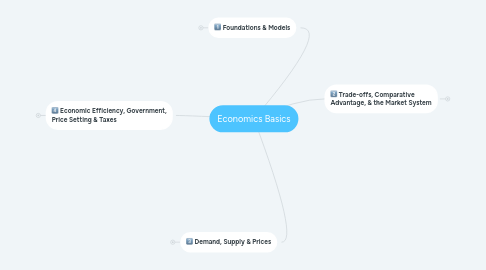

1. Foundations & Models

1.1. 3 key economic ideas

1.1.1. people are rational

1.1.2. People respond to economic incentives

1.1.3. optimal decisions are always made at the margin

1.1.3.1. marginal analysis

1.1.3.2. involves comparing marginal benefits & marginal costs

1.2. concepts:

1.2.1. trade-off

1.2.1.1. because of scarcity, producing more of 1 good means producing less of another good

1.2.1.2. force society to answer 3 questions:

1.2.1.2.1. what will be produced?

1.2.1.2.2. how will good/services be produced?

1.2.1.2.3. who will receive goods/services?

1.2.2. opportunity cost

1.2.2.1. value of the next best alternative when a decision is made.

1.2.3. Efficiency - 2 types:

1.2.3.1. productive

1.2.3.1.1. where one good/service is produced at the lowest possible cost

1.2.3.2. allocative

1.2.3.2.1. producing up to where MR = MC

1.2.4. voluntary exchange

1.3. types of economies

1.3.1. centrally planned

1.3.1.1. government decides how resources are allocated

1.3.2. market

1.3.2.1. markets allocate resources

1.3.3. mixed

1.3.3.1. most decisions are market based, but the government plays a significant role

1.4. economic models

1.4.1. role of assumptions

1.4.1.1. to simplify models so the can be useful

1.4.2. economic variable

1.4.2.1. something measurable that can have different values

1.4.3. 2 types of analysis:

1.4.3.1. positive

1.4.3.1.1. concerned with "what is"

1.4.3.2. normative

1.4.3.2.1. concerned with "what ought to be"

1.5. Fields of economcs

1.5.1. microeconomics

1.5.1.1. study of how firms & households make choices, interact in markets, & how government affects their choices

1.5.2. macroeconomics

1.5.2.1. study of the economy as a whole

2. Demand, Supply & Prices

2.1. Demand

2.1.1. demand schedule

2.1.1.1. Table showing relationship between price & quantity demanded

2.1.2. demand curve

2.1.2.1. curve or line showing relationship between price & quantity demanded

2.1.3. the law of demand

2.1.3.1. When prices increase, quantity demanded decreases; & vice versa

2.1.3.2. substitution effect

2.1.3.2.1. change in quantity demanded from a change in price

2.1.3.3. income effect

2.1.3.3.1. change in quantity demanded from a price change effect on purchasing power

2.1.4. variables that shift demand curve

2.1.4.1. income

2.1.4.2. prices of related goods

2.1.4.3. tastes

2.1.4.4. population & demographics

2.1.4.5. expected future prices

2.1.5. change in demand

2.1.6. change in quantity demanded

2.2. Supply

2.2.1. supply schedule

2.2.1.1. Table showing the relationship between price and quantity supplied

2.2.2. supply curve

2.2.2.1. curve/line showing the relationship between price & quantity supplied

2.2.3. The Law of Supply

2.2.3.1. When prices increase, quantity supplied increases; & vice versa

2.2.4. Variables that shift the supply curve

2.2.4.1. change in prices of inputs

2.2.4.2. change in price of substitutes

2.2.4.3. # firms in the market

2.2.4.4. expected future prices

2.2.5. change in supply

2.2.6. change in quantity supplied

2.3. Market Equilibrium

2.3.1. quantity demanded = quantity supplied

2.3.2. surplus & shortage

2.3.2.1. Surplus is when Supply > Demand

2.3.2.2. Shortage is when Demand > Supply

3. Economic Efficiency, Government, Price Setting & Taxes

3.1. Surplus

3.1.1. consumer

3.1.1.1. marginal benefit

3.1.2. producer

3.1.2.1. marginal cost

3.2. Efficiency

3.2.1. competitive equilibrium

3.2.2. economic surplus

3.2.3. deadweight loss

3.2.4. economic efficiency

3.2.4.1. 2 conditions

3.2.4.1.1. MB = MC

3.2.4.1.2. where producer + consumer surplus is at maximum

3.3. Government intervention

3.3.1. price floor

3.3.1.1. minimum wage laws

3.3.2. price ceilings

3.3.2.1. rent control

3.3.2.1.1. benefits renters

3.3.2.1.2. costs landlords

3.4. Taxes

3.4.1. impact on economic efficiency

3.4.2. Social Security taxes

3.4.2.1. do employers & workers really share equally?

3.4.2.2. burden mostly falls on workers

4. Trade-offs, Comparative Advantage, & the Market System

4.1. Production Possibilities Frontier (PPF)

4.1.1. opportunity cost

4.1.2. marginal opportunity cost

4.1.3. economic growth

4.1.4. Trade:

4.1.4.1. absolute advantage

4.1.4.1.1. ability to produce more of a good than competitors using same amount of resources

4.1.4.2. comparative advantage

4.1.4.2.1. ability to produce a good at a lower opportunity cost than competitors

4.2. The market system

4.2.1. 2 types of markets:

4.2.1.1. product

4.2.1.2. factor

4.2.1.2.1. factors of production:

4.2.2. circular flow diagram

4.2.2.1. 2 key groups:

4.2.2.1.1. households

4.2.2.1.2. firms