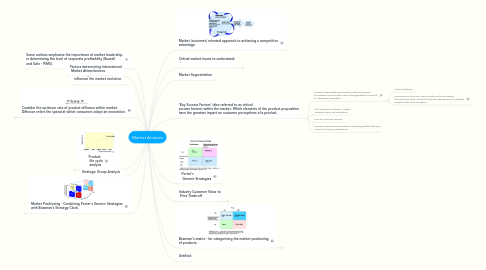

1. Market Positioning - Combining Porter's Generic Strategies with Bowman's Strategy Clock.

1.1. Broad Market Scope

1.1.1. Low frills (For example, Ryanair).

1.1.2. Customer Value-added Leader/ Value Innovator

1.1.3. Differentiated Product (premium price)

1.1.4. Failure Strategy

1.2. Narrow Market Scope

1.2.1. Price Focus

1.2.2. Differentiation focus (premium price)

1.2.3. Niche Customer Value-added Leader

1.2.4. Niche Potential Failure Strategy

2. Strategic Group Analysis

3. Product life cycle analysis

3.1. It may also be appropriate to consider the International product life cycle

4. Consider the optimum rate of product diffusion within market. Diffusion refers the speed at which consumers adopt an innovation.

4.1. Diffusion refers the speed at which innovations are adopted by consumers.

4.1.1. Diffusion refers the process by which innovations are adopted for use by consumers, or in the case of process innovations by other organisations.

4.1.2. For example, a rapid rate of diffusion causes an innovation to become very popular, very quickly.

4.2. Diffusion often exhibits the shape of an S-curve.

4.2.1. Consumers are initially unfamiliar with a new product of its potential benefits, and are consequently reluctant to purchase.

4.2.2. Sales are modest during the early stages of market development - rate of diffusion is low.

4.2.3. Following a period of awareness building, consumers gradually become aware of the innovation and its advantages. Early adopters are important influencers.

4.2.4. Social factors are particularly influential in determining the speed of innovation adoption. Social factors can include peer pressure, fashion, word of mouth, and social networks.

4.3. Corporate objective is to influence would be adopters, to create a bandwagon effect that motivates potential adopters to become keen adopters of the innovation.

5. Technological factors can influence the market evolution

6. Some authors emphasise the importance of market leadership, in determining the level of corporate profitability (Buzzell and Gale - PIMS).

7. Factors determining International Market Attractiveness

8. Market (customer) oriented approach to achieving a competitive advantage

9. Critical market issues to understand: -

9.1. Understand bases of competition

9.1.1. Competitor intelligence

9.1.2. Competitor intelligence refers to a systematic identification and analysis of competitor information.

9.1.3. Elements of competitor intelligence

9.1.3.1. Review presentations by senior managers to shareholders, investment analysts, and journalists.

9.1.3.2. Understand the present strategies of current and potential competitors, because their future behaviour often derives from continuing previous trends.

9.1.3.2.1. What are the competitor's capital expenditure priorities?

9.1.3.2.2. What are the competitor's research priorities?

9.1.3.2.3. What types of products are currently being launched by competitors?

9.1.3.3. Forecast competitors future strategies.

9.1.3.3.1. What are competitors objectives? This indicates the types of strategies competitors will need to pursue in order to achieve corporate objectives.

9.1.3.3.2. How does competitor perceive itself, and their industry?

9.1.3.3.3. Identify competitors strengths and weaknesses (relates to organisation's resources and capabilities).

9.1.3.4. Predict each competitors likely response (their strategy and tactics) to each of our strategic options, and potential internal changes (for example, new chief executive officer) and changes within the external environment (for example, increasing raw material costs).

9.1.3.5. Identify how competitor behaviour can be influenced to become more favourable.

9.1.4. Game Theory is useful for structuring this analysis.

9.2. Is the organisation able to establish a competitive advantage within the market.

9.3. Which type of competitive advantage is most appropriate for the organisation?

9.4. What is our target market? Who are our customers?

9.4.1. What are customer characteristics?

10. Market Segmentation

11. 'Key Success Factors' (also referred to as critical success factors) within the market. Which elements of the product proposition have the greatest impact on customer perceptions of a product.

11.1. "product features that are particularly valued by a group of customers and, therefore, where the organization must excel to outperform competition.

11.1.1. Similar definitions: -

11.1.2. Key Success Factors (KSF) refer to factors within an industry that customers value, and which allow the organisation to successfully compete within the marketplace.

11.2. What motivates customers - Analyse customer needs and preferences.

11.3. What do customers require?

11.4. How do customers choose between competing product offerings? - Basis for consumer preferences?

12. Porter's Generic Strategies

13. Industry Customer Value to Price Trade-off

13.1. Industry Value to Price trade-off curve represents the range of value to price positions of product propositions currently existing within the market.

13.1.1. Value Equivalence Line (VEL) shows all points where price is equal to perceived user value. This is a 45 degree line to axes, where the same scales are used on both axes.

13.1.2. Consumers will not purchase where the value relative to price point is above the Value Equivalence Line, because price exceeds the perceived user value expressed in monetary terms.

13.1.3. The industry Customer value to price trade-off being to the left of the value equivalence line indicates the existence of consumer surplus - The consumer is acquiring a greater benefit in monetary terms than they are paying for.

13.1.4. Where all product propositions are on this trade-off curve the market shares of industry incumbents will be stable.

13.1.5. The term 'Consumer Surplus' is explained in the markets mind map, which can be accessed by following the attached hyperlink.

13.2. Market shares are stable, when firms product propositions are all on the Industry Value to Price trade-off curve

13.3. Aim is to set a price as close to the monetary benefit acquired by consumers, whilst remaining competitive with regard to competing product propositions within the marketplace.

13.4. What are the customer perceptions of the main product attributes driving consumer choice - see strategy canvas.

13.5. Aim: Understand the customer perceived benefit levels of attributes for your product and competing products, in order to determine their relative importance. Determine the monetary value customers consider each product attribute offers.

13.5.1. Following internal perceptions of what customers require can undermine the product proposition. Value is determined by the customer, and so customer opinions should be sought when seeking to understand the relative importance customers place on product attributes.

13.5.2. Softer aspects of the product proposition, such as customer perceptions of reliability, customer service and support, can be as important to customers as more tangible factors.

13.6. Use market research techniques such as conjoint analysis, discrete choice analysis, and multi-staged conjoint analysis to quantify customers perceived benefit.

13.7. Two ways to increase corporate financial returns is to:-

13.7.1. Increase the value that customers perceive to be worth paying extra - see strategy canvas within Blue Ocean Strategy mind map.

13.7.1.1. See also: Porter's first-order fit.

13.7.2. Developing a price closer to the customer benefit expressed in monetary terms the customer receives. One element that may enable this objective to be achieved is price discrimination between customers receiving different levels of benefit. Secondly, adjustment of price for each additional item that a consumer purchases (for example, time constrained discounts for bulk purchase).

13.8. Need to consider the dynamic effect of a company's price benefit positioning, in terms of competitor and customer responses to the company's chosen price - customer benefit position, together with the impact of the sum of these changes on overall industry profitability.

13.9. Market shares are not stable when companies start producing product propositions to the right of the Industry Value to Price trade-off. Value advantage may be a consequence of value innovation.

13.10. Customers are not equally distributed across the industry value to price trade-off, but instead customers are clustered. Consequently, a company should consider which market segments generate the greatest total added value.

13.10.1. Differences in the value of different market segments may be due to the volume of customers in each market segment.

13.10.2. Market Value = Price multiplied by Sales Volume in each market segment.

13.10.3. Therefore, it is important to understand differences in the volume of customers at different points along the Industry Value to Price trade-off curve.

13.10.4. Consumer do not consistently perceive acquired benefits in the same way.

13.10.5. There may be break-points between market segments, which causes a slight increase in product benefits to cause consumers to perceive a significant increase in product delivered benefits and resulting customer value.

13.10.6. Some consumers define a price cap that prevents them buying a product at a price higher than their defined price cap, whatever the additional level of benefit provided by purchasing a product that is above the price cap.

13.11. Importance of dynamic value management. Value maps are not static, but dynamic. Constantly changing as a consequence of changing customer attitudes and affluence, together with changes to competitors product propositions.

13.11.1. Dynamic Value Management requires managers to constantly review likely changes in customer value perceptions, and competitor value positions.

13.11.2. Repositioning the product on the Industry value to price trade-off curve will be considered to be a less aggressive move by rivals than shifting the value - price ratio to the right of the Industry Value to Price trade-off, which would generate a value advantage for customers (increased consumer surplus) that would cause the firm to raise its market share if competitive rivals do not respond effectively to the strategic move. Secondly, it will affect fewer firms - the firms whose market segments you are encroaching.

13.11.3. Repositioning a product on the Industry value to price trade-off.

13.11.3.1. Requires the organization to understand how customer price perceptions will be influenced by a change in product features.

13.11.3.2. Requires a company to understand where customer clusters are positioned in the market, and how competitive rivals are positioned with regard to the key price-benefit segments of the market.

13.11.3.3. Organisation must assess the potential gains and losses from product repositioning in the market.

13.11.3.3.1. Repositioning could cause company to lose some customers that preferred the old positioning.

13.11.3.3.2. Potential for gaining new customers that prefer the new trade-off position.

13.11.3.4. Importance of being smart in choosing which product attributes to vary. Also consider how new customer groups may be attracted by changing the range of product benefits offered, which will not undermine sales to existing customer groups.

13.11.3.5. Organisation should also consider whether it is able to satisfy the new market position efficiently and effectively, given organisation capabilities and core competences.

13.11.3.6. Select changes in product attributes and 'customer value to price' positions that is least likely to provoke undesirable competitor reactions to your organization's strategic move.

13.11.4. Shifting the 'customer value to price trade-off' to the right of the existing curve can be both extremely rewarding and risky.

13.11.4.1. Pursuing a value advantaged position is likely to be commercially detrimental to all other firms within an industry, because their 'customer value to price' propositions will be 'less attractive as a consequence of your organization's strategic move.

13.11.4.2. However shifting the customer value to price trade-off to the right of the existing curve can expand the market, where the organization correctly identifies the potential provided by latent demand that is not currently served by producers, due to the perceived unattractiveness of current value propositions to consumers.

13.11.4.3. What are the customer volume elasticities of moving along the price and customer benefits (value) axes?

13.11.4.4. How are competitors likely to respond?

13.11.4.5. What will be the overall impact on organization profitability, as a consequence of repositioning the company on the 'customer value to price trade-off curve', once competition has responded to the organization's strategic move?

13.12. Sources used to develop approach:

13.12.1. Bowman's strategy Clock

13.12.2. Dynamic Value Management - McKinsey paper

13.13. Hyperlink to a relevant article from The Economist magazine:

14. Bowman's matrix - for categorising the market positioning of products.

14.1. Market positioning oriented.

14.2. Positioning is relative to other competitors within the marketplace.

14.3. Authors consider customer perceived product benefits (use value), relative to competing products within the marketplace.

14.4. Authors consider product or service price relative to the industry average.

14.5. Low frills

14.5.1. A low frills strategy is potentially attractive within:

14.5.1.1. Commodity markets.

14.5.1.2. Significant customer segments are price sensitive.

14.5.1.3. Buyers have significant bargaining power.

14.5.1.4. Low buyer switching costs.

14.5.2. Low frills strategy may limit company to a small market segment - Price conscious customers that are prepared to accept an inferior product.

14.5.3. Risk of industry encountering low profit margins, due to product homogeneity and resulting frequent price wars.

14.6. Customer value-added leader/ Value innovator.

14.6.1. Provide superior value to customers at a relatively low market price, due to: -

14.6.2. Product proposition delivering superior value-added to consumers enables the organisation to acquire a substantial market share, which enables organisation to achieve greater economies of scale than rivals.

14.6.3. Proprietary capabilities enable the organisation to deliver an improved value proposition, by reconfiguring their value chain and value system.

14.6.4. Recognise changes in the external environment that will enable the organisation to reconfigure its value chain and value system, in order to deliver an improved value proposition.

14.6.4.1. For example, the Internet provided retailers with an opportunity to deliver a significantly improved value proposition.

14.6.4.1.1. Opportunity for value innovation - For example, an Internet pure play for delivering teaching vacancies.

14.6.4.2. Provides short-term competitive advantage when business model innovation can be easily replicated by rivals.

14.6.4.3. An initial advantage may be turned into a long-term competitive advantage, due to the development of complementary assets, during the period when the innovator benefits from a competitive advantage in value innovation.

14.6.4.3.1. Complementary assets could include:

14.6.4.3.2. Complementary assets

14.7. Differentiator (premium price)

14.7.1. Build a broad market by developing additional features (beyond market proximity), which customers commonly value.