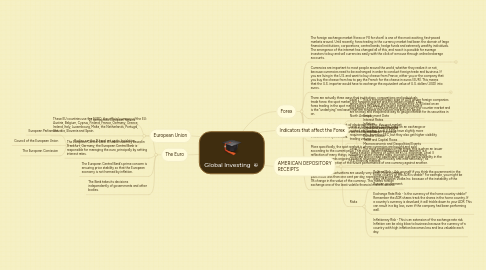

1. European Union

1.1. 27 democratic European nations

1.2. Bodies run the EU and set up its legislation

1.2.1. European Parliament

1.2.2. Council of the European Union

1.2.3. The European Comission

2. The Euro

2.1. These EU countries use the EURO, the official currency of the EU: Austria, Belgium, Cyprus, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

2.2. The European Central Bank: A stable currency based in Frankfurt, Germany, the European Central Bank is responsible for managing the euro, principally by setting interest rates.

2.3. The European Central Bank's prime concern is ensuring price stability so that the European economy is not harmed by inflation.

2.4. The Bank takes its decisions independently of governments and other bodies.

3. Forex

3.1. The foreign exchange market (forex or FX for short) is one of the most exciting, fast-paced markets around. Until recently, forex trading in the currency market had been the domain of large financial institutions, corporations, central banks, hedge funds and extremely wealthy individuals. The emergence of the internet has changed all of this, and now it is possible for average investors to buy and sell currencies easily with the click of a mouse through online brokerage accounts.

3.1.1. Task

3.1.2. Prerequisites

3.2. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. and want to buy cheese from France, either you or the company that you buy the cheese from has to pay the French for the cheese in euros (EUR). This means that the U.S. importer would have to exchange the equivalent value of U.S. dollars (USD) into euros.

3.2.1. Task

3.2.2. Prerequisites

3.3. There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market and the futures market. The forex trading in the spot market always has been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on.

3.4. However, with the advent of electronic trading, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators.

3.5. More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another.

3.6. Daily currency fluctuations are usually very small. Most currency pairs move less than one cent per day, representing a less than 1% change in the value of the currency. This makes foreign exchange one of the least volatile financial markets around.

4. AMERICAN DEPOSITORY RECEIPTS

4.1. Level 1 - This is the most basic type of ADR where foreign companies either don't qualify or don't wish to have their ADR listed on an exchange. Level 1 ADRs are found on the over-the-counter market and are an easy and inexpensive way to gauge interest for its securities in North America.

4.2. Level 2 - This type of ADR is listed on an exchange or quoted on Nasdaq. Level 2 ADRs have slightly more requirements from the SEC, but they also get higher visibility trading volume.

4.3. Level 3 - The most prestigious of the three, this is when an issuer floats a public offering of ADRs on a U.S. exchange. Level 3 ADRs are able to raise capital and gain substantial visibility in the U.S. financial markets.

4.4. Risks

4.4.1. Political Risk - Ask yourself if you think the government in the home country of the ADR is stable? For example, you might be wary of Russian Vodka Inc. because of the instability of the Russian government.

4.4.2. Exchange Rate Risk - Is the currency of the home country stable? Remember the ADR shares track the shares in the home country. If a country's currency is devalued, it will trickle down to your ADR. This can result in a big loss, even if the company had been performing well.

4.4.3. Inflationary Risk - This is an extension of the exchange rate risk. Inflation can be a big blow to business because the currency of a country with high inflation becomes less and less valuable each day.