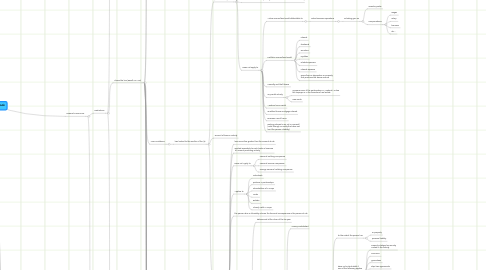

1. Business Tax

2. Trusts

3. Retirement

4. Individuals required to File

4.1. Age

4.1.1. younger than 65

4.1.2. 65 or older

4.2. Gross Income

4.2.1. Does not include SS

4.2.2. Includes Foreign Income

4.2.3. gain from the sale of a residence

4.3. Filing Status

4.3.1. Single

4.3.2. Married

4.3.3. Qualified Window(er)

4.3.4. Married filing Jointly

4.3.5. Married Filing Seperately

4.4. Is the individual a dependant?

4.4.1. include child's income on parent's return

4.4.2. under the age of 18

4.4.2.1. gross income (if any) was from dividends and interest

4.4.2.1.1. Less than $8500

5. Due Dates

5.1. Extensions

5.1.1. Automatic six month extension (form 4868)

5.1.1.1. ext. to file; not to pay

5.1.2. Automatic if serving in combat zone

5.2. Head of Household

5.3. Types

5.3.1. Individual Income tax

5.3.1.1. Calendar year

5.3.1.1.1. W/O wages subject to US withholding

5.3.1.1.2. April 15

5.3.1.2. Fiscal Year

5.3.1.2.1. 15th day of the fourth month after the end of the fiscal year

5.3.2. Dead Person

5.3.2.1. 15th day of 4th month of decedent's normal tax year

5.3.3. Estate Tax

6. Presonal Income Tax

6.1. Deductions

6.1.1. Below the line

6.1.1.1. Standard

6.1.1.1.1. MFS

6.1.1.1.2. MFJ

6.1.1.1.3. HH

6.1.1.1.4. Single

6.1.1.1.5. Qualified Widoe

6.1.1.2. Itemized

6.1.1.2.1. Medical Expenses (limited to only amounts above 7.5% of AGI(

6.1.1.2.2. Casualty Losses

6.1.1.2.3. Charitable Deductions

6.1.1.2.4. Taxes

6.1.1.2.5. Second-Tier Miscellaneous Items (amount that exceeds 2% of AGI)

6.1.1.2.6. Interest Expense

6.1.1.2.7. Miscellaneous (line 27)

6.1.1.2.8. Limitation on Itemized deductions

6.1.2. Above the line (Result's in AGI)

6.1.2.1. Alimony

6.1.2.1.1. must be made in cash (or cash equivelent

6.1.2.1.2. payment received by under a divorce or separation agreement

6.1.2.1.3. Payee spouse and payor spouse cannot be in the same household

6.1.2.1.4. spouses must not file joint returns (with each other)

6.1.2.1.5. Child Support is not considered alimony

6.1.2.2. Moving Expenses

6.1.2.2.1. must be work related

6.1.2.2.2. may be deducted in the year incurred

6.1.2.2.3. must be "direct" expense

6.1.2.2.4. if an individual other than the taxpayer expenses are deductible if

6.1.2.2.5. Indirect expenses (not deductible)

6.1.2.3. Loss Limitations

6.1.2.3.1. loss limited to the smaller of the (3)

6.1.2.4. Archer MSA's

6.1.2.5. Health Savings Accounts

6.1.2.6. Health Insurance Deduction

6.1.2.7. Qualified Education Loans

6.1.2.8. Deduction for Education Expense

6.1.2.9. Self-Employment Deductions

6.1.2.10. Retirement Savings (IRA) Contributions

6.1.3. Rental Property Expenses

6.1.3.1. Personal Use Rules

6.1.3.1.1. Deductions allowed when Rented...

6.1.3.1.2. Deductions NOT allowed when personal use MORE THAN

6.1.3.1.3. other persons who have an interest in property

6.1.3.1.4. Relatives

6.1.3.1.5. Rented for less than

6.1.3.1.6. Reciprocal arrangement

6.1.3.1.7. When Fair rental Value is NOT charged

6.1.3.1.8. Exception