1. macroeconomic performance

1.1. aggregate supply

1.2. aggregate demand

1.3. Measures

1.3.1. economic growth

1.3.1.1. GDP

1.3.1.1.1. trend rate of growth 2.5% increase

1.3.1.2. GDP per capita

1.3.1.2.1. indicate living standard

1.3.2. employment

1.3.2.1. shows how fully the human resources are utilised

1.3.3. inflation

1.3.3.1. happens when AD is higher than AS

1.3.3.2. RPI

1.3.4. export/import

1.3.4.1. if AD from outside increases, export will increase

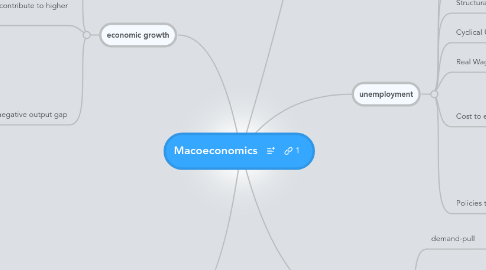

2. economic growth

2.1. trend rate of growth 2.5%

2.1.1. the stable rate in which there won't be inflation

2.1.2. the productive capacity increases by 2.5%

2.2. mainly supply-side factors contribute to higher productive capacity

2.2.1. however demand-side factors need to be consider to absorb the extra supply

2.2.2. increase factors of production

2.2.3. increase productivity

2.2.4. advances in technology

2.3. negative output gap

2.3.1. more unemployment

2.3.2. lower output

2.3.3. inside PPF

2.3.4. increases AD to tackle this

2.3.4.1. too much can cause inflation

3. The current account of the balance of payments

3.1. the balance of trade in goods and services plus net investment incomes from overseas assets

3.2. causes of the UK trade deficit

3.2.1. Short-term factors

3.2.1.1. Strong consumer demand

3.2.1.2. strong exchange rate

3.2.1.3. High income elasticity of demand for imports

3.2.1.4. The weakness of the global economy

3.2.2. Longer-term factors

3.2.2.1. structural factors

3.2.2.2. supply-side deficiencies

3.2.2.3. manufacturing sector has been in long-term decline

3.2.3. Effects

3.2.3.1. Reductions in demand in the circular flow

3.2.3.2. Dip in business confidence and investment

3.2.3.3. Unemployment

3.2.3.4. Reductions in inflationary pressure

3.2.4. A common misconception is that balance of payments deficits are always bad for the economy

4. inflation

4.1. demand-pull

4.1.1. increase in AD

4.1.2. A depreciation of the exchange rate

4.1.3. Higher demand from a fiscal stimulus

4.1.4. Monetary stimulus to the economy

4.1.5. Faster economic growth in other countries

4.1.6. Fiscal Policy

4.1.6.1. reduce spending, increase indirect tax

4.1.7. Monetary Policy

4.1.7.1. increase interest rate

4.2. cost push

4.2.1. rise in price in raw materials

4.2.2. tight labour market, rise in wage, or trade union

4.2.3. rise in indirect taxes

4.3. sustained increase in the general price level

4.4. measured by CPI, aims to stay at 2% by Bank of England

5. unemployment

5.1. available and willing to work at the going wage rate but who cannot find work despite an active search for work

5.2. Frictional Unemployment

5.2.1. due to people moving between jobs

5.3. Structural Unemployment

5.3.1. long run decline in demand in an industry leading to a reduction in employment perhaps because of increasing international competition

5.4. Cyclical Unemployment

5.4.1. involuntary unemployment due to a lack of demand for goods and services

5.5. Real Wage Unemployment

5.5.1. real wages being above their market clearing level leading to an excess supply of labour

5.6. Cost to economy

5.6.1. Loss of income

5.6.2. Loss of national output

5.6.3. Fiscal costs

5.7. Policies to reduce unemployment

5.7.1. Stimulate an improvement in the human capital of the workforce

5.7.2. Improve incentives for people to search and then accept paid work

5.7.3. Employment subsidie

5.7.4. Achieve a sustained period of economic growth