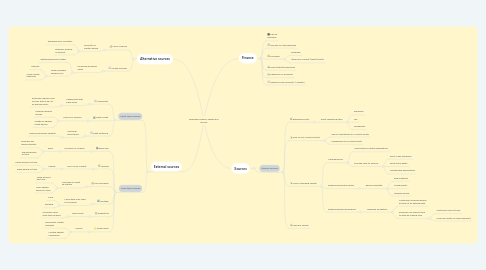

1. External sources

1.1. Short-term sources

1.1.1. Overdrafts

1.1.1.1. Agreement with bank allow

1.1.1.1.1. Business spends more money than it has to an agreed limits

1.1.2. Trade credit

1.1.2.1. Source of finance

1.1.2.1.1. Supplier lending money

1.1.2.1.2. Length of agreed credit period

1.1.3. Debt factoring

1.1.3.1. Sell trade receivables

1.1.3.1.1. Improve business liquidity

1.2. Long-term sources

1.2.1. Bank loan

1.2.1.1. Provision of finance

1.2.1.1.1. Bank

1.2.2. Leasing

1.2.2.1. Use of non-current

1.2.2.1.1. Paying

1.2.3. Hire purchase

1.2.3.1. Purchase of asset by paying

1.2.3.1.1. Fixed amount per time

1.2.3.1.2. Over agreed period of time

1.2.4. Mortage

1.2.4.1. Long-time loan used to purchase

1.2.4.1.1. Land

1.2.4.1.2. Building

1.2.5. Debenture

1.2.5.1. Bond issue

1.2.5.1.1. Company raise long-term finance

1.2.6. Share issue

1.2.6.1. Source

1.2.6.1.1. Permanent capital available

1.2.6.1.2. Limited liability companies

2. Alternative sources

2.1. Micro-finance

2.1.1. Amounts of capital loaned

2.1.1.1. Entrepreneurs countries

2.1.1.2. Business finance is difficult

2.2. Crowd-funding

2.2.1. Financing business ideas

2.2.1.1. Obtaining amount capital

2.2.1.2. Large numbers people from

2.2.1.2.1. Internet

2.2.1.2.2. Social media networks

3. Finance

3.1. Set up business

3.2. Pay day-to-day expenses

3.3. Purchase

3.3.1. buildings

3.3.2. other non-current (fixed) assets

3.4. Invest latest technology

3.5. Expansion of business

3.6. Research new products / markets

4. Sources

4.1. Internal sources

4.1.1. Retained profits

4.1.1.1. Profit remaining after

4.1.1.1.1. Expenses

4.1.1.1.2. Tax

4.1.1.1.3. Dividendes

4.1.2. Sale of non-current assets

4.1.2.1. Sale of unwanted non-current assets

4.1.2.2. Leaseback non-current assets

4.1.3. Uses of working capital

4.1.3.1. Cash balances

4.1.3.1.1. Used finance capital expenditure

4.1.3.1.2. Enough cash to finance

4.1.3.2. Reducing inventory levels

4.1.3.2.1. Reduce quantity

4.1.3.3. Reducing trade receivables

4.1.3.3.1. Referred as debtors

4.1.4. Owner's saving