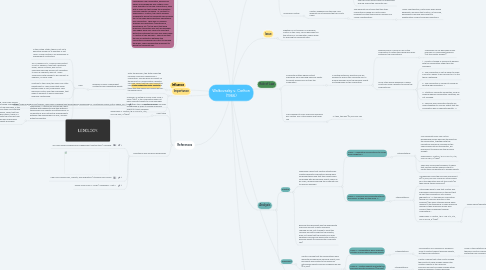

1. Impact

1.1. L&T Fuel Oil v. Saljo Bakery Corporation et al. (2006). L&T Fuel Oil sued Saljo Bakery and Impartato (sole shareholder of Saljo Bakery corporation) for unpaid fuel bills. The plaintiff asserted that they had been providing fuel oil to the bakery for 19 years under an oral contract which preceded Impartato's involvement in the bakery. Impartato informed L&T that he was taking over the operation of the bakery during the course of this contract. The plaintiff asserts that they thought they were dealing with an individual, not a corporate officer in the oral contract. Impartato argued that all of the bills were addressed to the bakery, and he was merely a corporate officer, so it was the corporation, not he, that had incurred the debt. The court granted summary judgement for the defendant, finding there was insufficient evidence to prove that the plaintiff had been tricked or misled into dealing with a corporation instead of an individual. The judge cited Walkovzsky v. Carlton as as case providing that a company may be incorporated solely for the purpose of limiting liability.

1.2. Goldberg v. Lee Express Cab Corporation et al (1995). In a shockingly similar case to Walkovszky v. Carlton, Goldberg was hit by a taxi while on the sidewalk outside the Hilton Hotel in Manhattan. The cab was owned by Lee Express Cab Corporation, whose sole owner and shareholder was Nathan More. More operated 16 taxi cab corporations, each with a single car that carried the mandatory minimum liability insurance. In contrast to Walkovszky v. Carlton, the courts allowed Goldberg to pierce the corporate veil because the 16 taxi cabs were essentially operated as one corporation. They had co-mingled finances and operations (maintenance, dispatching, etc.) to the point that each individual corporation was not recognizable. The judges were very careful to draw that distinction between this case and Walkovszky v. Carlton in their decision. They found that the lack of distinction between the corporations evidenced an intent to defraud the public, which allowed the defendant to pierce the corporate veil.

2. Influence

2.1. Legal Separation from Liability

2.1.1. Business Models: independent contractors and separating liability

2.1.1.1. Uber

2.1.1.1.1. In the Untied States, there is not yet a definitive answer as to whether or not Uber's "Driver Partners" are employees or independent contractors.

2.1.1.1.2. As of January 2017, Miami's Third District Court of Appeals, ruled that a particular driver, Darren McGillis, was not an employee because he was not mandated to pick up requests, was not under supervision with regards to his conduct or behavior, or dress code.

2.1.1.1.3. Contrary to this ruling, the New York State Department of Labor found that driver partners were in fact, employees. Uber exercised control over the employees, that made it apparent it was an employee employer relationship.

2.1.1.1.4. Walkovszky v. Carlton has influenced Uber's strategy with regards to how they distance themselves from liability by putting layers of corporations and contractual arrangements between the shareholders of uber, and any potential liabilities.

3. Importance

3.1. After the decision, the state raised the minimum insurance required by a corporation. This will have an impact on the amount of compensation a plaintiff can seek, given that the court ruled they cannot pierce the corporate veil to gain more than the maximum covered by the insurance policy.

3.2. However, as noted in Kinney Shoe Corp v Polan (1991), if the corporation does not have sufficient assets to cover damages owed, then the corporation may be disregarded in order to pursue individual assets to cover damages.

4. References

4.1. Facts and Issues Sources

4.1.1. https://scholar.google.com/scholar_case?case=7388866155319458484&q=Walkovszky+v.+Carlton&hl=en&as_sdt=6,39&as_vis=1

4.2. Court case

4.2.1. Walkovszky v. Carlton, 18 N.Y.2d 414, 419, 223 N.E.2d 6, 9 (1966)

4.3. Importance and Influence References

4.3.1. Are Uber drivers employees or independent contractors? | Lexology

4.3.2. Uber Self-Driving Cars, Liability, and Regulation | Stanford Law School

4.3.3. Kinney Shoe Corp. v. Polan | Casebriefs - Part 2

5. The order of the Appellate Division should be reversed, with costs in this court and in the Appellate Division, the certified question answered in the negative and the order of the Supreme Court, Richmond County, reinstated, with leave to serve an amended complaint Walkovszky v. Carlton, 18 N.Y.2d 414, 421, 223 N.E.2d 6, 10 (1966)

6. Facts

6.1. Parties

6.1.1. Plaintiff: John Walkovszky

6.1.2. Defendant: William Carlton

6.2. What Happened?

6.2.1. NYC 1962: Walkovsky was a pedestrian who was struck and injured by a taxi owned by Carlton under the corporate entity of Seon Cab Corporation

6.2.2. Carlton owned 20 taxis split across 10 different corporations (2 per corporation)

6.2.2.1. Each corporation only held the minimum insurance liability coverage of $10,000. This is done to limit the liability of the corporation by limiting the number of assets.

6.2.3. Walkovsky sued Carlton but because of the minimum liability held by the corporation he was only able to sue the corporation that was associated with the vehicle, Seon Cab Corporation, that hit him and not the other nine corporations. Thus, he was limited in his action against Carlton

6.2.3.1. Carlton argued that there was nothing illegal about his 10 corporations. He had the necessary minimum amount of insurance and all paperwork was in compliance with the law.

6.2.3.2. Walkovszky argued that Carlton deliberately created multiple corporate entities to fraudulently spread out his assets and liabilities to limit his liability when an issue such as this came about

6.2.3.2.1. Walkovszky further argued that if Carlton had not spread out his assets under 10 corporations and instead had just one corporation, then Carlton would have been able to pay all of Walkovszky's medical bills

6.2.3.3. The trial court ruled in favor of Walkovszky and did "pierce the corporate veil"

6.3. Procedural History

6.3.1. Carlton Appealed and the New York appellate court reversed the trial courts ruling

6.3.1.1. The appellate court ruled that the other corporations owned by Carlton were irrelevant and that there was no evidence of "under-capitalization"

6.3.1.1.1. Under-capitalization, particularly when being deliberate, would be that Carlton, in this case, purposefully did held back assets to illegitimately conduct business operations

7. Issue

7.1. Whether or not a person or individual, Carlton in this case, can be held liable for the actions of a corporation, which leads to "piercing the corporate veil'?

8. Rule of Law

8.1. Corporate entities legally protect individuals from exposing personal assets to liability arising from acts by the corporation

8.1.1. In limited instances, plaintiffs may be allowed to "pierce the corporate veil" to pursue damages from the personal assets of stockholders of the corporation

8.1.1.1. Requires proof of fraud or use of the corporation to futher the individual's goals instead of the corporations

8.1.1.1.1. Individuals can be held liable under principle of "respondeat superior" (Let the Master answer) ***

8.1.1.2. Cross cites several examples of when courts will allow a plaintiff to pierce the corporate veil:

8.1.1.2.1. 1. A party is tricked or misled into dealing with the corporation rather than the individual.

8.1.1.2.2. 2. The corporation is set up never to make a profit or always to be insolvent or it is too thinly capitalized.

8.1.1.2.3. 3. The corporation is formed to evade an existing legal obligation. *

8.1.1.2.4. 4. Statutory corporate formalities, such as holding required corporation meetings, are not followed.

8.1.1.2.5. 5. Personal and corporate interests are mixed together to such an extent that the corporation has no separate identity. **

8.2. Cabs required to carry minimum insurance per Section 370 of the vehicle and traffic law

8.2.1. In 1965, this was $10,000 per cab

9. Conclusion

9.1. Appeal

9.1.1. Defendant's motion to dismiss is granted

10. Analysis

10.1. Plaintiff

10.1.1. Walkovsky claims that Carlton intentionally created separate corporations which were undercapitalized and that their assets were comingled with his personal assets, which in his claim, required piercing the corporate veil to recover damages

10.1.1.1. Claim 1 -Separating Corporations to evade legal obligation *

10.1.1.1.1. Interpretations:

10.1.1.2. Claim 2 - Personal and corporate intersts are mixed, so they are the same **

10.1.1.2.1. Interpretations:

10.1.2. Because the defendant had the appropriate minimum amount of auto insurance required by law, but it failed to meet the recovery amount sought by the plaintiff, does not mean that the plaintiff can seek additional recovery by going after Carlton's personal assets (by piercing the corporate veil)

10.2. Defendant

10.2.1. Carlton claimed that the corporations were separate excluding any personal assets, and his liability was limited to the minimum automobile liability insurance required by law ($10,000)

10.2.1.1. Claim 1 - Corporations were separate entities and excluded personal assets

10.2.1.1.1. Interpretations:

10.2.1.2. Claim 2 - Limited liability met with the purchase of auto insurance ($10,000)

10.2.1.2.1. Interpretations: