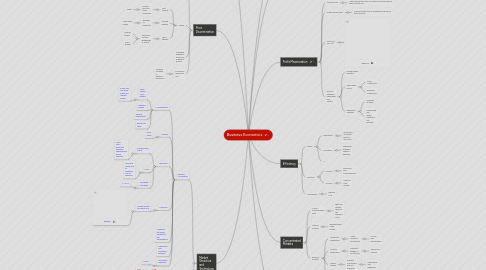

1. Monopoly

1.1. The firm is the industry

1.2. Pricing

1.2.1. Price Maker

1.2.1.1. Higher Prices and lower output

1.2.1.1.1. supernormal profit

1.2.1.1.2. Reduced consumer surplus

1.3. Barriers to Entry

1.3.1. High fixed costs

1.3.2. Economies of scale

1.3.3. Brand loyalty

1.3.4. Legal Barriers

1.3.5. Predatory Pricing

1.4. Efficiency

1.4.1. Productive inefficient

1.4.2. Allocative inefficient

1.5. Diagram

1.6. Innovative Behavior

1.6.1. Potentially Strong

2. Price Discrimination

2.1. Conditions

2.1.1. Different Price Elasticities

2.1.2. Separation of markets

2.2. Types

2.2.1. First Degree

2.2.1.1. Unique price for every consumer

2.2.1.1.1. Ebay

2.2.2. Second Degree

2.2.2.1. Batches of products

2.2.2.1.1. Multi-pack Crisps

2.2.3. Third Degree

2.2.3.1. Set prices by time geography or status

2.2.3.1.1. Cinema tickets

2.2.3.1.2. Train tickets

2.3. Charging different prices for different buyers

2.4. Consumer Welfare is lost

2.4.1. Possible increase in dynamic efficiency

3. Market Structure and Technology

3.1. Perfect Competion

3.1.1. Assumptions

3.1.1.1. Many Sellers, Many buyers

3.1.1.1.1. Every firm is a Price Taker, NO market power

3.1.1.2. Identical Goods

3.1.1.3. Perfect information

3.1.1.4. Barriers to entry

3.1.2. Pricing

3.1.2.1. Price Taker

3.1.3. Short Run

3.1.3.1. Supernormal Profit

3.1.3.1.1. More firms enter the industry, supernormal profit reduces

3.1.3.2. Loss

3.1.3.2.1. Firms are driven out of business, loss is reduced

3.1.3.3. Shutdown Condition

3.1.3.3.1. P< AVC

3.1.4. Long Run

3.1.4.1. Normal Profit for every firm

3.1.4.1.1. diagram

3.1.5. In Reality not many markets fit the assumptions

3.1.6. Productive and Allocative efficient

3.1.7. Innovative Behavior

3.1.7.1. None

3.2. Oligopoly

3.2.1. Few Producers

3.2.1.1. CR5 >60%

3.2.2. Pricing

3.2.2.1. Price Maker/ Price Rigidity/ Price War

3.2.3. Barriers to Entry

3.2.3.1. Economies of scale

3.2.3.2. High Fixed Costs

3.2.3.3. Price Fixing

3.2.3.4. Consumer Loyalty

3.2.3.5. Legal Barriers

3.2.4. Strategic Interdependence

3.2.4.1. The Kinked Demand curve

3.2.5. Non-price Competition

3.2.5.1. Customer Services

3.2.5.2. Advertisement

3.2.5.3. Loyalty Cards

3.2.6. Explicit Collision

3.2.6.1. illegal

3.2.7. Tacit Collision

3.2.7.1. Game theory

3.2.7.1.1. Prisoner's Dilemma

3.2.7.2. Similar to Monopoly

3.2.8. Competitive Oligopoly

3.2.8.1. Lower Prices

3.2.8.2. Possible Price Wars

3.2.8.2.1. E.g. Tesco's and Sainsbury's

3.2.9. Innovative Behavior

3.2.9.1. Very Strong

4. Cost

4.1. Long Run

4.1.1. economies/diseconomies of scale

4.1.1.1. Minimum efficient scale

4.1.1.2. Internal + External

4.2. Short Run

4.2.1. Diminishing Returns to a fator

5. Revenue

5.1. Total Revenue

5.1.1. Price x Quantity Sold

5.2. Average Revenue

5.2.1. Total Revenue/ Quantity Sold

5.3. Marginal Revenue

5.3.1. Addition to Total Revenue from the sales of 1 additional unit of output

6. Profit Maximisation

6.1. Normal Profit

6.1.1. Just sufficient to keep all factors of production in their present use.

6.2. Supernormal Profit

6.2.1. Supernormal profit is anything in excess of normal profit

6.3. Occurs at MC=MR

6.3.1. diagram

6.4. Divorce between ownership and control

6.4.1. Prinpal-agent problem

6.4.2. Alternative Goals

6.4.2.1. Sales Maximising

6.4.2.2. Revenue Maximising

6.4.3. Behavioral Theories

6.4.3.1. Coalition of goals

6.4.3.2. Maximising one single variable is not possible

7. Efficiency

7.1. Static

7.1.1. Productive

7.1.1.1. Producing at lowest point on AC curve

7.1.2. Allocative

7.1.2.1. Supplying at where Supply = Demand

7.1.3. X

7.2. Dynamic

7.2.1. Product

7.2.1.1. Research and Developement

7.2.2. Process

7.2.2.1. Invest in new capital

7.3. Inefficiency

7.3.1. Welfare Loss

8. Concentrated Markets

8.1. N firm concentration ratio

8.1.1. the total market share of the largest n firms

8.2. Internal Growth

8.2.1. Reinvestment using profits

8.3. External Growth

8.3.1. Horizontal Integration

8.3.1.1. Same Stage of production

8.3.1.1.1. Co-op and somerfields

8.3.2. Vertical Integration

8.3.2.1. Different stages of production

8.3.2.1.1. Apple and Foxcon

8.3.3. Lateral Merger

8.3.3.1. Related businesses but not identical

8.3.3.1.1. Newspaper and magazine

8.3.4. Conglomerate merger

8.3.4.1. Firms in unrelated businesses

8.3.4.1.1. Tata Group

9. Contestable Markets

9.1. Level of Barriers to Entry

9.1.1. Perfectly Contestable when sunk costs are 0

9.1.1.1. Lower Profit Margins

9.1.1.1.1. more competitive

9.1.2. Higher Sunk Costs, Less Contestable

9.1.2.1. Higher Profit margins

9.1.2.1.1. less competitive