fair (MIFB)

3.2.1.1.2. - This JV build a business connection to facilitate brand exhibitors to expand their market globally.

3.2.1.1.3. - MIFB provide international programms to look for right international and local business partners.

3.2.1.1.4. - Exhibitors will be connected with the right business partners, locally or globally, and generate new business opportunities.

4. Culture

4.1. Malaysia data

4.1.1. - The sales value of manufactured soft drinks in Malaysia increase MYR 0.06 billion

4.1.2. - Juice is the 3rd beverage most consumpted in Malaysia with 52.42% of regular consumption

4.1.3. - Increasing consumption of healthy drinks is one of the primary growth factors of non-alcoholic drink Malaysian market

4.1.4. - Malaysian consumers are increasingly demandind for natural and organic product drinks: premium soft drinks

5. PESTEL Analysis

5.1. Political and Legal analysis

5.1.1. - Malaysia consider FI an important factor for economic growth

5.1.2. - Corporate Tax rate established in 24%

5.1.3. - Liberalized regulations and remotion restrictions

5.1.4. - Sugar tax of 40% implemented on soft drinks in Malaysia that contains or exceed the stated values

5.1.5. - Risk rate decrease which means good business environment

5.2. Economic analysis

5.2.1. - Population growth of 1.3% (2018)

5.2.2. - GDP growht of 4.3%

5.2.3. - GDP per capita of $12,109.50 in 2018

5.2.4. - Economy recovered growth of 3.6% in 2019

5.2.5. - Imports rate increase by 0.9% (3.2% in food and beverages)

5.2.6. - FDI increase to MYR 3 73 billion

5.2.7. - Inflation rate in softer for food and beverages increase from 0.9% to 1.7%

5.2.8. - Government forecast of 4.7%

5.2.9. - Soft drinks in Malaysia saw growth by 5% in off-trade and on-trade volume trends and 6% in off-trade current value terms in 2019

5.2.10. - Imported and premiun brands of bottled water, carbonated bottled water and fruit/vegetable juice recorded healthy growth rates.

5.3. Social analysis

5.3.1. - 3rd vegetarian-friendly country according to Global Vegetarian Index

5.3.2. - Consumer awareness, health and wellness affected the performance of soft drinks in Malaysia in 2019

5.4. Environmental analysis

5.4.1. - 3rd vegetarian-friendly country according to Global Vegetarian Index

5.4.2. - Malaysia was one of the top performers on the 2010 Environmental Performance Index in the Asian region, ranking 54th out of 163 countries

5.4.3. - Malaysian government intends to reduce carbon intensity by 40–45% by 2020

6. Marketing Segmentation

6.1. Lovely drinks consumer

6.1.1. - Non-Alcoholic and Vegan millenium

6.1.2. - Middle young class

6.2. B2B off tray

6.2.1. - Vegan and Healthy restaurants

6.2.2. - Organic and vegan hypermarkets

6.2.3. - Bars and Pubs

7. Competitors

7.1. Competition

7.1.1. - Local players such as Fraser & Neave Holdings, which remained the leader, and Etika Beverages, in third place, benefit from their long-standing presence and strong resonance with local consumers, giving them a competitive edge over international players.

7.1.2. - The competition in non-alcoholic drink is in terms of product diferentiation, price, quality, distribution and marketing.

7.2. Direct local Competitors

7.2.1. - Global Malaysia Soft Drinks market competition by top manufacturers, with production, price, and revenue (value) and market share for each manufacturer; the top players including

7.2.1.1. House Boom

7.2.2. - Lovely Drinks is different from competition because of the vegan drink implementation and a range of flavours