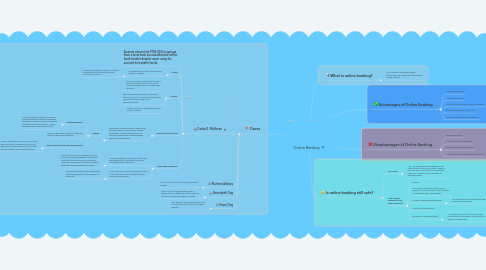

1. Cases

1.1. Carlos D. Malibiran

1.1.1. A senior citizen lost P159,000 in savings from a local bank via unauthorized online fund transfer despite never using his account to transfer funds.

1.1.2. Victim

1.1.2.1. A businessman in Metro Manila named Carlos D. Malibiran

1.1.2.1.1. He had been working at Akinto Marketing Corporation as a consultant, earning P30, 000 per month.

1.1.3. Conflict

1.1.3.1. The victim noticed that funds are being taken from their account, some even occurring the day the funds enter their account.

1.1.3.2. This would not be possible as the victim (Carlos) does not use online transactions in transferring funds, as he does it over-the-counter.

1.1.3.3. A total of P159,000 was taken from the victim's account.

1.1.4. Explanation to the Case

1.1.4.1. Union Bank, as stated in one of their emails, that the victim, at some point may have shared their credit card information to scammers which have utilized phishing emails and fake websites.

1.1.4.1.1. Phising

1.1.5. Union Bank's Response

1.1.5.1. Union Bank issued a response to the victim, explaining that at some point, they may have shared their credentials.

1.1.5.1.1. The victim refused this explanation as the victim only used the website for checking their balance and has never received any suspicious email asking for their credentials, revealing a possible breach in security.

1.1.5.2. Union Bank also refused to reveal the name of the bank accounts to which the funds have been transferred.

1.1.5.2.1. This has fueled the victim's feeling that what has happened to him was also an inside job.

1.2. Marlene Atienza

1.2.1. Lost P115,000 after she checked her bank's balance

1.3. Bernadeth Ong

1.3.1. Lost P20,000 which was taken from a transaction in Ortigas even though she lives in Davao and has never been to Ortigas.

1.4. Frane Ong

1.4.1. Lost P90,000 after checking their bank account balance from the Union Bank website.

2. What is online banking?

2.1. Is is a method of banking in which transactions are conducted electronically via the Internet.

3. Advantages of Online Banking

3.1. It is generally secure

3.2. It is accessible 24/7

3.3. You can access the bank virtually anywhere

3.4. It's faster than going to the bank

3.5. Includes many features and services

4. Disadvantages of Online Banking

4.1. Isn't always secure

4.2. Not all online banks are stable

4.3. Not all banks are FDIC-secured

4.4. Not all banks offer immediate transactions

5. Is online banking still safe?

5.1. My opinion

5.1.1. Yes, I do believe that online banking is still safe. We just need to learn how to keep our account safe: to not share our credentials under any condition and to be aware of potential scams.

5.2. How to avoid phishing (or any scam in general)

5.2.1. Be alert.

5.2.2. Do not open suspicious texts, pop-up windows or click on links or attachments in emails (these should be deleted)

5.2.3. Keep your personal details secure

5.2.3.1. This includes personal information and credit card credentials.

5.2.4. Create strong passwords

5.2.5. Be aware of unusual requests

5.2.5.1. If someone asks you for your credit card information for something, do not give it to them, no matter what.