1. quotation

1.1. definition: a statement of willingness to buy or sell currency at an announced price

1.2. European terms

1.2.1. the foreign currency price of a US dollar

1.3. American terms

1.3.1. the dollar price of a foreign currency

1.4. Direct

1.4.1. the home currency price of unit of foreign currency

1.5. Indirect

1.5.1. foreign currency price of a unit of home currency

2. Features

2.1. Geographical extent

2.1.1. Major currency trading centers, which open and close throughout the day

2.1.1.1. London

2.1.1.2. Tokyo

2.1.1.3. New York

3. immense daily transactions

3.1. on a spot basis

3.1.1. requiring settlement two days after the transaction

3.2. on a forward or swap basis

3.2.1. requires settlement at some designated future date

3.3. Nondeliverable forwards

3.3.1. posses the same characteristics as traditional, except they are settled only in US dollar and foreign currency is not delivered

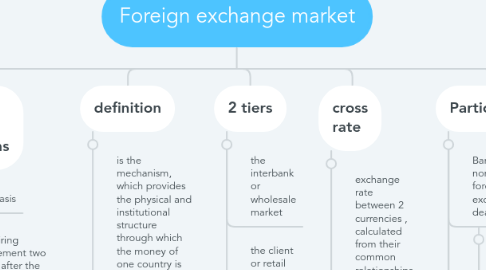

4. definition

4.1. is the mechanism, which provides the physical and institutional structure through which the money of one country is exchanged for that of another country, the rate of exchange between currency is determined and foreign exchange transactions are physically complete

5. 2 tiers

5.1. the interbank or wholesale market

5.2. the client or retail market

6. cross rate

6.1. exchange rate between 2 currencies , calculated from their common relationships with a 3rd currency

7. Participants

7.1. Bank and nonbank foreign exchange dealers

7.1.1. major currency-trading banks derive between 10-20% of their annual net income from currency trading

7.1.2. dealers function as market makers

7.1.3. Banks buy exchange on a bit price and sell at ask price

7.2. Individuals and firms conducting commercial or investment transactions

7.2.1. importers and exporters, international portfolio investors, MNEs, Tourists

7.3. speculators and arbitragers

7.3.1. Profit from trading the market itself

7.3.2. no need or obligation to serve clients or to ensure continuous markets

7.4. central bank and treasuries

7.4.1. use the market to acquire or spend their country's foreign exchange reserves as well as to influence the price at which their own currency is traded

8. foreign exchange

8.1. definition

8.1.1. the money of a foreign country

8.2. types

8.2.1. currency bank balances

8.2.2. banknotes

8.2.3. checks

8.2.4. drafts

9. 3 main functions

9.1. Transfer function

9.1.1. to facilitate the conversion of one currency into another, i.e., to accomplish transfers of purchasing power between two countries

9.2. Credit function

9.2.1. provides credit for foreign trade. Bills of exchange, with maturity period of three months, are generally used for international payments.

9.3. Hedging function

9.3.1. (the avoidance of a foreign exchange risk)In a free exchange market when exchange rate change, there may be a gain or loss to the party concerned. Under this condition, a person or a firm undertakes a great exchange risk if there are huge amounts of net claims or net liabilities which are to be met in foreign money.